Expanding your business across borders means accessing a wider pool of skilled professionals. However, hiring internationally brings unique challenges, especially when it comes to staying compliant and choosing the right way to hire. Many businesses consider two main options: using an Employer of Record (EOR) or working directly with independent contractors. Both options let you hire talent globally without setting up a local office. Yet, they differ significantly in legal duties, tax responsibilities, and the level of control you have over your remote team.

This guide will clearly explain the differences between EOR services and independent contractors. We’ll look at the benefits and drawbacks of each approach, giving you the information you need to make smart decisions. Whether your goal is to build a steady, well-organized international team or you need flexible help for specific projects, understanding these models will help you manage your global growth better and avoid costly mistakes.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) allows businesses to hire employees in foreign countries without the need to set up a local legal entity. The EOR takes on all employer responsibilities, including payroll outsourcing, tax compliance, social security contributions, benefits administration, work permits, and ensuring adherence to local labor laws. Meanwhile, the company directs the employee’s daily tasks and manages their performance.

This structure helps reduce risks such as worker misclassification, tax penalties, and violations of labor laws, which can result in costly fines and legal challenges. It also speeds up entry into new markets by removing the lengthy and expensive process of registering a local subsidiary. Additionally, an EOR provides the flexibility to quickly scale your workforce, making it an effective solution for businesses exploring new markets or managing remote teams.

What is a Contractor?

A contractor, also known as an independent contractor or freelancer, is a self-employed individual who provides services to your company under a contract for a specific project or time period. Unlike employees, contractors operate their own businesses, handle their own taxes and benefits, and cover their own expenses. Companies often choose contractors for their flexibility and cost efficiency, especially when they need specialized skills or temporary support.

Contractors work independently, which means businesses avoid the long-term commitments and administrative responsibilities tied to full-time employees. Using contractors allows businesses to quickly scale their workforce and adapt to changing demands while controlling costs and minimizing legal exposure. This makes contractors an ideal choice for project-based work or short-term assignments across different markets.

EOR vs Contractor: Comparison Table

| Feature/Aspect | Employer of Record (EOR) | Contractor |

| Legal Employer | Yes, the EOR is the official legal employer | No, the contractor is self-employed |

| Compliance & Payroll | Fully managed by the EOR | Managed by contractor or company |

| Control over Work | Moderate – company directs daily tasks | High – company directly manages work details |

| IP Ownership | Usually retained by the company | Can be unclear without a clear contract |

| Cost | Higher due to EOR service fees | Lower hourly/project rates |

| Risk of Misclassification | Low – EOR ensures correct classification | High – risk of penalties if misclassified |

| Duration | Best for long-term or permanent hires | Best for short-term or project-based work |

| Scalability | Easy to scale workforce globally | Requires managing multiple individual contracts |

Industry-Specific Use Cases

- Tech Startups: Tech startups often need to scale rapidly and hire specialized talent worldwide. An EOR allows them to onboard international employees quickly and compliantly, without the delays of entity setup. This ensures startups maintain agility while adhering to local labor laws, payroll, and benefits requirements-critical for retaining top tech talent.

- Manufacturing Firms: Manufacturing companies frequently require contractors for short-term projects, such as equipment installation or seasonal labor. Contractors provide the flexibility to scale workforce up or down without long-term commitments. However, when projects extend or require sensitive IP, switching to EOR employment can reduce compliance risks.

- Creative Agencies: Creative agencies benefit from hybrid models, combining contractors for freelance projects with EOR-employed staff for core functions. This approach offers flexibility in managing fluctuating workloads while ensuring compliance and IP protection for key employees.

- Healthcare & Pharma: Sectors like healthcare and pharmaceuticals face strict regulatory and compliance demands. Using an EOR ensures all local labor laws, certifications, and benefits are correctly managed, reducing legal exposure. Contractors may be used for specialized consulting, but core staff are typically hired through EOR arrangements for compliance and quality control.

Legal & Compliance Risks to Consider

- Misclassification Risks: Classifying a worker incorrectly as a contractor instead of an employee can lead to significant fines, back taxes, and legal action. Many jurisdictions have strict criteria defining employment status, and enforcement is increasing globally.

- Tax Liabilities: Employers are responsible for withholding and remitting payroll taxes for employees. Contractors handle their own taxes, but if misclassified, the company may be liable for unpaid taxes and penalties.

- Intellectual Property (IP) Ownership: Without clear contracts, IP created by contractors may not automatically belong to the company, risking loss of proprietary assets. EOR-employed staff typically have IP agreements embedded in employment contracts.

