Hiring in Pakistan is evolving rapidly, shifting the focus from simply finding the right skills to ensuring absolute trust in your workforce. While background checks are not mandatory for every single role, they have become the standard for forward-thinking companies in banking, healthcare, logistics, and the booming tech industry. As the job market expands and remote work opens new doors, the volume of applications is higher than ever, bringing both opportunity and the hidden risk of fake degrees and identity fraud. A thorough background check is the most effective way to ensure you are hiring genuine talent while strictly following data privacy laws.

In this guide, we break down how to conduct background checks that are compliant and effective. You will learn the legal framework for proper screening, the essential checks used across the industry, and a practical step-by-step plan for execution. We also highlight the common pitfalls to avoid, giving you the complete resource to hire with confidence.

What is an Employee Background Check in Pakistan?

An employee background check is the practice of validating a candidate’s private information against official public records to ensure they are qualified and safe to hire. In Pakistan, this goes beyond just checking references; it involves authenticating a candidate’s CNIC via NADRA, verifying university degrees, and scanning police records for criminal activity.

For sensitive roles, this review also extends to financial credit reports and global security watchlists to meet strict industry regulations. This thorough process is the only way to detect the common issue of fake degrees and fake documents. Employers typically manage this task either through their internal teams or by partnering with specialized services to validate the information accurately.

Benefits of Conducting Background Checks in Pakistan

Background checks protect Pakistani employers from hiring risks in a market where fake degrees and forged documents are common challenges. Implementing a strong screening process offers clear advantages:

- Prevents Qualification Fraud: The most immediate benefit is filtering out candidates who use fake documents. With credential fraud rising, relying on a resume alone is risky. A background check authenticates every claim, from university degrees to past job titles, ensuring you base your hiring decisions on real facts rather than unverified details.

- Avoids Legal Liability: Hiring someone with a hidden criminal history can lead to financial loss and legal trouble. Screening helps you identify these red flags early, protecting your organization from lawsuits and ensuring you meet the strict compliance standards required in banking and finance.

- Improves Quality of Hire: Candidates who pass a complete screening process are often more reliable and committed. By removing those with a history of misconduct or instability, you build a stronger team with lower turnover rates, saving the time and money spent on constant re-hiring.

- Secures Remote Teams: With the rise of remote work, verifying that an employee actually exists and resides in Pakistan is critical. Background checks confirm identity and location, preventing “outsourcing fraud” where a hired remote worker secretly delegates their tasks to unqualified third parties.

- Ensures Regulatory Compliance: Conducting these checks in line with PECA laws protects you from data privacy violations. Following the correct legal procedures for consent and data handling shows current employees and regulators that your company operates with the highest level of professionalism.

- Builds Market Reputation: Hiring trustworthy and reliable employees strengthens your brand. Businesses that conduct thorough background checks demonstrate a commitment to high standards, which attracts better talent and helps create a positive, secure work culture.

