Employer of Record (EOR) services help companies hire and manage employees in other countries without opening a local office. This makes it easier to grow and manage a global workforce. The market for EOR services is growing steadily and is expected to reach nearly $6.79 billion by 2028, with many companies in North America using these services. However, working with an EOR involves specific risks. These include unexpected costs, legal compliance issues, data privacy concerns, and potential disruptions if the EOR fails to meet obligations.

If not managed properly, these risks can lead to financial losses and damage to a company’s reputation. This guide explains the main risks involved with using an EOR, how to identify them, and what steps to take to reduce their impact. Whether you are expanding your business overseas or hiring remote workers, understanding these risks will help you make safer decisions and protect your company.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party company that legally employs workers on behalf of another business, allowing that business to hire employees in different countries without establishing a local legal entity. The EOR manages all employment-related responsibilities such as payroll, taxes, benefits, and compliance with local labor laws. Meanwhile, the client company maintains control over the employees’ daily tasks and performance.

Using an EOR lets companies expand globally faster and with less risk, avoiding the time and cost of setting up and managing foreign subsidiaries. This makes hiring international employees compliant, efficient, and scalable.

Most Common Risks Associated with Using an EOR

Partnering with an EOR introduces several common risks that businesses must understand and manage. These risks include operational disruptions, financial costs, data security vulnerabilities, and payroll or worker classification errors. Each of these risks can affect business continuity, legal compliance, and financial outcomes if not properly addressed.

Operational Risks

Operational risks in an Employer of Record (EOR) relationship arise when the EOR provider faces challenges that disrupt its ability to manage your employees effectively. These challenges may include financial instability, loss of local registrations or licences, poor internal processes, or failure to keep up with local labor law changes. Such disruptions can lead to serious consequences:

- Payroll delays or errors: If the EOR’s payroll system fails, your employees may receive their salaries late or incorrectly, which impacts morale and productivity.

- Compliance failures: Non-adherence to local labor laws by the EOR can expose your company to fines, audits, or legal action.

- Employee management gaps: Errors in employment contracts, benefits administration, or work permits can create legal exposure and workforce dissatisfaction.

Mitigation Strategies

- Negotiate contracts with clear service-level agreements (SLAs), defining timelines, quality standards, and penalties for non-compliance.

- Require regular performance and compliance reporting from the EOR.

- Develop a contingency or disaster recovery plan that outlines steps if the EOR experiences operational problems. This may include alternate providers or temporary in-house management.

- Avoid reliance on a single EOR provider by diversifying providers in multiple regions where feasible.

Financial Risks

Financial risks with EORs can be complex and surprising because the fee structure often goes beyond a simple per-employee monthly charge. Some common financial risk factors include:

- Scaling inefficiencies: As your headcount grows, the cost per employee charged by the EOR may increase, or additional fees may be applied (such as for payroll processing or compliance checks).

- Onboarding and offboarding fees: Many EORs charge extra for hiring or terminating employees, which can add up during high turnover or rapid growth.

- Severance pay liabilities: Even though the EOR technically employs your staff, in some jurisdictions your company may still be responsible for severance or redundancy costs if the EOR does not cover them properly.

- Currency exchange and tax fluctuations: Paying employees in foreign currencies or taxing bodies changing rates can unexpectedly increase payroll costs.

- Mandatory benefits costs: Local laws may require specific employee benefits (health insurance, pensions) that increase total employment costs beyond salary and fees.

Budgeting Tips:

- Request a detailed cost breakdown from your EOR provider including potential variable fees and taxes.

- Compare these costs against the expenses involved in setting up and operating a local legal entity to ensure long-term value.

- Build a financial buffer for unforeseen charges related to legal compliance or market shifts.

- Regularly review and audit invoices from your EOR to catch discrepancies early.

Data Protection & Security Risks

When partnering with an EOR, you are entrusting them with sensitive employee data including personal identification, employment contracts, bank details, and tax information. This creates several data and security risks:

- Data breaches: A security failure at the EOR or improper handling of employee data can cause unauthorized access, theft, or misuse of information.

- Regulatory non-compliance: Laws like the General Data Protection Regulation (GDPR) impose strict requirements on how employee data must be protected and processed. Non-compliance can result in heavy fines or legal actions.

- Data storage and transfer risks: Cross-border data transfers between your company and the EOR must comply with local privacy regulations, and inconsistent controls may expose data to vulnerabilities.

