Employee benefits and compensation play a crucial role in keeping employees motivated and productive. Employers who provide clear mandatory employee benefits in Pakistan not only meet legal requirements but also build trust and loyalty among their workforce. These benefits typically include paid leave, social security coverage, maternity leave, and workers’ compensation, which protect employees during important life events and provide financial security. A well-structured employee compensation package – covering competitive salaries, allowances, bonuses, and overtime pay – helps companies attract and retain skilled workers.

Many organizations develop comprehensive employee benefits policies that go beyond statutory requirements by offering additional perks such as health insurance, retirement benefits, and wellness programs. These voluntary benefits improve employee satisfaction, reduce turnover, and contribute to better overall company performance. This blog provides a practical guide to understanding and implementing employee benefits and compensation in Pakistan. You will learn about essential benefits every employer should provide, how to design effective compensation structures, and the latest trends shaping the workplace.

What are Employee Benefits?

Employee benefits are additional perks and protections employers provide alongside salary to improve employees’ overall compensation. These benefits play a vital role in supporting employees’ financial stability, health, and work-life balance. By offering these benefits, companies not only comply with labor standards but also create a more engaged and loyal workforce, which directly contributes to higher productivity and lower absenteeism. In Pakistan, employee benefits fall into two main categories:

- Mandatory (Statutory) Benefits: These are legally required benefits that employers must provide. They include eobi, pension, paid annual leave, sick leave, maternity leave, social security contributions, and compensation for workplace injuries. These benefits protect employees during illness, childbirth, or accidents and ensure a basic safety net.

- Voluntary (Supplementary) Benefits: These are additional perks employers may offer to improve employee satisfaction and retention. Examples include private health insurance, retirement plans, wellness programs, education allowances, and performance bonuses. These benefits help companies stand out in a competitive labor market.

Why Employee Benefits Matter in Pakistan

Employee benefits are not just a legal obligation in Pakistan, they are a strategic tool for building a competitive, productive, and sustainable business. By prioritizing both mandatory and supplementary benefits, companies set themselves apart in a challenging labor market.

- Reduce Employee Turnover: Providing comprehensive benefits reduces employee turnover by increasing job satisfaction. This saves companies significant costs related to recruiting, hiring, and training new staff. Skilled workers are in demand across sectors like IT, manufacturing, and services, making retention vital.

- Attract Skilled Talent: In a competitive labor market, companies that offer health insurance, enhanced retirement plans, and other voluntary perks stand out to top professionals. These benefits signal that a company values its employees’ wellbeing and long-term security, making it more attractive to job seekers—especially in high-growth industries.

- Ensure Compliance: Providing all legally required benefits is not optional. Companies that comply with mandatory leave, social security, pension, and safety requirements avoid fines, legal disputes, and reputational damage. Staying compliant also reduces the risk of operational disruptions and supports long-term business stability.

- Enhance Workplace Engagement: When employees feel supported through benefits, they develop greater loyalty and commitment. This leads to a positive workplace culture, encourages teamwork, and drives higher productivity, that translate directly to business performance.

Mandatory Employee Benefits in Pakistan

Employers in Pakistan must comply with specific mandatory employee benefits as defined by labor laws to protect workers’ rights and ensure operational compliance. These benefits cover wages, working hours, leave entitlements, social security, and compensation, directly impacting employee well-being, retention, and business success.

Social Security

Employers must register eligible employees with the Employees’ Social Security Institution (ESSI). This provides workers with access to medical treatment, sickness/injury benefits, maternity benefits, disability coverage, and survivor pensions—directly supporting both employees and their families during critical life events. Non-registration is illegal and exposes employers to fines and penalties.

EOBI

EOBI is a mandatory national pension scheme. Employers contribute 5% and employees contribute 1% (each calculated on the minimum wage) to this fund. EOBI ensures a retirement pension, invalidity pension, and survivor pension for eligible workers, providing a foundation for old-age financial security. Both employer and employee contributions are legally required.

Minimum Wage

All employees, regardless of sector or province, must be paid at least the legally mandated minimum wage. As of 2025, this ranges approximately from 35,000 PKR/month in Punjab to 37,000 PKR/month in Sindh, reflecting local economic conditions. Non-compliance can result in fines, legal action, and reputational damage.

Pension

All eligible employees in Pakistan must be registered with the Employees’ Old-Age Benefits Institution (EOBI). Employers and employees both contribute a set amount each month. At retirement (age 60 for men, 55 for women), employees receive a monthly, lifelong pension, helping ensure basic financial security after work.