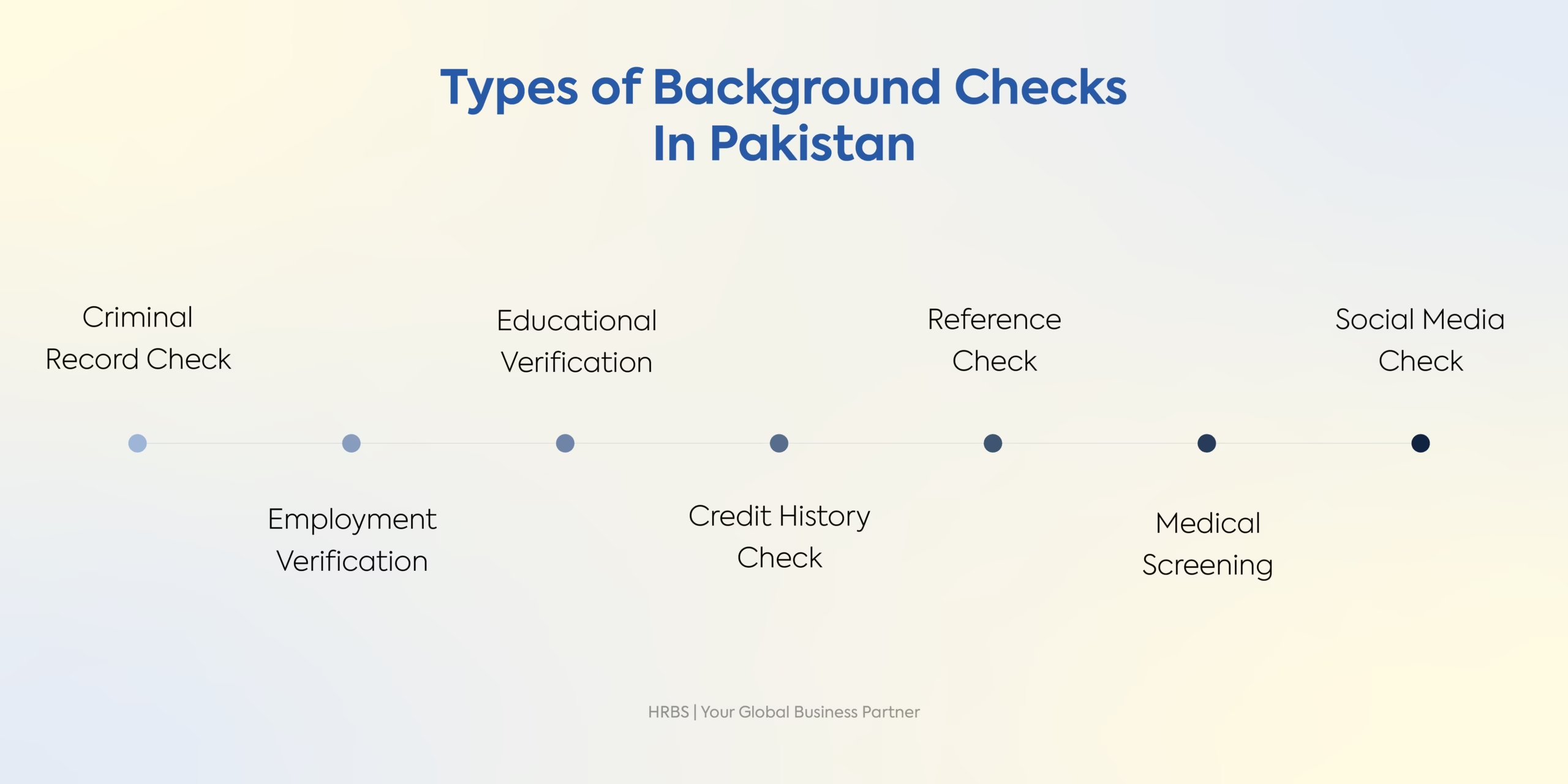

Types of Background Checks in Pakistan

In Pakistan, employment screening covers essential areas that help employers effectively evaluate a candidate’s background and suitability. Knowing the different types of background checks allows organizations to design tailored screening processes that match the job role requirements and maintain compliance with local regulations. Key types of background checks include:

Criminal Record Check

This check reveals if a candidate has a history of illegal activity, from past convictions to pending court cases. It is the primary way to ensure you are not bringing safety risks into your workplace.

- What it checks: FIRs, police complaints, and court records via the Criminal Record Management System (CRMS).

- How it works: Digital verification through the Police Khidmat Markaz (in Punjab/Sindh) or manual clearance from local police stations.

- Turnaround: 1–3 days for digital checks; 5–7 days for manual letters.

- Best for: Security guards, drivers, cashiers, and government staff.

Employment History Verification

Verifying a candidate’s past work history is the most effective way to detect fake experience letters and inflated job titles. It ensures that every claim on the resume is backed by actual tenure and performance.

- What it Checks: Job titles, exact joining and leaving dates, salary brackets, and reasons for resignation.

- Local Insight: Request bank statements for salary credits to instantly expose fake experience letters, as fake documents cannot show consistent monthly transfers.

- Turnaround: Typically 3–5 business days.

- Best For: Mid-to-senior managers, technical experts, and positions requiring specialized industry skills.

Education Verification

Verifying academic credentials is the only way to filter out fake degrees and unaccredited diplomas. This process confirms that qualifications are real and recognized by accredited institutions.

- What it Checks: Degree authenticity, passing year, and accreditation status.

- How it Works: Verify university degrees through HEC and school certificates via IBCC or local BISE Boards. For technical diplomas, cross-check directly with the specific training institute.

