Registering a sole proprietorship in Pakistan is one of the simplest ways to start a business. It is ideal for freelancers, contractors, and small business owners who want to operate independently with minimal requirements. Unlike other business forms, sole proprietorship does not require start-up capital or SECP registration, just an NTN from FBR.

This guide gives you all the information needed to register a sole proprietorship in Pakistan, covering the steps, documents, bank account setup, sales tax rules, licensing requirements, compliance deadlines, regulatory standards, document verification procedures, and practical tips for a smooth registration experience. Whether you are starting out or expanding your operations, it will help you complete the process efficiently and stay compliant with the law .

What is a Sole Proprietorship in Pakistan?

A sole proprietorship in Pakistan is a business structure where a single individual owns and operates the enterprise, making all decisions and bearing full responsibility for profits, losses, and liabilities. The business is not a separate legal entity, so the owner’s personal assets may be used to settle business obligations, resulting in unlimited personal liability. Both Pakistani citizens with valid CNIC and foreign nationals with appropriate work permits can establish a sole proprietorship.

It is especially suitable for freelancers, consultants, and small-scale enterprises seeking operational control without partner dependencies or extensive regulatory requirements. Sole proprietorships offer simplicity and flexibility but come with limitations, such as difficulty in raising capital and scaling the business. There are no specific sectoral restrictions for Pakistani citizens, but foreign nationals may need additional permits depending on the industry.

Who Can Register a Sole Proprietorship in Pakistan?

Almost any individual who meets basic legal requirements can register as a sole proprietor in Pakistan. This structure is accessible, requiring no complex qualifications or minimum capital investment. Here are the eligibility criteria:

| Eligibility Criteria | Requirements | Details |

|---|---|---|

| Minimum Age | 18 years or older | Must be legally competent to enter contracts and manage business affairs independently |

| Pakistani Citizens | Valid CNIC required | CNIC is mandatory for all official registrations, tax filings, and opening business bank accounts |

| Foreign Nationals | Valid work visa or permit + passport | Foreigners can register if they hold appropriate legal status and identification acceptable under Pakistani law |

| Entity Type | Individual persons only | Corporate entities, partnerships, and non-individual legal entities cannot register as sole proprietors |

| Legal Competency | Ability to manage financial and legal obligations | Must understand contracts, maintain accurate records, and handle payments responsibly |

| Capital Requirement | None | No minimum capital investment needed to start operations |

| Family Employment | Allowed | Family members can be hired as staff without additional restrictions |