Best Practices for Data Security:

- Choose EORs that have internationally recognized security certifications, which prove they follow stringent controls.

- Require a Data Processing Agreement (DPA) to clearly describe how employee data is handled and protected.

- Conduct regular security audits and risk assessments with your EOR to ensure ongoing compliance.

- Implement strict access controls and encryption both at your company and within the EOR’s systems.

Payroll and Classification Risks

Payroll management through an EOR is complex and prone to errors. Common causes of payroll errors include miscommunication between your team and the EOR, incorrect data entry, or misunderstanding of local payroll practices. Consequences can be delayed or incorrect payments, tax withholding mistakes, and employee dissatisfaction.

Worker classification risks occur when employees are misclassified as contractors or vice versa. Misclassification can lead to:

- Violations of labor laws with penalties or back taxes owed.

- Missing employee benefits or protections that local law requires.

- Liability for employer social security, taxes, or severance pay that the EOR or company may not have planned for.

Recommendations:

- Maintain clear and frequent communication with the EOR to confirm all payroll details and changes.

- Use payroll software or audit tools to regularly verify payroll accuracy.

- Monitor employment classification carefully and consult labor legal experts when entering new markets.

- Include strong compliance audit rights and penalties in your contract with the EOR.

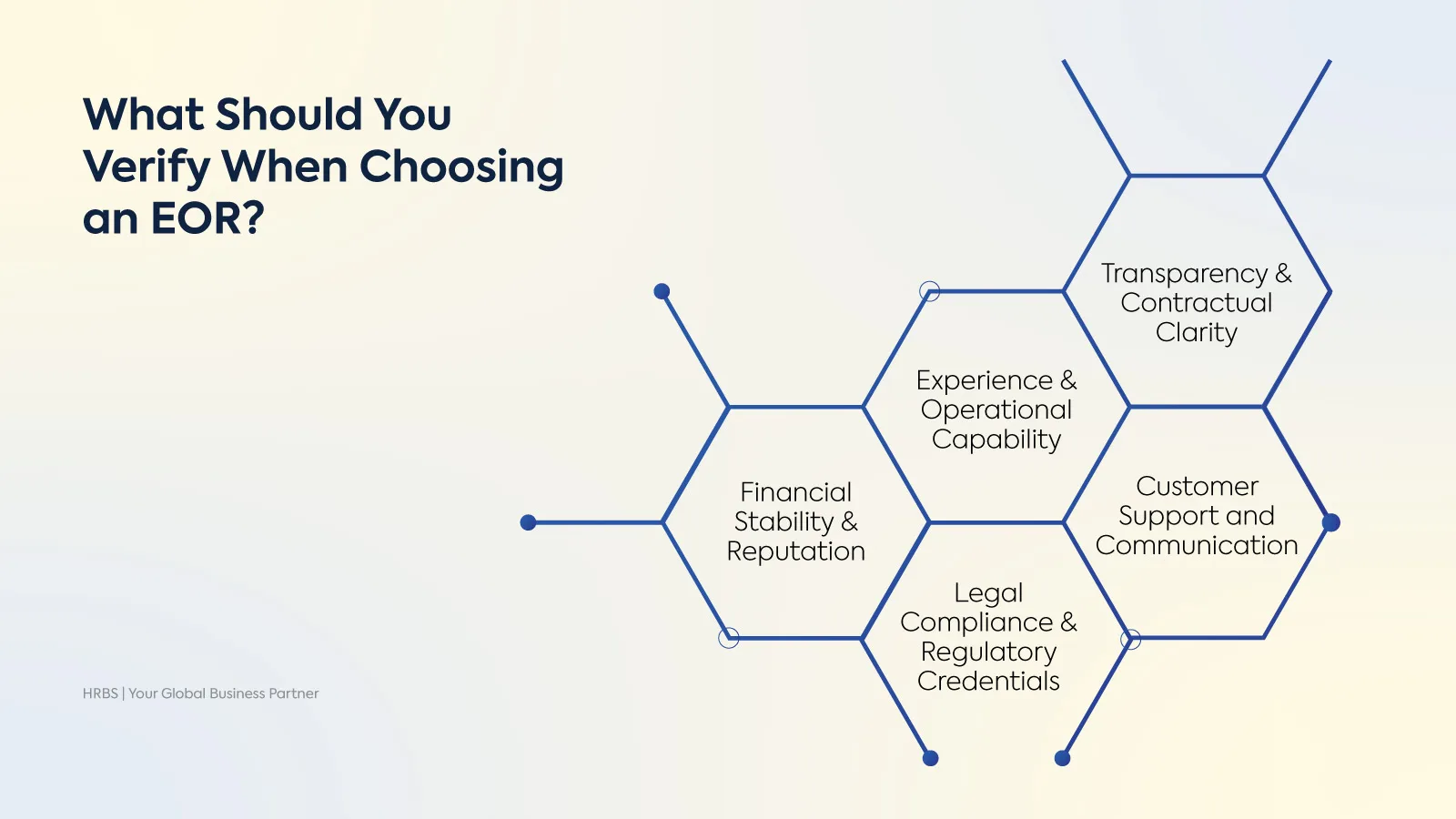

What Should You Verify When Choosing an EOR?

Choosing the right Employer of Record (EOR) is a critical decision that significantly affects your business’s legal compliance, employee experience, and operational stability. To reduce risks and make an informed choice, verify the following key factors:

Financial Stability and Reputation

- Financial Health: Verify that the EOR is financially sound and able to sustain operations long-term. An unstable provider might fail to pay employees or taxes, causing legal and reputational damage to your business.

- Business Reputation: Check for market reputation through independent reviews, industry ratings, and client testimonials. An EOR with a proven track record is less likely to expose your company to surprises or poor service.

Legal Compliance and Regulatory Credentials

- Local Compliance Expertise: Ensure the EOR has deep knowledge of and adheres strictly to local labor laws, tax regulations, and employment standards in the countries where you want to hire.

- Licenses and Registrations: Confirm possession of all necessary licenses and registrations required by local authorities to legally provide employment and payroll services.

- Data Privacy and Security Compliance: Verify commitment to data privacy through adherence to relevant laws, or local privacy regulations that protects both your company and employees from data breaches or misuse. While certifications like ISO can be helpful, focus primarily on practical compliance and transparent security controls.

Experience and Operational Capability

- References and Case Studies: Request client references and detailed case studies to understand how the EOR has handled employment in industries and regions similar to yours.