- Turnaround: Typically 7–15 business days.

- Best For: Doctors, engineers, lawyers, and skilled professionals.

Identity Verification

Confirming identity is the most basic step in the hiring process. It proves that the person stands before you is who they claim to be and prevents “ghost employees” from entering your payroll.

- What it Checks: CNIC validity, permanent address, date of birth, and family details.

- How it Works: Validate the candidate’s details directly against the NADRA database using the Verisys system. This confirms that the CNIC number belongs to the candidate and is currently active.

- Turnaround: Instant to 1 business day.

- Best For: Every single employee, freelancer, and contractor.

Reference Checks

Contacting previous supervisors provides insights that a resume cannot show. This step evaluates a candidate’s work ethic and professional behavior through direct conversation.

- How it Works: Conduct structured phone interviews with past reporting managers. Always verify the reference’s own professional profile (e.g., on LinkedIn) to confirm they actually held a supervisory role. This prevents candidates from listing friends or junior colleagues as “managers” to secure a positive review.

- Turnaround: Typically 2–4 business days.

- Best For: Senior management, team leaders, and client-facing roles.

Financial History Review

Screening financial records helps you assess a candidate’s level of financial responsibility and integrity. This check is critical for preventing fraud, especially when hiring for positions that involve handling cash, budgets, or sensitive company assets.

- What it Checks: Credit worthiness, loan default history, bankruptcy status, and any reported financial misconduct.

- How it Works: Request a Consumer Credit Report (CCR) or check the Electronic Credit Information Bureau (eCIB) data through authorized channels. This reveals if a candidate has a history of defaulting on bank loans or serious financial mismanagement.

- Turnaround: Typically 3–5 business days.

- Best For: Accountants, Chief Financial Officers (CFOs), cashiers, and bank employees.

Social Media Screening

Checking a candidate’s public online presence helps you see the real person behind the resume. This step protects your company’s reputation by spotting behavior that could hurt your brand image.

- What it Checks: Public professional conduct, hate speech, conflicting business interests, and undisclosed side businesses.

- How it Works: Always obtain written consent to remain compliant with privacy standards. Look for conflicting commitments, such as a candidate actively promoting their own private agency while applying for a full-time role with you.

- Turnaround: Typically 1–2 business days.

- Best For: Marketing leads, senior executives, and anyone representing your brand publicly.

Essential Documents & Requirements for Background Checks in Pakistan

To conduct a lawful and effective background check, you must gather specific documents before the process begins. Missing any of these items can delay verification or create legal liabilities under privacy laws.

- Written Candidate Consent: Before collecting any data, you are legally required to obtain a signed consent form from the applicant. This document is your primary protection under data privacy standards. The consent form must be specific; it should explicitly list exactly which areas will be investigated (such as credit history, criminal record, or past employment) so the candidate cannot claim their privacy was violated later.

- Government-Issued ID (CNIC): You need a clear, legible copy of the candidate’s CNIC to run a NADRA Verisys check. This step confirms the person is a valid citizen and not using a stolen identity. Crucially, you must immediately verify that the card is currently active. An invalid card prevents the candidate from legally opening a salary account or signing a binding employment contract.

- Academic Degrees and Transcripts: Request original copies of degrees and detailed transcripts to cross-reference with university records. Holding the physical degree is not enough; you must specifically look for the verification sticker or stamp on the back of the document. This unique mark proves the degree has been verified by the education board, instantly filtering out fake documents.

- Employment Experience: Beyond a simple list of past employers, you must request the formal “Resignation Acceptance” or “Service Certificate” from the candidate’s last workplace. A candidate who cannot produce this proof may have left without notice or been terminated for cause. Additionally, require the tax registration number of previous employers to verify they are real businesses and not fake companies set up to hide gaps.

- Salary Slips or Bank Statement: To confirm the candidate’s actual job level and value, request the last three months of salary slips or a bank statement showing salary credits. This is the surest method to verify their previous compensation. Many candidates claim higher amounts during interviews; the bank statement provides undeniable proof of their actual earnings and employment status.

- Police Clearance Certificate (PCC): For roles involving cash handling, security, or sensitive data, demand a recent clearance certificate issued by the local police. Ensure the certificate is original and less than 6 months old. This document is generated based on the candidate’s permanent address and checks for any legal proceedings registered against their CNIC.

