Handling payroll tax in Pakistan can be tricky, with frequent changes to tax laws and different rates across provinces. If you run a business, manage HR or accounting, or want to understand what’s being deducted from your pay, it’s important to have a clear grasp of payroll tax. Correctly managing these taxes protects your business from penalties, ensures employees get the social benefits they are entitled to, and helps everyone stay in line with rules. Employers and employees are both responsible for making accurate payments to programs like the Employees’ Old-Age Benefits Institution (EOBI) and their local social security department. To avoid fines, it’s important to pay taxes and file the required reports on time, monthly deadlines fall on the 15th of each following month, while the annual statement must be filed by July 31st.

This guide provides updated information based on Pakistan’s current tax regulations and answers to the most common payroll tax questions. Whether you want to make sense of the deductions on your payslip or need to keep your business compliant, you’ll find practical help here for managing payroll tax confidently and correctly.

What Are Payroll Taxes in Pakistan?

Payroll taxes in Pakistan are mandatory payroll deductions and statutory contributions that employers must accurately calculate, withhold, and remit to comply with the Federal Board of Revenue (FBR) regulations and labor laws. These payroll taxes include income tax withholding and provincial social security contributions, which together fund vital social welfare programs such as healthcare, retirement pensions, and workplace injury compensation.

Employers play a crucial role in managing payroll tax compliance by deducting the correct amount of income tax from employees’ salaries based on progressive tax slabs set by the government. These deductions directly affect employees’ net pay and must be submitted regularly as part of the payroll tax filing process to avoid penalties and legal consequences. Maintaining compliance with these statutory payroll tax obligations ensures employees receive their entitled benefits and protects businesses from legal risks.

Types of Payroll Taxes in Pakistan

Payroll taxes in Pakistan are mandatory deductions and contributions that employers must manage to comply with the law and provide benefits to employees. These taxes fund important programs like retirement pensions, healthcare, and social security. Knowing the different types of payroll taxes helps businesses stay compliant, avoid fines, and ensure employees get the benefits they deserve.

- Income Tax Withholding: Employers deduct income tax from employees’ salaries every month based on Pakistan’s tax slabs. This deduction is mandatory and depends on the employee’s total taxable income. Employers must calculate the correct tax, withhold it, and submit payments to the Federal Board of Revenue (FBR) on time. Failing to do so can lead to penalties and interest charges. Providing employees with accurate salary certificates helps them file their tax returns smoothly. Proper income tax withholding also prevents surprises during annual tax assessments.

- Employees’ Old-Age Benefits Institution (EOBI): Employers and employees both contribute to EOBI, which provides retirement pensions, disability benefits, and survivors’ support. Employers pay a larger share, while employees contribute a smaller portion deducted from their wages. Timely monthly payments to EOBI protect workers’ future financial security and keep the business compliant. Non-compliance can result in fines and legal action. For employees, EOBI contributions mean guaranteed income after retirement or in case of disability, which is crucial in Pakistan’s social security landscape.

- Social Security Contributions: Employers contribute to provincial social security funds that cover medical care, maternity benefits, sickness allowances, and compensation for workplace injuries. These contributions protect employees and reduce employer liability in case of accidents or illness. Social security also offers rehabilitation services, helping injured workers return to work faster. Understanding provincial differences in contribution rates and benefits ensures accurate payroll processing and compliance.

- Other Mandatory Deductions: Depending on the province or sector, employers may also deduct professional tax or contribute to local welfare funds like the Workers’ Welfare Fund (WWF). These funds support worker welfare initiatives, including improving workplace safety, providing financial aid during emergencies, and funding skill development programs. Employers should stay updated on local regulations to ensure all required deductions are applied correctly.

Payroll Tax: Employer’s & Employee’s Obligations

Understanding payroll taxes from both the employer’s and employee’s perspectives is essential for accurate payroll tax calculation, smooth compliance, and maintaining workplace trust in Pakistan.

Employer’s Obligations

Employers in Pakistan are required to make several mandatory contributions to social security funds and comply with payroll tax laws. Failure to meet these obligations often leads to common payroll errors, which can result in costly penalties, employee dissatisfaction, and compliance risks. These obligations vary based on fund type and province, making it essential for employers to maintain accurate payroll processes to avoid such errors.

- Employees’ Old-Age Benefits Institution (EOBI): Employers contribute 5% of the declared minimum wage per employee to this federal pension scheme. Employees contribute 1% via salary deductions. Contributions are calculated on the minimum wage floor, regardless of actual salary.

- Provincial Social Security Institutions (PESSI, SESSI, etc.): Employers must contribute a percentage of wages to provincial social security funds providing healthcare and related benefits. Rates vary, typically around 5-7% from employers and 1% deducted from employees, applicable for workers earning below defined wage limits.

- Workers’ Welfare Fund (WWF): Employers with annual income above a specific threshold contribute 2% of total income. This fund supports worker welfare programs and is primarily for industrial enterprises.

- Workers’ Participation Fund (WPF): Companies meeting capital or asset thresholds contribute 5% of net profits, distributed as profit-sharing to eligible employees.