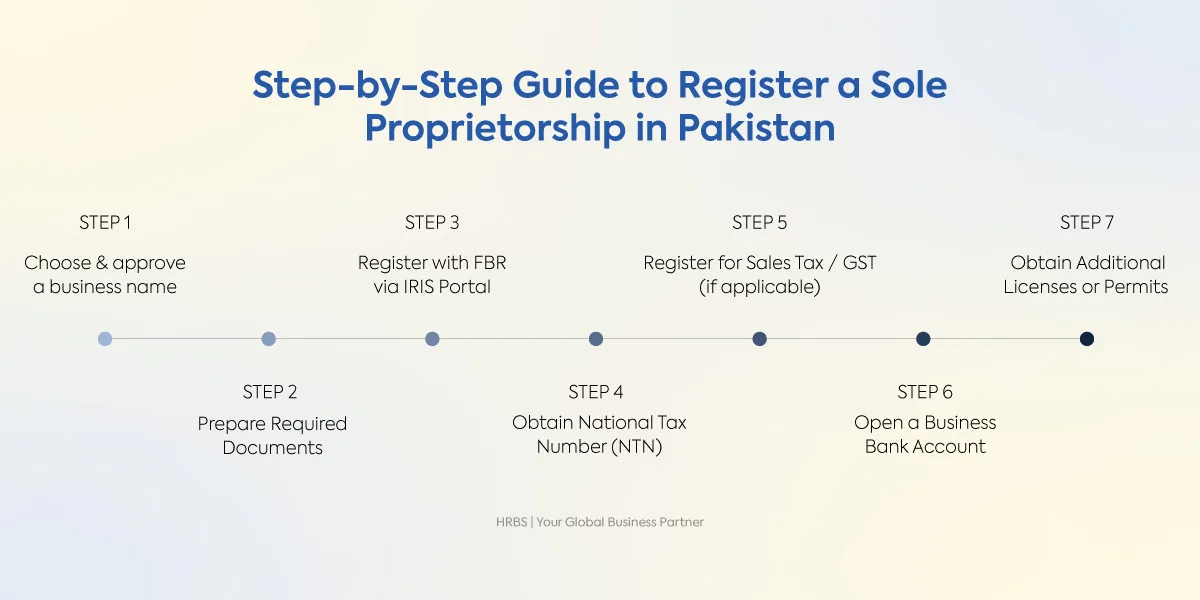

How to Register a Sole Proprietorship in Pakistan: Step-by-Step

Starting a sole proprietorship in Pakistan is an efficient way to launch your business quickly with minimal formalities. Understanding the detailed requirements and procedure will ensure smooth registration, legal compliance, and readiness to operate.

Step 1: Confirm Your Eligibility

Before starting registration, verify you meet these basic requirements:

- You must be 18 years or older

- Pakistani citizens need a valid, non-expired CNIC

- Foreign nationals require a valid passport plus work visa or residency permit

Step 2: Choose a Business Name

You can operate under your own legal name or select a separate trade name for your business. Sole proprietorships don’t require formal name registration with SECP, but checking for existing trademarks or duplicates helps avoid legal conflicts later. Search the SECP eServices portal to verify no company is already using your preferred name.

Step 3: Prepare Required Documents

Gather these documents before starting your IRIS portal registration:

- Valid CNIC copy (both sides, colored photocopy preferred for clarity)

- Proof of business address not older than 3 months (utility bill, rental agreement, or property ownership documents)

- Business letterhead with your business name, address, and contact details

- Brief description of your business activities (trading, services, manufacturing, etc.)

- Active mobile number and email address for receiving OTP verification codes during registration

For foreign nationals, additionally provide:

- Valid passport copy (bio page showing personal details)

- Work visa or residency permit copy proving legal status in Pakistan

Step 4: Register with FBR for NTN

Registration with FBR through the IRIS portal provides your National Tax Number, which serves as your official business registration and is required for all tax filings, business transactions, and opening a business bank account. The entire registration process takes 10-15 minutes and is completely free.

Step 5: Register for Sales Tax/ GST (if applicable)

Sales tax registration depends on your business type, annual turnover, and location. Manufacturers, wholesalers, distributors, and importers typically need to register with the Federal Board of Revenue if they exceed prescribed turnover thresholds. Service providers may need to register with provincial authorities based on their province and service category.

Step 6: Open a Business Bank Account

Using your NTN certificate and registration documents, open a dedicated business bank account for your sole proprietorship in local banks. A separate business bank account separates personal and business finances, simplifies tax filing with FBR, and enables smooth payment processing from clients and suppliers.

Step 7: Obtain Additional Licenses or Permits

Certain businesses need special permits or licenses from local or federal authorities for example, food safety certificates for restaurants or trade licenses for retail shops. Consult your local chamber of commerce or relevant regulatory body to ensure your business complies fully with industry regulations.

Sole Proprietorship Post-Registration Requirements

Once your sole proprietorship is registered with FBR, you must fulfill ongoing compliance obligations to maintain legal status and avoid penalties.

- Annual Income Tax Filing: File your annual income tax return by September 30 each year through the IRIS portal. Pakistan’s fiscal year runs from July 1 to June 30, and you report business income as personal income under progressive tax slabs. Active filer status provides benefits including lower withholding tax rates and easier access to business financing.

- Monthly Sales Tax Returns: If you registered for sales tax, file Form STR-1 by the 18th of each following month through IRIS. Charge applicable sales tax rates on taxable supplies, issue invoices showing your STRN, and maintain computerized records of all transactions.