- Professional Council Registrations: For specialized technical roles, a university degree is insufficient. You must request valid, active registration cards from the relevant regulatory bodies. This includes PMDC (for doctors), PEC (for engineers), and ICAP (for accountants). These documents prove the candidate is currently licensed to practice and has not been blacklisted for professional malpractice.

How to Conduct Employee Background Checks in Pakistan: Step by Step Process

Running a background check in Pakistan is a necessary process for employers who want to hire with confidence and comply with local laws. Here’s a clear, step-by-step approach to conducting background checks that ensures fairness, transparency, and legal compliance while offering unique value to both employers and candidates.

1. Obtain Candidate Consent (Same Day): Get written consent from the candidate before starting any background check. This form should explain what information will be checked and how it will be used. Under PECA Act requirements, consent must be clear and specific for each type of verification. Use standardized consent forms that cover all potential verification types to avoid delays later.

Best Practice: Use standardized consent forms that cover all potential verification types to avoid delays later.

2. Verify Identity First (1-2 Days): Use the candidate’s CNIC or passport to confirm their identity through NADRA’s official verification system. This prevents identity fraud and ensures all subsequent checks are tied to the correct person.Verification through authorized providers provides instant to same-day identity confirmation for most candidates.

3. Collect Required Documents (1-2 Days):Ask candidates to provide official government ID, academic certificates, previous employer contact details, and professional references. For specific roles, request proof of residence or professional licenses. Provide a detailed document checklist to candidates upfront to avoid back-and-forth requests that delay the process.

4. Check Employment History (3-5 Days): Contact each previous employer to confirm job titles, employment dates, and reasons for leaving. Ask about performance and conduct when possible. Contact previous employers during working days and business hours for higher response rates.

5. Confirm Educational Qualifications (2-4 Days): Contact educational institutions directly to verify degrees, diplomas, and certificates. Always request verification from official registrar offices rather than third-party sources.Request official transcripts directly from registrar offices for the most reliable verification. Professional license verification through PMDC/PNC is mandatory alongside educational credentials for regulated professions.

6. Screen Criminal Record (5-7 Days): For roles requiring trust or safety, request police clearance certificates through official channels. This check is essential for finance, healthcare, security, and government positions. Follow specific police clearance procedures as outlined in local regulations for faster processing.

7. Contact References (2-3 Days): Speak with provided references, former supervisors or colleagues to learn about work habits, attitude, and reliability. Prepare specific behavioral questions for reference calls. Ask open-ended questions about specific situations rather than yes/no questions for better insights.

8. Review Financial History (3-4 Days): For jobs involving money handling or sensitive financial information, check credit history through authorized bureaus like ECIB, but only with explicit consent and direct job relevance. Financial checks must comply with data protection laws and be directly relevant to job responsibilities.

9. Conduct Medical and Drug Screening (1 Day): Industries like healthcare, transportation, and manufacturing may require medical certificates or drug test results to meet health and safety standards. Follow sector-specific health screening requirements as mandated by regulatory bodies.

10. Review Online Presence (1-2 Days – Optional): With candidate consent, review public social media profiles for professionalism and cultural fit. Focus only on job-relevant information and respect privacy boundaries. Only review publicly available information and avoid personal or private content that isn’t job-related.

11. Document the Process: Keep detailed records of each step, including consent forms, verification reports, and any correspondence. Proper documentation protects both the employer and the candidate, and supports compliance with legal requirements. Store all background check records securely with access limited to authorized personnel only.

How Much Does it Cost To Conduct Background Check in Pakistan

Background check costs in Pakistan vary based on verification depth, check types selected, turnaround time requirements, and whether employers conduct verifications internally or through professional agencies. Understanding these cost factors helps organizations budget effectively while ensuring thorough candidate screening.

