Establishing a presence in Pakistan offers significant market potential, but the growth of your expansion depends on how you handle the specific mix of federal revenue rules and provincial labor regulations. Payroll acts as the primary function where strict government mandates meet employee compensation rights, meaning that managing these elements accurately is critical to preventing the large financial penalties and government audits linked to incorrect calculations or missed deadlines.

To help you stay prepared, this guide converts our practical understanding into a detailed technical resource that examines exact salary structures, efficient allowance allocations to minimize tax liability, proper banking compliance, and the mandatory social security payments required by law. We outline the specific legal obligations necessary to maintain a satisfied workforce while protecting your business reputation.

What You Need to Know About Payroll in Pakistan

Managing payroll in Pakistan relies on balancing federal tax rules with provincial labor laws. For both local and global firms, managing these elements correctly is the only way to avoid financial risks and legal issues linked to non-compliance.

- Legal Framework: Payroll operations follow key laws, including the Payment of Wages Act, Income Tax Ordinance, and Employees’ Old-Age Benefits Act. These rules require paying salaries on time, cutting taxes based on income levels, and making required pension payments.

- Salary and Overtime Calculation: Gross salary usually splits into Basic Pay (approx. 60-66%) and allowances for housing, medical needs, and transport. You must also account for overtime work and public holidays, which typically pay double the ordinary rate (2x) per hour. Deduct tax and social security correctly before paying the final net amount.

- Mandatory Contributions: Employers must deduct income tax at the source and send it to the government on time. Additionally, both the company and the employee contribute to pension and social security funds. Sending these payments promptly is vital to avoid penalties and stay in good standing with authorities.

- End-of-Service Benefits: You are legally bound to provide a terminal benefit to permanent staff, requiring a choice between gratuity and a provident fund. While Gratuity is the default legal mandate, establishing a provident fund allows you to distribute the financial burden and stabilize cash flow, eliminating the risk of sudden, large payouts during staff turnover.

- System Setup and Records: Compliant payroll starts with registering your business with tax departments and opening a corporate bank account for clear transactions. Companies must set clear policies for leave and benefits while keeping accurate employee records, including national ID and tax numbers to support official audits.

- Payment Cycle and Incentives: Salaries in Pakistan are paid monthly and must meet minimum wage standards. While not required by law, offering annual performance bonuses is a common practice to support staff retention.