- Record Retention: Maintain all financial records, including invoices, receipts, bank statements, contracts, and tax returns for a minimum of 5 years. These documents are critical during FBR audits or bank loan applications.

- Business Updates: Notify FBR immediately through IRIS if your business address, contact details, mobile number, or business activities change. Update your business bank account information when necessary.

- License Renewals: Monitor expiration dates for trade licenses, health certificates, NOCs, or sector-specific permits obtained during registration. Renew before expiry to avoid business disruptions or penalties.

Sole Proprietorship vs Other Business Structures in Pakistan

| Feature | Sole Proprietorship | Private Limited Company |

|---|---|---|

| Registration Authority | FBR (NTN only) | SECP + FBR |

| Owners | Single Owner | 2-50 shareholders |

| Setup Timeline | 3-7 days | 14-21 days |

| Legal Status | Owner = Business | Separate legal entity |

| Liability | Unlimited personal liability | Limited to share capital |

| Minimum Capital | None | PKR 100,000 |

| Tax Rate | 15-45% (non-salaried) | 29% (corporate) |

| Audit Required | No | Yes (if revenue > PKR 10M) |

| Ownership Transfer | Not transferable | Requires Board approval and Form 3 filing with SECP |

| Investment Access | Limited | High |

| Foreign Ownership | Allowed with visa | Allowed (approval for restricted sectors) |

| Best For | Freelancers, consultants, solo entrepreneurs | Growth-focused startups, scalable businesses |

How Much Does it Cost to Register a Sole Proprietorship in Pakistan

Registering a sole proprietorship in Pakistan costs between PKR 500 to PKR 3,000 if you handle the process yourself, or PKR 5,000 to PKR 10,000 if you hire professional services. The typical costs involved are relatively low compared to other business structures and include the following:

| Expense Type | Typical Range (PKR) | Notes |

|---|---|---|

| NTN Registration | Free | Mandatory with FBR |

| Document Attestation & Letterhead | 500 – 2,000 | Variable by provider |

| Business Stamp | Around 500 | Optional |

| Bank Account Opening Deposit | Varies by bank | Some banks have minimum deposits |

| Trade Licenses / Permits | 1,000 – 10,000 | Depends on sector and city |

| Professional Fees | 2,000 – 5,000+ | Optional, for consultancy/legal |

Overall, the entire cost to register a sole proprietorship in Pakistan generally ranges from PKR 5,000 to 10,000, making it one of the most cost-effective ways to start a legal business in the country.

Financial and Tax Obligations for Sole Proprietors in Pakistan

As a sole proprietor in Pakistan, your business income is taxed as personal income under the Income Tax Ordinance, 2001. Understanding your financial and tax obligations ensures compliance and avoids penalties.

- Income Tax: You pay income tax on business profits under individual non-salaried tax rates. The tax rates for FY 2024-25 start at 0% up to PKR 600,000, then progressively increase from 15% to 45% for the highest incomes.

- Sales Tax: Manufacturing, import, wholesale, retail, distribution, and service businesses must register for sales tax once turnover crosses industry-specific thresholds. Retailers and manufacturers earning under PKR 5 million annually are exempt. Standard rates span 16-21% based on your products, services, and operating province.

- Withholding Tax: FBR requires withholding tax on specific transactions, including contractor payments, employee compensation, imports, exports, and banking activities. These deducted amounts reduce your final tax liability when filing your annual return.

- Corporate Tax: If you convert your sole proprietorship into a private limited company, corporate tax of 29% applies to company profits. This rate is distinct from individual income tax and applies to the company as a separate legal entity. Companies with income exceeding PKR 150 million also pay super tax at tiered rates from 1% to 10%.

- SME Tax: Small and medium enterprises (SMEs) with an annual turnover up to PKR 100 million may be eligible for preferential tax rates. For instance, Category 1 SMEs benefit from a reduced flat tax rate of 7.5% on taxable income, subject to specific conditions set by the FBR.