| Cost Factor | Impact on Pricing | Considerations |

|---|---|---|

| Verification Scope | Single checks cost less than comprehensive packages | Basic NADRA identity verification is less expensive than full packages combining criminal, education, employment, and reference checks |

| Check Types Selected | Each verification type increases total cost | Criminal records, education, employment history, financial screening, and license validation each carry separate costs |

| Turnaround Time | Expedited processing costs more | Standard verification (7-10 days) costs less than rush services (3-5 days) |

| Candidate Location | Remote areas increase costs | Multi-city employment history requires verification across jurisdictions, adding processing fees |

| Industry Requirements | Regulated sectors need extensive checks | Banking, healthcare, and government positions require criminal, financial, and license verification |

| Volume and Frequency | Higher volumes reduce per-check costs | Regular hiring enables bulk pricing or subscription models from providers |

| Verification Method | Automated systems cost less operationally | Manual verification requires staff time for calls and follow-ups versus automated database access |

| Document Complexity | Foreign qualifications increase costs | International degree verification or multi-sector employment requires additional validation |

What’s Included in Different Background Check Packages

Background check providers in Pakistan offer primary verification packages based on role requirements, industry regulations, and hiring risk levels. Organizations select packages that match position responsibilities while meeting sector-specific compliance standards.

- Basic Package: Includes NADRA identity verification and criminal record check through police databases, suitable for entry-level positions with limited responsibility. This foundational screening confirms candidate identity and checks for undisclosed criminal history, addressing primary hiring risks for roles without financial responsibilities or sensitive data access. Typical turn around time is 3-5 business days.

- Standard Package:Combines identity verification, criminal records, employment history, and education verification, appropriate for mid-level professional roles. This package validates work experience claims, confirms educational credentials, and prevents hiring based on fake degrees or inflated qualifications common in Pakistan’s job market. Typical turnaround time is 5-7 business days.

- Comprehensive Package: Full screening including identity, criminal records, complete employment history, education credentials, professional licenses, reference checks, and financial history, required for senior positions, banking, healthcare, or roles with financial responsibilities. This thorough verification meets regulatory compliance standards from State Bank of Pakistan (banking sector) and Pakistan Medical Commission (healthcare). Typical turnaround time is 7-10 business days.

Additional Background Check Cost Considerations

Beyond standard verification packages, several additional factors influence background check costs in Pakistan, including verification method, geographic scope, and investigation complexity.

- Re-verification Costs: Initial checks sometimes reveal discrepancies requiring additional investigation beyond standard verification procedures. When employment dates don’t match, education authenticity questions arise, or criminal record matches need court verification, follow-up investigations add processing time and costs.

- Geographic Variations: Verification costs may vary between urban centers like Karachi, Lahore, and Islamabad versus smaller cities where institutional access and verification infrastructure differ. Candidates with rural education or employment backgrounds may require additional processing time and resources.

- Cross-Border Verification: Candidates with foreign degrees, international work experience, or overseas professional certifications require cross-border verification that significantly increases costs. This involves accessing international databases, coordinating with foreign institutions across different time zones, and navigating varying regulatory frameworks—processes that typically take 10-20 business days versus 3-7 days for domestic checks.

- Verification Method: Automated verification systems and digital institutional connections complete checks faster at lower operational costs than manual processes. Manual verification requires dedicated staff for phone calls, email correspondence, and extensive follow-ups, increasing labor costs significantly.

Industries Where Background Checks Are Essential

In Pakistan, background checks are a critical part of the hiring process for industries where employees access sensitive information or have a significant impact on safety, security, and trust. Employers in these sectors use thorough background screening to reduce risks and protect their organizations.

- Finance and Banking: Banking institutions conduct criminal record, financial history, and employment verification to meet state bank of pakistan compliance requirements for roles handling sensitive financial data. Credit history checks and fraud screening are mandatory for positions with monetary access or budget authority.

- Healthcare: Healthcare organizations verify medical credentials, professional licenses through pakistan medical commission, and criminal history to ensure patient safety and regulatory compliance. Hospitals and clinics screen for undisclosed misconduct that could compromise patient care quality.

- Education: Educational institutions verify teaching credentials, degree authenticity, and criminal history, particularly for offenses related to child safety before hiring academic staff. Background screening protects students and maintains institutional credibility across schools and universities.

- Security and Government Roles: Government positions and security roles require extensive screening including criminal records, employment history, and financial background to assess candidate trustworthiness for sensitive work. Security clearances for defense and intelligence positions involve comprehensive multi-level verification.

- Tech and Data Management: IT and technology companies conduct criminal background checks, employment verification, and education credential validation to protect intellectual property and sensitive data. Roles involving cybersecurity, database administration, or confidential information access require thorough screening.