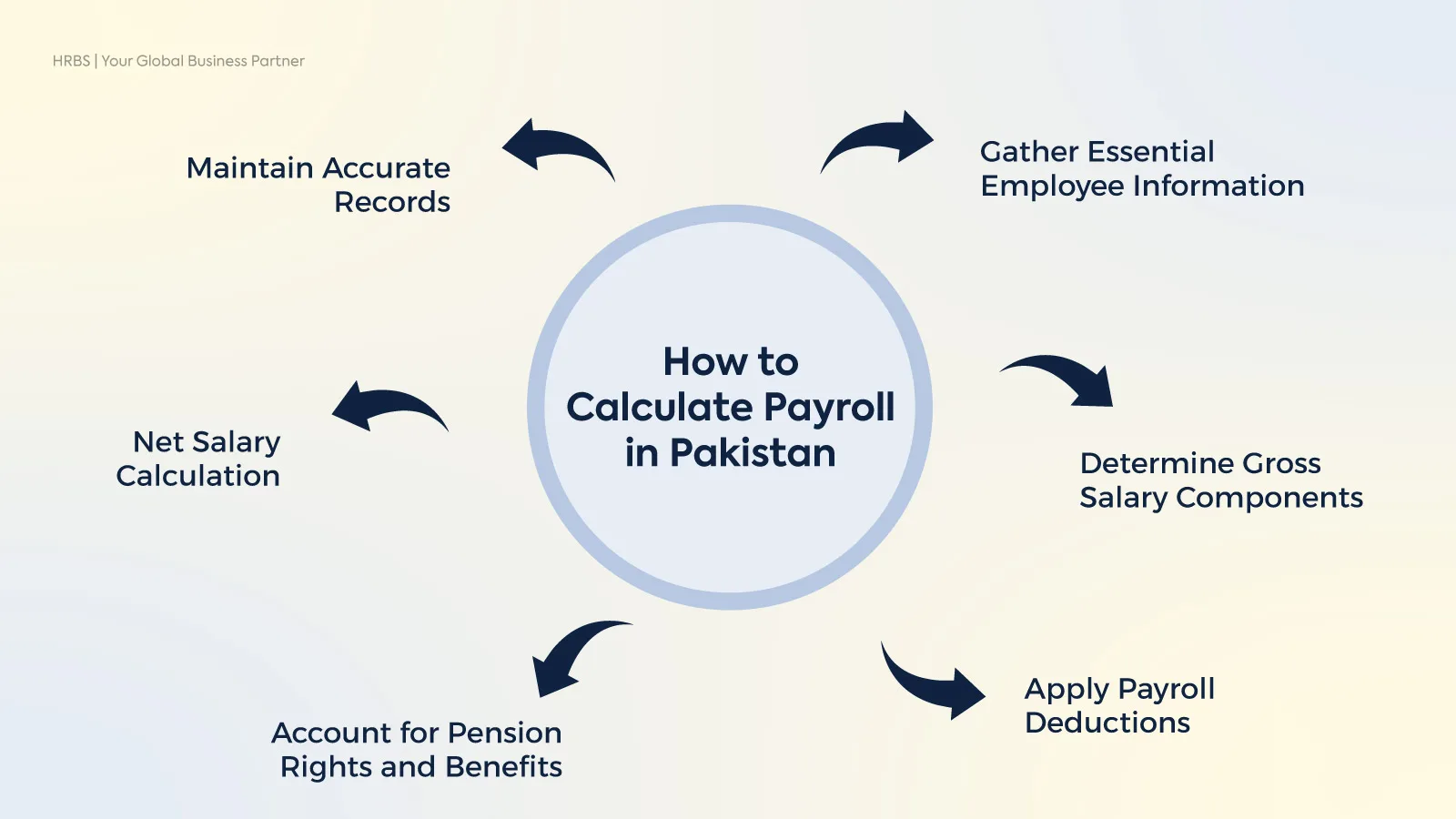

How to Calculate Payroll in Pakistan: A Step-by-Step Process

Calculating payroll in Pakistan requires a detailed understanding of tax slabs, strict operational deadlines, and specific contribution formulas. Follow this process to calculate salaries accurately and prevent audit penalties:

Step 1: Verify Employee Information

Before running the cycle, check that all employee records are active. Ensure every staff member has a valid National Tax Number (NTN) to prevent annual reporting complications. Crucially, confirm that the employee’s bank account title matches their CNIC name exactly. This alignment ensures salaries are credited instantly without manual intervention.

Step 2: Calculate Gross Salary

Gross salary represents the total earnings before any deductions. It typically consists of:

- Basic Salary: The fixed core pay, usually structured as 60-66% of the total package. This amount serves as the baseline for calculating provident fund and gratuity liabilities.

- Allowances: Standard additions for house Rent (40-45%) and conveyance, which are fully taxable. Medical allowance (10%) is distinct, as it is legally exempt from income tax up to 10% of the basic salary.

- Overtime & Incentives: Includes performance bonuses, commissions, and compensation for extra hours. Overtime is calculated based on the gross salary and must be included in the monthly taxable income calculation.

Step 3: Apply Statutory Deductions

This is the most critical stage for compliance. You must apply deductions in the following order:

- Income Tax: Apply the relevant tax slab to the estimated annual income. Recalculate this amount monthly based on actual payouts to keep the employee’s net pay stable, rather than deducting a large balance at the end of the year.

- EOBI Contribution: Calculate 5% (Employer) and 1% (Employee) of the current minimum wage. Do not calculate this on the total gross salary, as this significantly overstates the cost.