Sole Proprietorship Tax Rate in Pakistan

Sole proprietors in Pakistan are taxed as individuals under non-salaried income tax rates, meaning your business profits are treated as personal income. You can deduct legitimate business expenses like rent, utilities, and salaries before calculating your taxable income.

| Annual Income (PKR) | Tax Rate |

|---|---|

| Up to 600,000 | 0% |

| 600,001 – 1,200,000 | 15% |

| 1,200,001 – 1,600,000 | 20% |

| 1,600,001 – 3,200,000 | 30% |

| 3,200,001 – 5,600,000 | 40% |

| Above 5,600,000 | 45% |

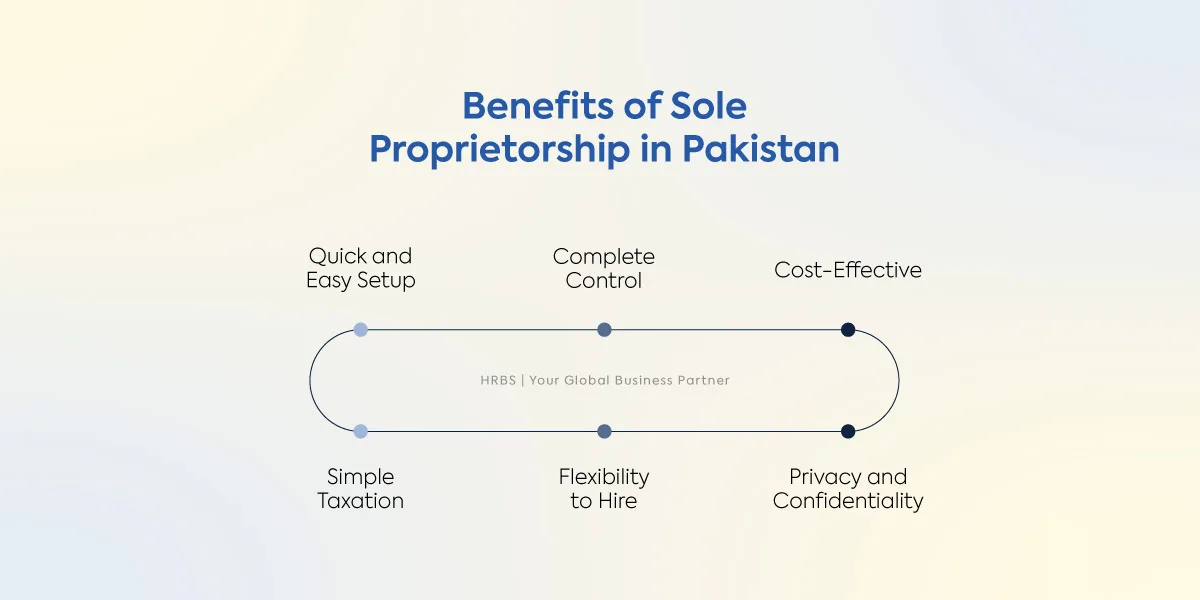

Benefits of Registering a Sole Proprietorship in Pakistan

Starting a sole proprietorship in Pakistan offers several practical advantages for freelancers, small retailers, and entrepreneurs.

- Registration with FBR enables self-employed individuals to hire employees or independent consultants for their operations. The process requires only NTN registration through the IRIS portal, completed within 2-5 working days without SECP incorporation procedures.

- Sole proprietors are taxed as individuals under progressive income tax slabs ranging from 0% to 45%. Record keeping is relatively more straightforward, and expenses are less compared to other forms of business entities. Business owners can deduct legitimate expenses such as rent, utilities, supplies, and salaries when filing annual returns.

- This structure in Pakistan provides complete control over business operations and direction. Owners have greater flexibility in deciding on pricing, sourcing, and meeting customers’ needs without consulting partners or shareholders.

- The setup cost is also much lower than other business forms. Depending on the kind of business, the start-up capital will be minimal, with basic registration requiring only PKR 500-1,000 for letterhead and stamps.

- The statutory filings and accounting procedures are also much more simplified. There is no need to file confirmation statements or publish financial reports publicly, leading to lesser interactions with governing bodies and less cumbersome paperwork processes.