Background Checks Mistakes To Avoid in Pakistan

To ensure legal, accurate, and ethical background checks, employers in Pakistan should avoid common errors. Whether hiring employees or contractors, these mistakes can lead to compliance issues and poor hiring decisions:

- Lack of Consent: Always obtain clear, written consent from the candidate before conducting any background checks. Failing to do so can result in legal consequences and damage your company’s reputation. Be transparent about the purpose of the background check to ensure trust and compliance with data protection laws.

- Bias Screening: Avoid letting personal biases influence the hiring process, as this can lead to discriminatory practices and legal challenges. Ensure the background check process is objective, focusing on job-relevant criteria to make fair and informed decisions. This helps create an inclusive and diverse workplace.

- Weak Data Protection: Ensure that candidate data is stored securely to comply with privacy laws and avoid penalties. Implement robust cybersecurity measures and secure storage systems to protect sensitive personal information. Proper handling of data also demonstrates respect for candidates’ privacy rights, promoting trust in your organization.

- Incomplete Verification: Don’t rely solely on self-disclosed information, verify all details for accuracy. Inaccurate or unverified information can lead to poor hiring decisions and expose your company to potential risks. Always cross-check with references, previous employers, and educational institutions to confirm the candidate’s credentials.

- Excessive Data Collection: Focus only on relevant information to prevent privacy violations and ethical concerns. Collecting unnecessary personal details can not only infringe on privacy rights but also result in compliance issues. Stick to what is necessary for the position, ensuring the background check is efficient and within legal boundaries.

- Neglecting Legal Compliance: Ensure your background checks comply with local and international regulations. Failing to follow legal requirements can lead to costly lawsuits and tarnish your company’s reputation. Be up-to-date with the latest laws regarding background checks, such as anti-discrimination and data privacy regulations.

- Not Communicating Findings Clearly: Once background checks are complete, ensure that any concerns or red flags are communicated clearly with the candidate. Open and respectful discussions about the findings help maintain transparency and ensure fair treatment throughout the hiring process.

Legal vs Illegal Background Checks in Pakistan

Background checks are completely legal and encouraged in Pakistan when done through official channels with proper candidate consent. However, the methods you choose make the difference between lawful hiring practices and serious legal violations. Understanding these boundaries protects your company from penalties while ensuring fair treatment of candidates. Below is a clear, comparison of what constitutes legal and illegal background check practices in Pakistan, helping employers comply with the law and avoid costly mistakes.

| Legal Background Checks | Illegal Background Checks |

|---|---|

| Criminal records through NADRA or authorized channels | Background checks without written candidate consent |

| Educational verification from recognized institutions | Accessing irrelevant information (medical, religious, political) |

| Employment history validation through former employers | Using unauthorized or unofficial data sources |

| Professional license checks for relevant roles | Financial checks without permission or job relevance |

| Credit checks with consent and job relevance only | Discriminatory use of results based on gender, ethnicity, religion |

| Identity verification using official CNIC or passport | Using fake documents or unverified identity sources |

| Reference checks with candidate permission and knowledge | Contacting references without informing the candidate |

| Conducting checks after conditional job offer | Running background checks during interviews or before job offer |

| Confidential handling of candidate information | Sharing candidate data with unauthorized third parties |

How HRBS Helps with Background Checks in Pakistan

HR Business Solutions has established itself as a go-to partner for employee verification and background screening services in Pakistan, helping businesses, from startups to large enterprises hire with confidence while ensuring compliance with local and international standards. If you want to reduce hiring risks, protect your company’s reputation, and streamline your recruitment, working with us is a practical, proven solution. With more than 500+ background checks conducted successfully, we combine experience with reliability so you can focus on growing your business, knowing your hires are safe and verified.

We deliver a full suite of background check solutions tailored for Pakistan’s unique market:

- Criminal Record Checks: We use trusted databases, including NADRA, to screen candidates for criminal history such as theft, fraud, or violence, providing real-time updates and local analysis to identify potential risks.

- Employment Verification: We directly contact previous employers to confirm job history, job titles, and performance details, helping you catch discrepancies that may not appear on resumes.

- Educational Credential Verification: Degrees, diplomas, and academic certificates are validated directly with issuing institutions, preventing the costly mistake of hiring candidates with falsified qualifications.