- Termination & Labor Law: Employment termination under an EOR must comply with local labor laws, including notice periods and severance. Contractors generally have more flexible termination terms, but improper handling can still result in disputes.

Cost Comparison: EOR vs Contractor

- EOR Costs: EOR services charge fees covering payroll management, statutory benefits, tax compliance, and HR administration. While these fees make EOR more expensive upfront, they reduce hidden costs related to legal risks, misclassification penalties, and administrative overhead.

- Contractor Costs: Contractors typically charge lower hourly or project rates and do not require benefits or payroll taxes. However, hidden costs include potential legal risks, IP disputes, and increased management time to ensure compliance.

- When EOR Costs are Justified: For long-term hires, critical roles, or when entering new markets, the security and compliance provided by an EOR outweigh the additional fees. For short-term, specialized tasks, contractors may be more cost-effective.

Hybrid Hiring Models: Combining EOR and Contractors

Many companies adopt hybrid models, using EORs for core employees and contractors for specialized or temporary projects. This approach balances compliance and flexibility, allowing businesses to scale efficiently while managing risk. Benefits include optimized cost management, access to diverse talent pools, and tailored workforce strategies. Challenges involve managing two types of employment relationships and ensuring clear contracts and compliance protocols. Hybrid models work well for creative agencies, tech firms with fluctuating project needs, and companies expanding into new markets while testing demand.

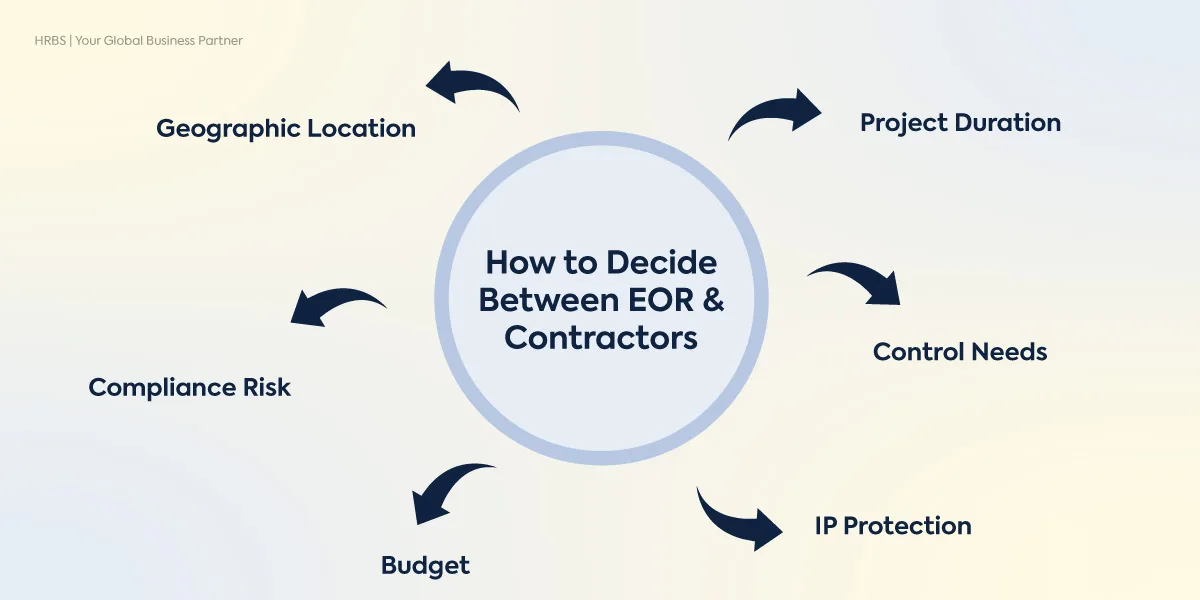

How to Decide Between Employer of Record (EOR) and Contractors

Use this comprehensive checklist to identify the best hiring model for your business needs:

- Project Duration: Consider whether the role is short-term or long-term. Long-term positions that require ongoing integration with your team and consistent oversight typically favor hiring through an Employer of Record (EOR), which provides stable employment and benefits. Short-term or project-based roles with clear deliverables are better suited for contractors, offering flexibility without long-term commitments.

- Control Needs: Assess how much control you need over the worker’s daily activities and work processes. If your business requires close supervision, training, and integration into your company culture, EOR employees offer higher control and alignment. Contractors operate independently, managing their own schedules and methods, which provides autonomy but less direct oversight.

- IP Protection: Evaluate the importance of safeguarding your company’s intellectual property. EOR employment contracts generally include stronger IP assignment and confidentiality clauses, reducing risks of IP leakage. With contractors, IP protection depends heavily on well-drafted contracts, but enforcement can be more challenging.