- SMEDA offers financing programs, business training, and development services specifically designed for self-employed entrepreneurs and small business owners.

Industry-Specific Licensing Requirements for Sole Proprietors

While the NTN registration process is universal for all sole proprietors, certain industries require additional sector-specific permits:

- Food and Catering Businesses: Health department approvals, food authority registration, kitchen safety inspections, and staff medical certificates

- Retail and Wholesale Shops: Municipal trade licenses from local district councils or municipal corporations, renewed annually based on shop size and location

- IT and Software Services: Optional registration with PSEB (Pakistan Software Export Board) for tax exemptions on IT service exports

- Professional Services: Industry-specific certifications including ICAP registration for chartered accountants, Pakistan Bar Council for lawyers, PMDC for doctors, and FBR authorization for tax practitioners

- Import/Export Businesses: Ministry of Commerce licenses and Importer Exporter Code (IEC) registration with Pakistan Single Window

- Manufacturing: Environmental permits from the EPA, health and safety approvals from PSQCA (Pakistan Standards and Quality Control Authority)

Contact your local chamber of commerce or relevant regulatory authority to determine specific requirements for your business type.

Sole Proprietorship Certificate in Pakistan

Your National Tax Number (NTN) certificate from the Federal Board of Revenue (FBR) serves as the official sole proprietorship certificate in Pakistan. There is no separate certificate issued by provincial authorities or the Registrar of Firms for sole proprietorships—the NTN certificate from FBR is your complete business registration certificate. This certificate proves your business is recognized by government authorities and authorized to operate. It displays your full legal name as shown on your CNIC, unique 7-digit NTN, registration date, and business details linked to your personal identity.

The NTN certificate is essential for opening business bank accounts, applying for sales tax registration, bidding on government tenders, signing commercial contracts, and fulfilling all legal business obligations in Pakistan.

Sole Proprietorship Act in Pakistan

Pakistan does not have a dedicated Sole Proprietorship Act. Instead, sole proprietorships operate under the Income Tax Ordinance, 2001, which governs registration and compliance requirements.

- Income Tax Ordinance, 2001: Requires all sole proprietors to register for a National Tax Number (NTN) with the Federal Board of Revenue through the IRIS portal. Business income is treated as personal income and taxed under progressive slabs ranging from 15-45%.

- Sales Tax Act, 1990: If your annual turnover exceeds prescribed thresholds for your business category, you must register for sales tax through the IRIS portal. This applies to manufacturers, wholesalers, distributors, importers, and certain service providers.

- Sector-Specific Regulations: Depending on your industry, you may need additional permits from municipal authorities (trade licenses for retail shops), health departments (food businesses), or federal ministries. These are operational requirements, not part of the core registration process.

How to Open a Sole Proprietorship Bank Account in Pakistan?

Opening a business bank account separates your personal and business finances, simplifies tax filing, and enables professional transactions with clients and suppliers.

Step 1: Choose Your Bank

Research and select a bank that meets your business needs. All major commercial banks in Pakistan offer sole proprietorship accounts with varying features and requirements.

Step 2: Visit Your Bank Branch

Visit your preferred bank branch with all required documents. Major banks offering sole proprietorship accounts include HBL, MCB, UBL, Meezan Bank, Allied Bank, and Bank Alfalah. Inform the business banking representative you want to open a sole proprietorship account.

Step 3: Complete Account Opening Form

Fill out the account opening form provided by the bank. The form requires:

- Your personal details (name, CNIC, contact information)

- Business information (business name, address, nature of business)

- NTN number

- Initial deposit amount

- Nominee details (optional)

Pro Tip: Bring both original documents and photocopies, as bank staff will verify documents against originals.

Step 4: Submit Documents and Application

Submit your completed application form along with all required documents. The bank will conduct verification, which requires your physical presence at the branch at least once. Some banks, like UBL, now offer partial online application processes, but in-person verification remains mandatory for final approval.

Step 5: Wait for Account Activation

Account activation takes 2-7 business days depending on the bank and completeness of your documents. Some banks may conduct a business premise visit to verify your business location before approval.