- Document Fraud Detection: Our advanced screening methods identify altered or counterfeit documents, protecting your business from fraud and reputational harm.

- Professional License, Credit, and Reference Checks: With candidate consent, we verify professional licenses, review credit or financial information, and contact references, all in compliance with privacy laws.

- Customizable Screening: Screening depth and focus are adjusted to match job roles, industry risks, and regional needs, from entry-level to executive positions.

Recruitment and Compliance Support: Beyond background checks, HRBS provides end-to-end recruitment solutions, compliance audits, and employer of record services for international companies hiring in Pakistan.

If you want to make smarter, safer hiring decisions in Pakistan, while staying fully compliant HRBS is the partner you can trust to deliver accurate, confidential, and actionable background checks tailored to your organization’s needs. . Get your comprehensive background check solution from HRBS and secure your workforce with Pakistan’s most trusted verification partner.

FAQ’S

What is the process for conducting a background check in Pakistan?

A typical background check in Pakistan includes verifying the candidate’s criminal history, employment background, educational qualifications, and references. Depending on the job, additional checks, like credit history or contacting previous employers may be performed. These screenings are usually conducted either in-house by the employer or through reputable third-party verification agencies to ensure accuracy, thoroughness, and compliance with legal requirements.

How can i get a background check for a foreign employee in Pakistan?

If you need to run a background check for a foreign employee working in Pakistan, partner with agencies specializing in international verifications. These agencies can validate criminal records, employment history, education, and more across different countries. Always confirm that your provider complies with both local and international data privacy laws to protect everyone’s information and maintain regulatory compliance.

What are the key documents required for a background check in Pakistan?

Key documents include a government-issued ID card (CNIC), proof of residence, academic certificates, and employment records. For certain roles, additional documents such as police clearance certificates or financial statements may be required. Providing accurate and complete documentation helps avoid delays and ensures a smooth verification process.

What does the PECA act require for background checks?

The Prevention of Electronic Crimes Act (PECA) requires written consent from candidates before conducting any background verification. Employers must clearly explain what information will be collected and how it will be used. The act mandates explicit consent for accessing personal data and requires all processing through authorized channels like NADRA. Employers cannot conduct background checks without proper consent documentation and must protect candidate privacy throughout the verification process.

When should you run employee background checks in Pakistan?

Run employee background checks after making a conditional job offer but before the candidate’s first day of work, which protects both employer and candidate rights while ensuring legal compliance. The ideal approach is to conduct background verification immediately after the conditional offer acceptance, allowing 7-10 business days for comprehensive screening that covers identity verification, employment history, and education credentials. Never conduct background checks during initial interviews or before making a job offer, as this violates candidate privacy rights and wastes resources on candidates you may not ultimately hire.

Can background checks help with verifying education qualifications?

Absolutely. Background checks in Pakistan can confirm educational qualifications by directly contacting the institutions listed on a candidate’s resume. This step helps employers verify degrees and certificates, preventing fraudulent claims and ensuring you hire candidates with genuine credentials.

How can i check my criminal record in Pakistan?

You can check your criminal record by visiting your local police station or the relevant authorities in your area. The process typically involves submitting a formal application, providing a valid government-issued ID (such as a CNIC), and paying any required fees. In some cases, fingerprinting may be needed to confirm your identity. For added convenience, online platforms now offer criminal record verification, making the process faster and more accessible.

What is the cost of conducting a background check in Pakistan?

The cost varies depending on the scope of the check, basic verifications are typically less expensive, while comprehensive screenings (covering criminal records, financial status, employment history, and international checks) cost more. For precise pricing, contact your chosen service provider with your specific requirements.

Can background checks assist in hiring contractors?

Yes, background checks are an important part of hiring contractors. They help verify a contractor’s work history, qualifications, and legal compliance, ensuring you engage skilled and reliable professionals for your projects while minimizing risk.

Which background check provider is most reliable in Pakistan?

HR Business Solutions stands out as a trusted background verification provider in Pakistan, offering comprehensive criminal record checks, employment verification, and education verification. With established contacts across institutions and employers nationwide, we provides reliable screening with detailed reporting and strict confidentiality. Our local market expertise and professional verification standards make us a dependable choice for both Pakistani and international employers requiring thorough background screening.