Working Hours and Overtime

Pakistani law sets a maximum 48-hour workweek (typically 8–9 hours/day, six days a week). Overtime is strictly limited to 12 hours/week and 3 hours/day, with compensation at 200% of the regular wage for ordinary days and 300% on holidays. These limits are enforced to prevent overwork and ensure fair compensation.

Paid Annual Leave

After 12 months of continuous service, employees are generally entitled to 14 consecutive days of paid annual leave. This supports mental and physical health, reduces burnout, and is a non-negotiable right under labor law. Leave records must be maintained by employers.

Public Holidays

Employees must receive paid leave on all government-declared national and religious holidays (typically 11–15 days/year). If required to work on a holiday, employees are entitled to substitute leave or overtime pay. Respecting these holidays is not just a legal obligation but also a cultural expectation.

Sick Leave

Workers are entitled to 10–16 days of paid sick leave per year (exact amount varies by sector), with medical certification required for extended absences. ESSI-registered employees also receive extended sickness benefits and medical coverage for both occupational and non-occupational illnesses.

Maternity Leave

The Maternity and Paternity Leave Act 2020 entitles female employees to paid maternity leave based on childbirth order:

- 180 days for the first child

- 120 days for the second child

- 90 days for the third child

Insured female employees who have contributed for at least 180 days in the previous year receive full wage compensation during maternity leave.

Paternity Leave

Male employees qualify for 30 days of paid paternity leave for the first three childbirths. This benefit supports family bonding and promotes gender-inclusive workplace policies, enhancing employer branding.

Casual Leave

Pakistani law requires employers to provide up to 10 days of paid casual leave per year for personal or family emergencies. This leave is separate from annual or sick leave. Rules for using it (such as prior approval, notice, and documentation) may vary by employer.

Termination and Severance Pay

Employees must receive advance written notice (usually 30 days) before termination. If terminated for reasons other than misconduct, they get severance pay (30 days’ wage per year of service).

Non-Mandatory Employee Benefits in Pakistan

Beyond what is legally required, many Pakistani employers choose to offer additional benefits as part of their compensation strategy to attract top talent, increase retention, and enhance employee satisfaction and productivity. These benefits are voluntary, not mandated by law, but play a crucial role in building a positive workplace culture and a competitive employer brand.

- 13th-Month Pay/Bonus: A common practice among larger organizations is to award employees with an extra month’s salary or a discretionary annual bonus. This is paid at year-end and serves as both a financial reward and a retention tool.

- Provident Fund: While EOBI is the mandatory pension scheme, some employers contribute to a provident fund where both the company and the employee make voluntary contributions. These savings provide additional financial security for employees after retirement.

- Health Insurance: Employers often offer private health insurance coverage, sometimes extending it to immediate family members. This benefit is highly valued as it reduces employees’ out-of-pocket medical expenses and supports overall well-being.

- Life Insurance: The employer pays for an insurance policy that gives money to the employee’s family if something unexpected happens to the employee. This helps protect the family’s financial future and gives employees peace of mind.

- Profit and Performance Bonuses: Profitable companies sometimes allocate a portion of annual profits to be distributed among employees, rewarding collective effort and success.

- Voluntary Pension Fund (VPF): Employees can join SECP-regulated pension schemes beyond mandatory EOBI. They or their employer can contribute flexible amounts, enabling more retirement savings for long-term security.

- Trainig and Development: Investing in employee growth through skills training, certifications, and leadership programs helps build a capable workforce and supports career progression.

- Travel Allowance: Travel allowance is an optional benefit some employers in Pakistan offer to cover or reimburse expenses employees incur while traveling for work, such as commuting between locations, client visits, or business trips.

- Meal Allowance: Some employers provide a meal stipend or on-site canteen facilities, reducing daily expenses for employees and supporting their convenience.

- Mobile Phone Allowance: A monthly stipend or company-provided device helps employees stay connected for work-related communication, especially important for hybrid or remote roles.

Workers’ Compensation and Death Benefits

If a worker is injured on the job, Pakistani law requires employers to cover all medical costs and provide compensation for lost wages during recovery. If an employee dies because of a work-related incident, specific benefits are paid to the family to provide immediate and ongoing support.

- Death Grants: A one-time payment equal to 30 days’ wages (with a legally set minimum amount) is given to the family when a worker dies due to a workplace accident, offering quick financial help during a difficult time.

- Survivor Pension: Dependents, such as a widow and children receive a regular survivor pension. This continues until the widow remarries or the children reach adulthood (usually age 18), helping the family maintain financial stability.