- Social Security: Calculate 6% of the minimum wage (Employer cost only) ensuring you deposit it with the relevvant provincial authority (e.g., PESSI in Punjab, SESSI in Sindh).

- Provident Fund: Deduct the agreed percentage (typically 10%) from the basic salary only, provided your company has established this benefit for its workforce.

Step 4: Determine Net Payable

Subtract total deductions from the gross salary to determine the net salary payable to the employee.

Formula: Net Salary = Gross Salary – (Income Tax + Pension + Provident Fund + Other Deductions)

Calculation Example:

- Gross Salary: PKR 100,000

- Income Tax: PKR 1,250 (Example rate)

- EOBI (1% of Min. Wage): PKR 400 (approx.)

- Provident Fund (10% of Basic): PKR 6,000

- Net Payable: PKR 100,000 – 7,620 = PKR 92,380

Tip: Always round off the net payable to the nearest whole rupee. Many corporate banking portals in Pakistan will reject the entire bulk salary file if a single entry contains a decimal (e.g., .50).

Step 5: Record & Disburse

Transfer salaries directly through a corporate bank account or verified digital wallets to ensure an irrefutable audit trail. Under the Payment of Wages Act, you must disburse funds by the 7th or 10th of the month (depending on staff size). Always issue a formal salary slip to every employee, as this documentation is your primary legal defense during labor disputes.

Key Elements of Salary Structure in Pakistan

A well-defined salary structure balances competitive pay with strict observance of the payment of wages act and income tax ordinance. Properly organizing these components is the only way to control tax liabilities for employees while protecting the company from labor audits.

Core Earnings (The Gross Salary)

Gross Salary is the sum of all fixed and variable payouts before deductions. It is typically structured as follows:

- Basic Salary: The fixed core pay serves as the foundational baseline for calculating overtime, gratuity, and social security. In Pakistan, this is standardly set at 60-66% of the Gross Salary to ensure full compliance with minimum wage laws while managing long-term separation costs.

- House Rent Allowance (HRA): This standard addition (typically 40-45% of Basic Pay) supports housing costs and is treated as fully taxable income under current laws.

- Medical Allowance: Usually capped at 10% of the Basic Salary, this allowance offers a significant financial advantage as it is exempt from income tax, provided the company does not offer free medical treatment (Clause 139, Income Tax Ordinance).

- Conveyance Allowance: A fixed monthly amount provided to cover commuting costs, which is treated as fully taxable income.

- Utility Allowance: A monthly payment designed to subsidize rising household costs, covering electricity, gas, internet, and mobile usage.

Statutory Deductions (The Employee’s Liability)

These mandatory subtractions from the gross salary determine the final net payable amount transferred to the employee’s account.

- Income Tax: Employers are legally required to withhold tax at the source based on the annual projected income, applying progressive rates from 0% to 35% for any earnings that exceed the current PKR 600,000 annual exemption threshold.

- Provident Fund (PF): While establishing this fund is voluntary for the company, the standard deduction (typically 10% of basic salary) becomes mandatory for enrolled staff to ensure they build a secure retirement fund.

- EOBI (Employee Share): To secure pension eligibility, a mandatory contribution of 1% of the current minimum wage is deducted. This calculation is strictly based on the minimum wage cap rather than the total gross salary to ensure the deduction remains affordable and legally compliant.

Employer Contributions

These components are paid by the company on behalf of the employee. They are not deducted from the salary but are part of the total cost to company (CTC).

- EOBI (Employer Share): The company must contribute 5% of the minimum wage to the federal institution.

- Social Security (SESSI/PESSI): A provincial payment of 6% of the minimum wage to cover employee healthcare. This is solely an employer expense.

- Gratuity (End-of-Service Benefit): Often overlooked but legally required. If no Provident Fund exists, the employer must pay Gratuity (equivalent to one month’s gross salary for every year of service) upon resignation or termination.