Once approved, you’ll receive:

- Account number

- Checkbook

- Debit card

- Access to internet and mobile banking

Important Considerations

- For Foreign Nationals: Foreign nationals operating sole proprietorships in Pakistan can open business accounts provided they have valid work visas, residency permits, and meet the bank’s requirements.

- Minimum Balance: Most banks require minimum balance maintenance (typically PKR 5,000 to PKR 50,000) to avoid monthly service charges.

- International Payments: If you plan to receive payments from overseas clients, choose banks like HBL, UBL, or MCB that support SWIFT transfers and have dedicated international transaction channels.

- Shariah-Compliant Options: Meezan Bank and other Islamic banking windows offer Riba-free current accounts for sole proprietorships.

How HRBS Can Help With Sole Proprietorship Registration

Registering a sole proprietorship in Pakistan gives you complete control, but as your business expands, managing payroll, taxes, compliance, and legal obligations can become complex. With HRBS’s Employer of Record (EOR) services, you can offload these responsibilities while maintaining full operational control.

- Automate payroll processing with accurate salary calculations and timely payments

- Ensure tax compliance across income tax, sales tax, and social security contributions

- Onboard employees and contractors with compliant documentation and contracts

- Stay updated on changing labor laws and regulatory requirements

- Maintain proper records for FBR audits and compliance verification

- Access expert guidance tailored to Pakistan’s business environment

- Manage EOBI, PESSI, and provincial compliance requirements efficiently

Scale confidently and avoid compliance headaches. Discover how HRBS supports sole proprietors and small businesses in Pakistan, and get a free consultation to simplify your journey.

FAQs

What is sole proprietorship in Pakistan?

A sole proprietorship in Pakistan is a business owned and controlled by a single individual, who holds full responsibility for its operations and financial obligations. It is the simplest form of business, suitable for freelancers, small traders, and service providers due to minimal regulatory requirements. Unlike companies or partnerships, a sole proprietorship does not create a separate legal entity, meaning the owner’s personal assets may be used to cover business liabilities.

What are the key labor laws and tax regulations a sole proprietor in Pakistan needs to know?

Sole proprietors in Pakistan must adhere to labor laws including the Pakistan Shops and Establishment Ordinance, 1969, and industry-specific legislation like the Factories Act, 1934 if applicable. Employing five or more workers triggers mandatory registration with provincial bodies such as PESSI. For taxation, sole proprietors need to obtain a NTN from FBR and comply with income tax filings.

How to open a sole proprietor bank account in Pakistan?

To open a business bank account, you need your NTN certificate as the primary requirement. Major banks like HBL, MCB, UBL, and Meezan Bank offer sole proprietor accounts. Required documents include your CNIC, NTN certificate, business address proof, and business letterhead. The process typically takes 1-3 business days for approval. Having a dedicated business account helps maintain separation between personal and business finances for better tax compliance.

What are the typical costs of registering a sole proprietorship in Pakistan?

Self-registration costs PKR 500 to PKR 1,000 covering business letterhead and stamps only, as NTN registration through FBR’s IRIS portal is completely free. If hiring professional services, expect PKR 5,000 to PKR 10,000 including consultation and document preparation assistance. Additional costs include bank account opening deposits (PKR 1,000 to PKR 10,000 depending on bank), municipal trade licenses (PKR 1,000 to PKR 10,000 based on location and business type), and sector-specific permits if required. The entire process takes 5-7 business days for self-registration.

Can a sole proprietorship be converted into a different business structure in the future?

Yes, sole proprietorships can convert to private limited companies or partnerships by registering the new entity with SECP, transferring business assets and liabilities under proper valuation, and updating tax registrations with FBR. Conversion provides limited liability protection (personal assets separated from business debts), enhanced credibility with corporate clients and investors, easier access to institutional funding and bank loans, and the ability to issue shares for capital raising. The process takes 14-21 business days for SECP company registration.

What financing options exist for sole proprietors in Pakistan?