- Funeral Expenses Grant: The employer or social security institution pays for funeral costs, calculated as 30 times the daily sickness rate (with a minimum amount set by law), ensuring a respectful burial.

Iddat Benefits: Pakistani law provides paid Iddat leave, about 4 months and 10 days for widowed female employees, honoring cultural and religious traditions while protecting their income during mourning.

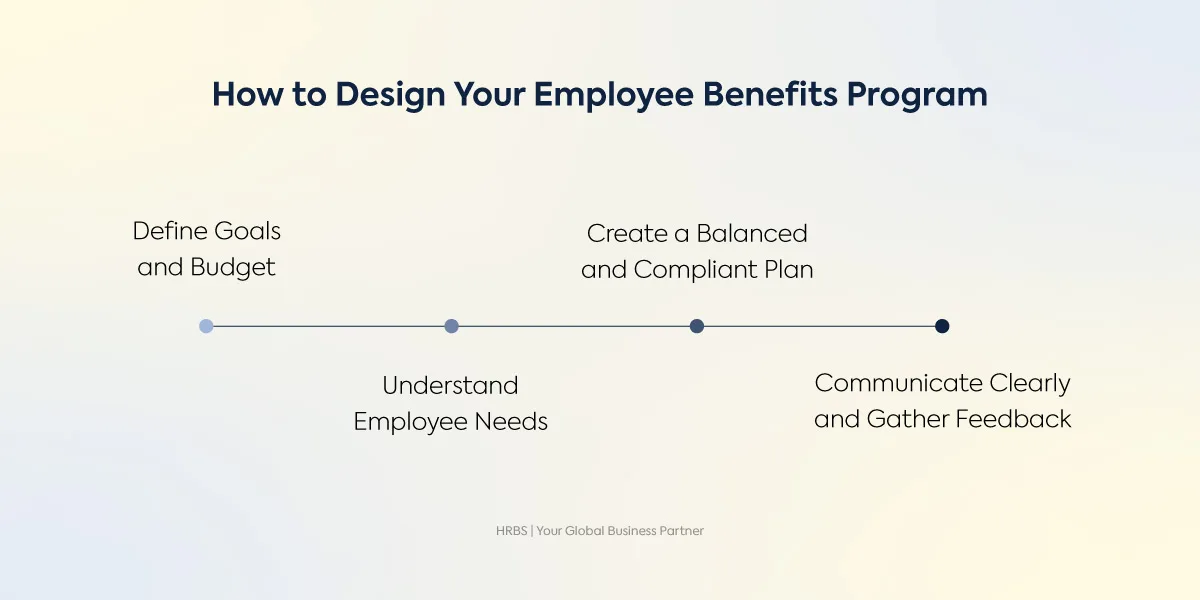

How to Design Employee Benefits Program in Pakistan

A well-structured benefits program helps you attract and retain talent, control costs, and avoid legal penalties. Follow these clear steps to build a compensation plan that fits your business needs and satisfies employees while ensuring compliance with labor laws:

Step 1: Define Goals and Budget

Start by clearly outlining your business objectives—such as attracting talent, reducing turnover, and meeting legal standards like minimum wage and mandatory benefits. Assess your company’s budget to allocate funds for salaries, allowances, and compulsory benefits without compromising profitability. Review existing employment contracts and agreements to avoid legal conflicts.

Step 2: Understand Employee Needs

Conduct employee surveys or focus groups to identify which benefits matter most, such as health insurance, provident fund, or paid leave. Compare your current offerings with industry and regional benchmarks to ensure your package remains competitive in Pakistan’s job market.

Step 3: Design the Compensation Structure

Establish a mix of fixed pay (basic salary, allowances) and variable pay (bonuses, annual increments). Integrate all legally required benefits, social security, EOBI, paid leave, and consider voluntary perks like medical coverage or flexible retirement plans. Customizable options help increase engagement and control costs.

Compensation Structure = Fixed Pay + Variable Pay + Mandatory Benefits + Voluntary Benefits

Step 4: Communicate and Collect Feedback

Clearly communicate the benefits plan to all employees, emphasizing both mandatory and optional components. Gather feedback regularly to identify any underused or low-value benefits. Make necessary adjustments based on this feedback to boost satisfaction and effectiveness.

Step 5: Review and Update Annually

Review your benefits plan at least once a year to ensure ongoing compliance with updated labor laws and regulations. Monitor key indicators such as employee retention, payroll costs, and satisfaction surveys. Use these insights to refine your program and maintain its relevance and competitiveness.

How to Calculate Employee Benefits in Pakistan?