Cost to Company (CTC)

CTC represents the total financial investment required to employ a staff member, typically calculated as 20-30% higher than the visible gross salary.

CTC = Gross Salary + (EOBI + Social Security + Gratuity) + (Health Insurance + Bonuses)

Relying on Gross Salary alone for budgeting is a critical error that leads to understated hiring costs and unexpected cash flow gaps, as it ignores the substantial employer-side payments that do not appear on the monthly salary slip.

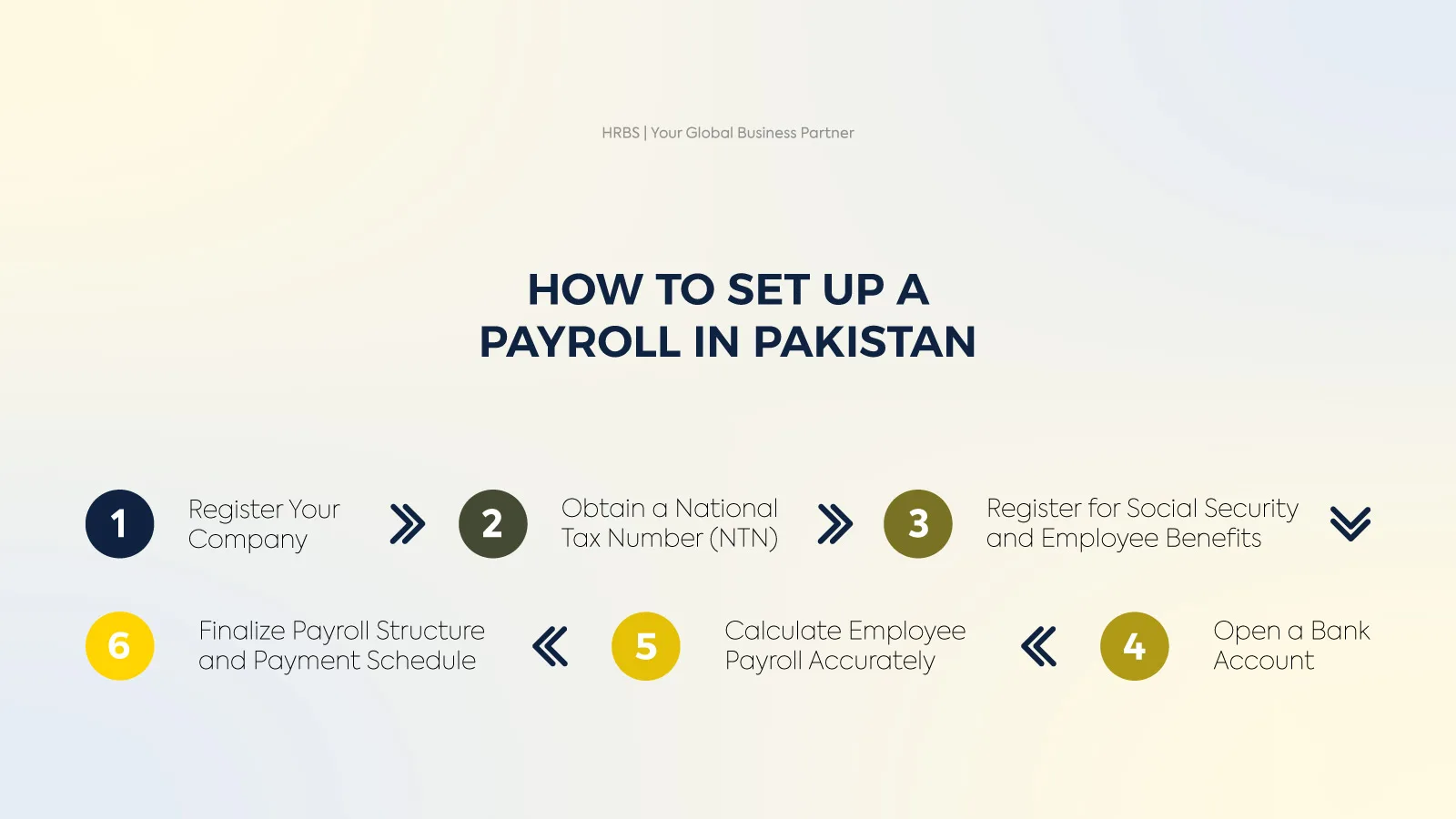

How to Set Up a Payroll in Pakistan

Setting up payroll in Pakistan requires more than just a spreadsheet; it demands a balance between operational efficiency and legal compliance. Whether you are starting a local startup or expanding an international branch, follow these essential steps:

Step 1: Register Your Business Entity

Before processing payroll, your business must be a legally recognized entity.

- For Companies: Register with the SECP to obtain incorporation documents. This registration is mandatory to generate the company NTN, which you strictly need to legally deduct and file employee taxes.

- For Sole Proprietors: Register directly with the FBR to obtain your certificate. This legal status is the basis for all subsequent tax and banking registrations.

Step 2: Obtain a National Tax Number (NTN)

Secure your NTN directly from the FBR to formally license your business as a withholding agent, granting you the authority to legally deduct income tax from salaries and file the mandatory annual employer statements. Operating your payroll without this registration immediately makes your tax deductions unauthorized and non-compliant.

Step 3: Register for Social Security and Benefits

You must register with two separate authorities to manage benefits, as the responsibility is divided between federal and provincial levels.

ded between federal and provincial levels.

- EOBI (Federal): Register with the EOBI to facilitate pension contributions. This registration becomes legally mandatory the moment your business employs five or more people.

- Social Security (Provincial): Register with the relevant provincial department (e.g., PESSI, SESSI) to cover healthcare. You must register in the specific province where your staff is located to ensure valid coverage.

Step 4: Open a Corporate Account