- Global and Local Presence: Check the geographical reach of the EOR and whether they operate via wholly owned entities or local partners, as these models affect control, compliance, and service quality.

- Technology and Reporting Tools: Evaluate whether the EOR uses modern payroll and HR technology that integrates smoothly with your systems, allowing you to monitor payroll, compliance, and employee data effectively.

Transparency and Contractual Clarity

- Pricing Transparency: Clarify the fee structure upfront including any onboarding fees, payroll processing charges, or additional service costs to avoid unexpected expenses.

- Contractual Protections: Review contracts carefully to confirm inclusion of essential clauses like service-level agreements (SLAs), data security and breach notification obligations, clear exit and transition plans, and indemnification provisions.

Customer Support and Communication

- Responsiveness: Verify the responsiveness of the EOR’s customer support team and their ability to resolve issues quickly.

- Dedicated Account Management: Determine if dedicated account managers or local compliance experts will be available to handle your queries and provide ongoing guidance.

By thoroughly verifying these aspects, you minimize your business’s exposure to operational, financial, legal, and reputational risks associated with EOR partnerships, paving the way for successful, compliant global workforce expansion.

Contractual Protections: What Clauses Should Be Included?

Your contract with an Employer of Record (EOR) should clearly outline each party’s responsibilities and protect your company from risks. Key clauses to include are:

Service Level Agreements (SLAs)

These clauses hold the EOR responsible for meeting agreed standards. They should specify:

- How quickly the EOR must respond to issues or requests

- Guarantees on payroll processing times and system uptime

- Penalties or remedies if the EOR fails to comply with laws, misses payments, or causes operational disruptions

- Reporting requirements so you can track performance regularly

Data Security and Breach Notification

Because the EOR handles sensitive employee data, the contract must:

- Require the EOR to use strong data protection methods, such as secure storage and encryption

- Define how and when the EOR must notify you if there is a data breach

- Include your right to audit their data security practices or request proof of compliance with privacy laws

- Clarify responsibilities regarding data ownership and handling after contract termination

Exit and Continuity Planning Clauses

To avoid disruption if the contract ends, these clauses should ensure:

- A clear process for transferring or offboarding employees smoothly without legal or payroll gaps

- Advance notice periods to prepare for contract termination or renewal decisions

- Plans to maintain business operations if the EOR stops providing services unexpectedly (for example, backing up employee records or transitioning to another provider)

- Protection of your company’s interests during the transition, including return or deletion of confidential data

Including these contractual protections helps reduce your exposure to financial, legal, and operational risks. It also ensures you have control and options if problems arise during your partnership with an EOR.