Sole proprietors can access SME lending schemes from commercial banks, with the State Bank of Pakistan providing refinancing facilities for small businesses. Government programs include SMEDA business loans, grants, and advisory services, plus the National Business Development Programme (NBDP) offering loan facilitation with flexible terms. Microfinance institutions like Akhuwat Foundation, Kashf Foundation, and Khushhali Bank provide small business loans from PKR 10,000 to PKR 500,000 with simplified documentation. Islamic banks offer Shariah-compliant financing options, including Murabaha and Musharaka structures.

How long does it take to register a sole proprietorship in Pakistan?

NTN registration through FBR’s IRIS portal takes 2-5 working days after submitting complete documentation online. Opening a business bank account requires an additional 2-7 days once you receive your NTN certificate. If your business requires industry-specific licenses such as municipal trade permits (7-14 days), food authority registration (14-21 days), or health department clearances (10-15 days), factor these into your timeline.

When do i need to register for sales tax as a sole proprietor in Pakistan?

Register for federal sales tax when annual turnover exceeds PKR 5 million for retailers and PKR 10 million for manufacturers and service providers. All importers must register for sales tax immediately regardless of turnover. Provincial sales tax registration applies separately: the Sindh Revenue Board requires registration at PKR 10 million turnover with rates ranging from 13-15%, while the Punjab Revenue Authority enforces similar thresholds with a 16% standard rate. File monthly sales tax returns by the 18th of each following month if registered.

Can foreign nationals register a sole proprietorship in Pakistan?

Yes, foreign nationals can register sole proprietorships in Pakistan with valid work permits or business visas. Required documents include a passport, a Pakistani visa or residency permit, proof of Pakistani address (utility bill or rental agreement), and contact details. Foreign nationals apply for NTN through FBR’s IRIS portal using passport numbers instead of CNIC. Processing takes 7-10 days due to additional verification checks. Some business sectors require special permits or SECP approval for foreign ownership.

Can i register my sole proprietorship online in Pakistan?

Yes, sole proprietorship registration is fully online through FBR’s IRIS portal. Create an account using your CNIC number, complete the NTN registration form, upload required documents (CNIC copy, utility bill not older than 3 months, business details), and submit digitally. The system generates your NTN certificate digitally within 2-5 working days for download directly from the portal. No physical office visits are needed for NTN registration.

What happens if i stop operating my sole proprietorship business in Pakistan?

File a final income tax return for the fiscal year up to your business closure date and settle all outstanding tax obligations, including sales tax if registered. Update your business status on the IRIS portal under “Change in Particulars” to mark it as inactive or closed. Close your business bank account after clearing all transactions and transferring any remaining funds. Maintain financial records, invoices, receipts, and tax returns for five years minimum, as FBR may conduct post-closure audits.

What should I do if my NTN application is rejected or delayed?

If rejected, log into the IRIS portal to check the rejection reason under “Application Status”. Common rejection causes include CNIC details not matching the NADRA database, expired CNIC, incorrect address format, poor document image quality (less than 100KB or unclear scans), or incomplete business description. Correct the errors and resubmit immediately through the same portal. If your application remains “pending” beyond 7 working days, contact FBR or visit your nearest Regional Tax Office with your application reference number, original CNIC, and supporting documents.

Do i need a lawyer or consultant to register a sole proprietorship in Pakistan?

No, hiring professionals is not legally required, as FBR’s IRIS portal enables self-registration, and most entrepreneurs complete NTN registration independently at zero cost. However, professional assistance becomes valuable for complex situations including sales tax registration across multiple provinces, industry-specific licensing in regulated sectors (pharmaceuticals, food, healthcare, imports), navigating application rejections, or trademark searches for business names.

What are some popular sole proprietorship business ideas in Pakistan?

Popular sole proprietorship businesses in Pakistan include freelancing services (writing, graphic design, web development, digital marketing), e-commerce stores selling through Daraz or independent websites, home-based food businesses (catering, baking, tiffin services), IT consulting and software development, tutoring and coaching centers, beauty salons and barbershops, boutique fashion and tailoring services, real estate brokerage, photography and videography services, and mobile repair shops.