Open a dedicated corporate bank account with banks like Meezan Bank, HBL, or Bank Alfalah to formally establish your payroll as a tax-deductible business expense. Processing payroll through direct digital transfer creates the necessary evidence needed to claim these costs during your annual audit.

Step 5: Calculate Employee Payroll Amount

Determine the accurate net salary by following a structured calculation process that prevents errors.

- Sum Total Earnings: Combine the fixed basic pay with all recurring allowances and any variable additions like overtime or monthly bonuses to find the Gross Salary.

- Apply Deductions: Subtract the applicable income tax and social security contributions from the total earnings based on current rates.

- Finalize Net Pay: The remaining balance is the actual amount you must transfer to the employee’s bank account.

Step 6: Finalize Schedule and Disburse Salaries

Complete the payroll process by following a fixed schedule to maintain workforce confidence. Issue a clear salary slip with every transfer to explain deductions, and save all digital payment proofs to legally protect your business during future audits.

Payroll Processing Stages in Pakistan

The payroll process in Pakistan involves several key stages to ensure timely and accurate salary payments and compliance with local regulations.. Payroll process comprises:

Pre-Payroll Stage

- Open a dedicated corporate bank account linked to your company NTN and establish clear policies for attendance and overtime to prevent calculation disputes.

- Confirm essential employee details, specifically filer/non-filer tax status and bank account numbers before processing any payments.

- Finalize mandatory registrations with the FBR, EOBI, and provincial social security departments to meet all legal requirements.

Payroll Stage

- Calculate gross salary by combining basic pay, allowances (housing, medical, conveyance), bonuses, and overtime pay.

- Deduct mandatory amounts such as income tax (progressive rates based on earnings), pension contributions, provident fund, and authorized deductions like loan repayments or insurance premiums.

- Provide a clear breakdown of earnings and deductions to every staff member for transparency.

Post-Payroll Stage

- Deposit all withheld taxes and benefits to the proper authorities to avoid late fees.

- Save all digital payment proofs and monthly sheets to legally defend your expenses during audits.

- Match your bank statement against your payroll register to find and fix any discrepancies.