Calculating employee benefits in Pakistan requires understanding both statutory requirements and the processes for each benefit. Here is a clear, step-by-step guide for employers and employees, focused on accuracy and compliance.

| Benefits | Calculation Method |

|---|---|

| Minimum Wage | Pay at least the provincial legal minimum wage. |

| Overtime | Maximum 12 hours/week or 3 hours/day, paid at double (normal days) or triple (holidays) the normal rate. |

| Annual Leave | 14 days paid leave after 12 months of service. |

| Public Holidays | Paid leave on all government-declared holidays; if worked, give substitute leave or overtime pay. |

| Sick Leave | 10–16 paid days/year (divide by 12 for monthly accrual). |

| Maternity Leave | Up to 180 days (first child), 120 days (second), 90 days (third)—full pay for eligible employees. |

| Paternity Leave | 30 days paid leave for first three childbirths. |

| Social Security (ESSI) | Employer pays 6% of minimum wage; employee pays 1%. |

| EOBI | Employer pays 5% of minimum wage; employee pays 1% (of minimum wage). |

| Gratuity | (Last year’s gross salary ÷ 26) × 30 × years of service. |

| Provident Fund | Employer and employee each pay a set percentage (commonly 8–10%) of salary. |

| Income Tax | Deduct tax from total salary plus taxable benefits using current income tax rates. |

Taxation and Financial Implications of Employee Benefits

Mandatory employee benefits in Pakistan carry direct tax and cost implications for both employers and employees, proper calculation, withholding, and reporting are essential for legal compliance and financial accuracy.

| Item | Who Pays | Rate | Tax Impact | Employer Steps |

|---|---|---|---|---|

| Income Tax | Employee | Progressive (0% to 35% based on income) | Paid on gross salary, including taxable benefits | Deduct tax monthly, file returns with FBR |

| Social Security (ESSI/EOBI) | Employer & Employee | Employer: 5–6% of minimum wage; Employee: 1% of salary | Employer: tax-deductible expense; Employee: reduces taxable income | Register employees, remit contributions monthly, report with payroll |

| Mandatory Cost | Employer | Approx. 6% of minimum wage per employee | Added to total compensation cost | Include in salary budgets |

| Payroll Filing | Employer | N/A | N/A | Monthly filings to FBR for compliance |

| Record-Keeping & Payslips | Employer | N/A | N/A | Issue detailed payslips monthly |

What Employees Should Know About Their Benefits?

Employees in Pakistan have legal rights to a range of benefits, knowing these helps ensure they receive what they are owed and encourages employers to comply with the law. Below is a straightforward, practical checklist covering what employees should know, how to qualify, and what to do if benefits are denied.

Key Benefits Employees Should Claim

- Maternity Leave: Paid time off for expectant mothers, as specified by law.

- Sick Leave: Paid leave for illness, with a valid medical certificate.

- Social Security Benefits: Access to medical care, paid sick/maternity leave, and retirement pensions through EOBI or provincial schemes.

- Workers’ Compensation: Medical expenses and wage replacement if injured at work.

- Paid Annual Leave: Earned leave after 12 months of continuous service.

- Public Holidays: Paid time off on official holidays.

- Overtime Pay: Extra pay for hours worked beyond the standard workweek.

Eligibility Requirements

- Regular, full-time status is typically required.

- Continuous employment (usually about 12 months) for certain benefits like annual leave.

- Registered with social security (EOBI or provincial equivalent); both employee and employer must contribute.

What if Benefits are Denied?

If an employer does not provide legally required benefits, employees can report the issue to local labor authorities for investigation and enforcement.

Legal Acts and Ordinances Governing Employee Benefits in Pakistan

Pakistani law provides a structured framework for employee benefits and workplace rights. Below are the key acts, their core requirements, and the unique benefit each delivers in the context of Pakistan’s labor market:

- Workmen’s Compensation Act, 1923: Employers must cover medical costs and pay compensation for workplace injuries, disabilities, or death, even if the employer wasn’t at fault. Workers and families get quick support without waiting for lengthy legal fights.

- Industrial Relations Ordinance, 2002: Employees can form and join unions and engage in collective bargaining. Employers must negotiate in good faith and follow official dispute resolution procedures.

- Minimum Wages Ordinance, 1961: Employers must pay at least the minimum wage set by their provincial government, which is reviewed and updated as needed. Employees are guaranteed a basic income standard that adjusts with local economic conditions, helping ensure their basic needs are met.