- Budget: Analyze your budget beyond initial costs. Contractors may appear cheaper upfront since you avoid payroll taxes and benefits expenses, but their rates often include premiums for self-managed costs. EORs involve service fees and employment costs but reduce hidden expenses related to compliance risks, penalties, and administrative overhead.

- Compliance Risk: Reflect on your company’s capacity to manage legal and regulatory risks. Hiring through an EOR significantly lowers compliance risks by ensuring adherence to local labor laws, tax regulations, and benefits requirements. Using contractors increases exposure to misclassification penalties, especially in countries with strict employment regulations.

- Geographic Location: Consider the complexity of labor laws in the countries where you hire. EORs simplify compliance in jurisdictions with complicated or evolving employment legislation, enabling faster market entry without establishing a local entity. Contractors may be more suitable in regions with clearer independent contractor regulations but require careful management.

How HRBS Can Help With Hiring Contractors in Pakistan?

Hiring contractors is a proven way for businesses to access specialized skills, scale teams rapidly, and control costs especially when expanding operations in Pakistan or building a global workforce. HRBS is trusted partner for secure, fully compliant contractor hiring, offering both Employer of Record (EOR) expertise and direct contractor management, so your business can grow with confidence and minimize risk.

- Legal Compliance: HRBS prepares contracts that strictly follow Pakistani labor laws and global compliance standards, ensuring clear terms for deliverables, timelines, and payments. This reduces the risk of disputes and legal exposure, especially when global classifications and local requirements must align.

- Accurate, Timely Payments: We handle all payments for your contractors. We take care of invoices, currency exchange, and payroll so contractors are paid correctly and on time whether they are in Pakistan or somewhere else. This keeps your contractors happy and your business running smoothly.

- Centralized, Transparent Oversight: HRBS gives you one place to manage all your contractors. You can see who is working on what, check project progress, renew contracts, and handle offboarding all from a single, secure platform. This makes it simple to keep track of your team, no matter how many contractors you have.

- Dedicated, Local Support: Our team in Pakistan provide assistance with onboarding, contract questions, and ongoing compliance, quickly resolving issues to keep your projects moving and your contractors satisfied.

Ready to simplify your contractor hiring? Contact HRBS today and discover how our dedicated solutions can help your business grow with confidence and compliance.

FAQs

What is the main difference between EOR and contractor?

An Employer of Record legally employs workers on behalf of a company, handling all compliance, payroll, taxes, and benefits administration. In contrast, contractors are self-employed individuals who manage their own taxes, benefits, and legal obligations independently. This distinction means EORs take on employer responsibilities, reducing compliance risks for companies, while contractors offer more flexibility but with higher legal risks for misclassification.

Can I switch from contractor to EOR later?

Yes, many companies initially hire workers as contractors for flexibility and cost savings, then transition them to EOR employment as roles become permanent or require closer compliance oversight. Switching to an EOR model helps mitigate risks related to labor laws, tax compliance, and benefits administration, making it a common practice for scaling businesses.

How does EOR handle employee benefits?

EORs provide statutory employee benefits mandated by local laws, such as health insurance, paid leave, social security contributions, and unemployment insurance. Additionally, many EORs offer enhanced benefits packages tailored to client needs, ensuring employees receive comprehensive coverage while relieving the client company from administrative burdens.

What are the tax implications of hiring contractors internationally?

Contractors are responsible for their own tax filings and payments. However, misclassifying employees as contractors can expose companies to significant liabilities, including unpaid payroll taxes, penalties, and interest in multiple jurisdictions. Using an EOR can help companies avoid these risks by ensuring proper tax withholding and compliance with international labor laws.

Is hiring through an EOR more expensive than using contractors?

Typically, yes. EOR services include fees for payroll, compliance management, and benefits administration, which add to the cost compared to contractors who handle their own expenses. However, EORs reduce hidden costs related to legal risks, tax penalties, and administrative overhead, often resulting in overall cost savings and peace of mind for companies.

How do I protect intellectual property (IP) when working with contractors?

Protecting IP requires clear, enforceable contracts that explicitly assign IP ownership to the company. While contractor agreements can include such clauses, employment contracts under an EOR generally provide stronger IP protections due to clearer employer-employee relationships and legal frameworks. Using an EOR can therefore enhance IP security.

Can I use both EOR and contractors simultaneously?

Yes, many companies adopt a hybrid workforce model, employing some workers through an EOR for compliance and benefits, while engaging others as independent contractors for flexibility and project-based work. This approach allows businesses to balance cost, compliance, and operational needs effectively.