Payroll Contributions in Pakistan

Both employers and employees contribute to social security in Pakistan as part of the country’s essential payroll requirements.

| Contribution Type | Responsible Party | Rate / Amount | Calculation Base |

| EOBI (Pension) | Employer | 5% (PKR 2,000) | Minimum Wage (PKR 40,000) |

| EOBI (Pension) | Employee | 1% (PKR 400) | Minimum Wage (PKR 40,000) |

| Social Security (SESSI/PESSI) | Employer | 6% | Upper Wage Limit (Varies by Province) |

| Income Tax (Salaried) | Employee | 0% – 35% | Annual Taxable Income (Progressive Slabs) |

| Provident Fund | Both | 8.33% – 10% | Basic Salary (Optional/Policy Based) |

| Workers’ Welfare Fund (WWF) | Employer | 2% | Annual Assessable Income (>Rs. 500,000) |

| Workers’ Profit Participation (WPPF) | Employer | 5% | Annual Net Profit (Industrial Only) |

Payroll Management Options in Pakistan

Companies in Pakistan can choose from several payroll management options based on their size, operational complexity, and resource availability. Selecting the right payroll solution ensures accurate salary processing, compliance with labor laws, and efficient management of employee benefits.

- Internal Payroll (In-House): Best for large enterprises with a permanent legal presence. This model offers maximum control but requires a dedicated team to manage the progressive tax slabs and monthly EOBI filings manually. It provides complete oversight of internal pay structures and sensitive data.

- Remote Payroll: Ideal for international firms with a small local presence. While it reduces local office costs, it requires a system to handle PKR currency disbursements and the 15th-of-the-month tax deposit deadlines. This ensures global reporting while managing local social security requirements.

- Outsourced Payroll Service: The preferred choice for SMEs seeking to minimize administrative load. Specialized providers in Pakistan use cloud-based software to automate everything from payslip generation to statutory reporting, providing access to local tax expertise without hiring full-time HR staff.

- Employer of Record (EOR): The fastest route for startups and expanding global firms. An EOR acts as the legal employer, meaning you can hire talent in days without a local entity. The EOR manage compliance, contracts, and statutory contributions, removing legal liability from your company.

Common Payroll Mistakes to Avoid in Pakistan

Managing payroll in Pakistan requires precise attention to local deadlines and tax status. Avoiding these common errors protects your business from automatic fines and keeps your workforce trust high.

- Incorrect Tax Status: One of the biggest mistakes is failing to check an employee’s current status. Non-filers often require higher tax withholding; applying the wrong rate leads to significant underpayment penalties during your annual audit.

- Missing Statutory Deadlines: The 15th of every month is a critical cutoff for depositing withheld income tax and EOBI contributions. Missing this window often triggers automatic late fees and interest charges from the authorities.

- Overtime Errors: Miscalculating overtime, which is legally double the ordinary pay rate is a frequent cause of labor disputes. Using automated tracking prevents these errors and ensures your gross salary totals are accurate.

- Poor Record Retention: Simply paying your team isn’t enough; you must save digital payment proofs and signed salary slips. Without these, you cannot legally claim payroll as a business expense to reduce your corporate tax.

- Vague Policy Communication: Undefined rules for leave and late arrivals lead to inconsistent deductions. Establishing clear, written policies ensures every deduction is transparent and prevents friction during the final settlement.

- Non-Bank Payments: Paying salaries in cash rather than through direct bank transfers, which can disqualify the expense from being tax-deductible

- Missed Deadlines: Overlooking the 15th-of-the-month cutoff for depositing taxes and EOBI, leading to automatic financial penalties.

Termination and Severance Rules in Pakistan

Closing an employment contract properly is as important as the initial hire. To keep your payroll clean and compliant, follow these standard steps for a professional departure.