West Pakistan Social Security Ordinance, 1965: Employers must register eligible employees with ESSI, make regular contributions, and provide access to social security benefits such as medical care, sickness pay, maternity leave, and injury compensation.Workers gain access to essential health and income support, reducing financial stress during illness, injury, or maternity leave. - Factories Act, 1934: This act regulates working conditions in factories across Pakistan to ensure the health, safety, and welfare of workers. It mandates provisions such as proper ventilation, cleanliness, lighting, and sanitation facilities. The act also governs working hours, rest intervals, and annual leave entitlements.

- Payment of Wages Act, 1936: Employees must receive their full wages on time, at least once a month, with no unauthorized deductions. Workers are protected from wage delays or unfair deductions, ensuring they receive their full earnings as promised.

How HRBS Can Help with Employee Benefits in Pakistan

Managing employee benefits and compensation in Pakistan requires a clear understanding of local labor laws, social security rules, and regional regulations. HR Business Solutions makes this easier by handling all legal and administrative responsibilities, ensuring your business stays fully compliant without needing to set up a local office. By automating payroll, accurately managing tax deductions, and ensuring timely social security contributions, HRBS minimizes errors and saves valuable time for your HR team.

Beyond compliance, HRBS assists in creating compensation packages that align with your business objectives and local market standards. These packages include salaries, allowances, bonuses, and required benefits such as maternity and sick leave. Smooth claims processing and transparent communication help increase employee satisfaction and build trust within your workforce. Working with HRBS allows you to hire and onboard employees in Pakistan quickly and efficiently, whether you need one employee or an entire team. Their flexible solutions adapt to your business needs, letting you focus on growth while ensuring proper management of employee benefits and compensation.

FAQ’S

What are the statutory employee benefits in Pakistan?

Pakistani law requires employers to provide minimum wage, limited working hours with overtime pay, paid annual leave, public holidays, casual and sick leave, maternity and paternity leave, workers’ compensation for injuries, social security (including medical care, sickness pay, disability, survivor, and funeral grants), and proper notice period, severance pay, and gratuity at termination. These are all legal obligations; failing to provide them can result in fines or legal action.

How does social security work for employees in Pakistan?

Employees registered with the Employees’ Social Security Institution (ESSI) receive access to medical care, paid leave during sickness or injury, maternity benefits, disability coverage, and survivor pensions. Both employer and employee must contribute. This system covers most formal sector workers and is mandatory for eligible employees.

Can employers offer benefits beyond the mandatory requirements?

Yes, employers may offer additional benefits, such as health and life insurance, provident fund, bonuses, training, meal/mobile allowances, and more. These are voluntary, not required by law, and help attract and retain talent.

How do employers calculate overtime pay in Pakistan?

Overtime pay is 200% of the regular wage rate for extra hours on ordinary days, and 300% on holidays. Total weekly overtime is capped at 12 hours. Calculation:

Overtime Pay = (Regular Hourly Wage) × Overtime Hours × (2 or 3)

How are employee benefits treated for tax purposes in Pakistan?

Mandatory benefits such as social security, EOBI, and statutory leave are generally not taxed for employees as long as they are within legal limits, but cash allowances and most voluntary benefits like transport, meal, mobile, and housing allowances are usually taxed as part of regular income and must be reported on the payroll.

How to calculate employee compensation in Pakistan?

Total compensation = Basic pay + legally mandated benefits (social security, EOBI, annual/sick/maternity/paternity leave, public holidays, overtime) + any voluntary benefits (bonus, insurance, allowances). Salary should be at least the minimum wage for the province and sector.

What maternity leave rights do female employees have in Pakistan?

Pakistani law guarantees paid maternity leave of up to 180 days (first child), 120 days (second child), and 90 days (third child). Insured female employees receive full wage compensation during leave after meeting contribution requirements.

How can employers ensure compliance with employee benefits laws in Pakistan?

Employers should:

- Register all eligible employees with ESSI and EOBI

- Pay at least the minimum wage and required overtime

- Provide all legally mandated leave and holidays

- Maintain accurate payroll records

- Stay updated on federal and provincial labor laws

- Communicate benefits clearly to employees

- Report violations promptly to labor authorities

- Respond to employee complaints and audits by provincial labor departments

What benefits are trending for remote or hybrid workers in Pakistan?

Currently, no law in Pakistan requires companies to provide specific benefits for remote or hybrid employees, all offerings depend on employer policy. Flexible work arrangements are increasingly available, including the option to work from home, coworking spaces, or with adjustable hours. Some companies also cover costs for internet, equipment (like laptops or monitors), and mobile data, or provide stipends for setting up a home office.