How to Develop a Contingency Plan for EOR Disruptions

Even with a strong contract and diligent partner selection, preparing for possible disruptions is vital:

- Maintain backup payroll and HR processes internally or with a secondary partner to cover delays or failures. Keep employee data and contracts accessible and up to date for rapid transitions.

- For critical locations, consider spreading risk by engaging multiple EOR providers or using localized service providers to avoid single-point failures.

- Have a plan to establish your own legal entity and internal HR/payroll functions if long-term local hiring needs to justify it. This option provides the highest control but requires more resources.

Having contingency plans reduces operational risk and protects employee experience under unforeseen circumstances.

What Emerging Trends Affect EOR Risk Management in 2025?

Looking ahead to 2025, several key trends will shape EOR risk management:

- AI Models for Compliance and Monitoring: Artificial intelligence and LLM-driven tools are increasingly enabling automated audit, real-time compliance monitoring, and payroll accuracy checks. These technologies help companies quickly identify discrepancies and regulatory changes that might affect their EOR arrangements.

- Increasing Regulatory Complexity: Countries continue to update labor, tax, and data protection laws, often tightening requirements for foreign employers and intermediaries like EORs. Staying updated and flexible in contract terms will be critical.

- Focus on Data Privacy and Security: With global data privacy regulations evolving rapidly, stronger emphasis will be placed on ensuring that EORs have solid data governance, cyber risk management, and breach response capabilities.

- Remote Work and Distributed Teams: As hybrid and remote work models persist, EORs will need to provide enhanced operational resilience and flexible solutions that can handle diverse employment scenarios legally and effectively.

How HR Business Solutions Helps You Manage EOR Risks

At HR Business Solutions, we know that expanding your workforce globally through Employer of Record (EOR) services involves certain risks. Our goal is to help you reduce these risks by providing clear, reliable, and compliant EOR solutions tailored to your business needs.

- Transparent Agreements: We provide straightforward contracts with clear terms, including well-defined service commitments and exit options, so you always understand your rights and responsibilities.

- Compliance Management: Our team stays up-to-date with the latest labor laws and regulations in every country we operate in. This helps us prevent issues like worker misclassification, missed payroll responsibilities, or legal penalties, keeping your business compliant at all times.

- Data Privacy and Protection: We take employee data security seriously by implementing strong data handling practices and ensuring only authorized access. We work closely with you to manage and protect sensitive information in line with applicable privacy laws.

- Accurate Payroll Processing: Our team provides expert payroll services to ensure employees are paid correctly and on time. We also carefully manage workforce classifications to avoid legal or financial risks, providing clear reporting and regular reviews.

By choosing HRBS as your EOR partner, you get expert support that helps you control risks effectively, maintain compliance, and focus on growing your business internationally.

FAQ’s

What financial liabilities does a company retain when using an EOR?

While the EOR legally employs the workers, your company may still face indirect financial liabilities. These can include reimbursements for unpaid taxes, penalties due to misclassification of workers, or costs related to contract breaches by the EOR. Contracts should clearly define cost responsibilities and remedies to limit your exposure.

How can companies ensure data privacy with an EOR?

To protect employee data, companies must verify that the EOR complies with relevant data protection laws and holds certifications. Including data protection clauses in agreements, conducting regular security audits, and requiring incident reporting protocols are essential steps.

What happens if the EOR fails to comply with local labor laws?

Non-compliance by an EOR can put both the EOR provider and your company at risk of fines, legal actions, and operational disruptions. It is critical to monitor the EOR’s compliance status regularly and have contractual protection such as indemnification clauses to mitigate potential consequences.

How to monitor payroll accuracy with an EOR?

Establishing clear communication channels and access to payroll reports is necessary to verify payments timely and accurately. Periodic audits and the use of payroll software that integrates with your systems help detect errors early. Insist on service level agreements (SLAs) that specify accuracy standards and penalties for repeated errors.