Notice Period

Standard practice in Pakistan requires a one-month written notice or payment of one month’s salary in its place. This ensures a smooth transition for both the business and the employee. While serious misconduct allows for an immediate exit, the reasons must be clearly documented to prevent future disputes. For those still in their initial three-month probation, the exit process is usually much faster and often requires little to no notice.

Final Settlement Calculation

When an employee leaves, you must process a “Full and Final Settlement.” This is not just the last month’s salary; it must include:

- Unpaid Salary: Prorated pay for the days worked in the final month.

- Leave Encashment: Payment for any accrued annual leave that was not used.

- Severance (Gratuity): For staff with at least one year of service, a final benefit is required—calculated as 30 days of basic salary for every year worked.

- Notice Pay: Payment for the notice month if the employee is asked to leave immediately

How HRBS Can Help With Payroll Processing in Pakistan?

Managing payroll in Pakistan involves tracking various aspects like processing cycles, tax contributions, and legal separation terms. Handling these details on your own can be difficult and take up too much time. You can avoid these tasks by using Employer of Record (EOR) or specialized payroll services.

- Expert Oversight: Our team stays ahead of changing tax rates and provincial wage updates so your business stays safe from fines.

- Monthly Submissions: We look beyond the full cycle, from taking out taxes to paying into pension and social security, ensuring every payment is made by the 15th-of-the-month deadline.

- Audit-Ready Records: Get clear payroll reports and cost details. We keep digital records ready for government checks, letting you legally count payroll as a business expense.

- Employee Onboarding: From checking tax status to setting up bank payments, we make sure new hires are part of your system without delays.

- Correct Calculations: We use simple tools to track overtime and create digital payslips, reducing mistakes and building trust with your team.

Get in touch with us and turn your payroll from a monthly worry into a smooth and solid part of your business.

FAQ’s

What is the easiest way to manage payroll for a team in Pakistan?

The most efficient method is using an employer of record service or a managed payroll provider. This removes the need for a local legal entity while ensuring that all tax withholdings, pension, and provincial social security are handled by experts in local law.

How do the new tax slabs affect my payroll budget?

Under the current progressive system, staff earning below PKR 600,000 annually are tax-exempt. For those in the next bracket (up to PKR 1.2M), the rate is a low 1%. As an employer, you must calculate these monthly to avoid the 5% non-compliance penalty from the FBR.

What is the typical salary structure in Pakistan?

A compliant salary structure usually divides pay into basic salary and allowances for housing, medical, and travel. This distinction is important because statutory benefits like pension and severance are calculated based on the salary portion, not the total gross pay.

When is the monthly deadline for depositing payroll taxes to the FBR?

All withheld income tax must be deposited with the FBR by the 15th of the following month. Missing this deadline triggers an automatic 5% penalty on the tax due plus additional daily interest charges.

How often should payroll be processed in Pakistan?

Payroll is almost always processed on a monthly basis. While some industries may offer different schedules, the monthly cycle is the standard required for proper tax and statutory reporting.

How is gratuity calculated upon termination?

In the private sector, employees are generally entitled to gratuity after one year of continuous service (unless a provident fund is provided). It is calculated as 30 days’ wages for every completed year of service, based on the last drawn gross salary.

What penalties can employers face for non-compliance with payroll and tax regulations?

Non-compliance results in immediate financial risks. Failing to deposit tax by the 15th triggers a 5% penalty, while delays in filing monthly statements incur a minimum fine of PKR 10,000. Paying below the mandatory minimum wage of PKR 40,000 (in most provinces) is a criminal offense.

Can I just pay a flat “Gross” amount to avoid the 13th-month bonus?

While a 13th-month salary isn’t mandatory, a profit bonus is required for eligible workers if your company declares a profit. Using a managed service ensures these triggers are tracked automatically, so you aren’t hit with unexpected legal claims.

Do I have to pay taxes for remote employees working in different cities?

Yes, while income tax is federal,social security is provincial. If your team is in both Lahore and Karachi, you must register with both PESSI and SESSI. Failing to do so is a common cause of provincial labor audits.