- Compliance Requirements: Employers must register employees with EOBI and provincial bodies, calculate contributions accurately, submit payments timely, and maintain proper records to avoid penalties.

- Financial Impact: Employer contributions add approximately 6-7% on top of gross salaries, affecting overall employment costs and requiring budget planning.

Employee’s Obligations

Employees in Pakistan are subject to several payroll deductions and responsibilities that directly impact their take-home pay and social benefits.

- Income Tax Withholding: Monthly income tax is deducted at source according to the current tax slabs. Employees earning up to PKR 600,000 per year are exempt, while higher earners contribute more. This ensures steady compliance with FBR requirements and reduces end-of-year tax liabilities.

- Social Security Deductions: A small portion of wages is deducted for provincial social security funds, granting employees access to essential benefits like medical care, hospitalization, maternity leave, and disability coverage. These schemes support employees during illness or workplace injury.

- EOBI Contributions and Pension Security: Employees contribute 1% of the declared minimum wage per month to the Employees’ Old-Age Benefits Institution (EOBI), while employers contribute a higher percentage. These deductions help build eligibility for retirement pensions, survivor benefits, and disability support.

- Zakat Deductions: For Muslim employees, zakat is automatically deducted by employers if the employee’s assets reach the nisab threshold on the 1st of Ramadan. This deduction is recognized under Pakistan’s tax laws and reduces the employee’s taxable income, helping fulfill religious and legal obligations.

- Payslip Transparency: Employees have the right to receive clear payslips listing gross salary, all deductions (including tax, zakat, and social security), and net pay. This enables them to verify their earnings and address any issues promptly.

- Claiming Deductions and Tax Credits: Employees can maximize their net income by submitting documentation for eligible tax deductions or credits (such as investments in pension funds, charitable donations, zakat, and qualifying educational expenses) to their employer for accurate monthly withholding.

Payroll Tax for Foreign Companies in Pakistan

Foreign companies operating in Pakistan must navigate unique payroll tax requirements alongside standard employer obligations. Key considerations include:

- Permanent Establishment (PE) Status: Foreign entities must determine if their operations represent a PE in Pakistan. A PE triggers registration with the Federal Board of Revenue (FBR) and full payroll tax compliance obligations.

- FBR Registration & Tax Withholding: Once registered, foreign companies must withhold income tax from employee salaries as per Pakistan’s progressive tax slabs and remit those taxes timely to the FBR.

- Provincial Social Security Contributions: Depending on local hire or secondment status, foreign companies may need to contribute to provincial schemes like PESSI or SESSI, which provide healthcare and welfare benefits.

- Expatriate Employee Taxation: Payroll taxation for expatriates depends on tax residency and duration of stay; specialized planning is needed to ensure compliance and optimize liability.

- Use of Local Payroll Providers: Given the complexity, many foreign companies outsource payroll operations to local experts to assure accurate tax calculation, filing, and compliance.

- Currency & Payment Compliance: Employers should pay salaries in Pakistani Rupees through regulated local banking channels to comply with currency and anti-money laundering laws.

- Double Taxation Conventions (DTCs): Pakistan has Double Taxation Agreements (DTAs) with over 66 countries to prevent the same income being taxed twice. DTCs allocate taxing rights between source and residence countries to avoid double taxation and offer relief through exemptions or tax credits. These treaties reduce withholding tax rates on dividends, interest, and royalties, often capped at 5-10%, aiding foreign businesses in managing their tax burden.

Regular Reporting & Compliance: Foreign companies must file monthly payroll tax returns through the FBR’s IRIS portal, ensuring accurate and timely submission to avoid penalties.

Payroll Tax Rates and Updates for 2025 in Pakistan

The Government of Pakistan has introduced new payroll tax rates and income tax slabs for salaried individuals through the Finance Act 2025, effective from July 1, 2025, to June 30, 2026. These changes aim to provide relief to low and middle-income earners by lowering tax rates while maintaining a progressive structure that ensures higher earners contribute a fair share.

Latest Income Tax Slabs for Salaried Individuals (FY 2025-26)

| Annual Salary (PKR) | Tax Rate / Formula |

| Up to 600,000 | 0% (No tax) |

| 600,001 – 1,200,000 | 1% of the amount exceeding 600,000 |

| 1,200,001 – 2,200,000 | 6,000 + 11% of the amount exceeding 1,200,000 |

| 2,200,001 – 3,200,000 | 116,000 + 23% of the amount exceeding 2,200,000 |

| 3,200,001 – 4,100,000 | 346,000 + 30% of the amount exceeding 3,200,000 |

| Above 4,100,000 | 616,000 + 35% of the amount exceeding 4,100,000 |

These revisions significantly reduce the tax burden for low and middle-income groups, with relief of up to 80% for those earning between PKR 600,000 and 1.2 million annually. Meanwhile, the highest earners see a modest tax rate reduction of around 3%. This balanced approach aims to boost disposable income for most salaried individuals while sustaining government revenue for public services.

Key Payroll Tax Updates and Compliance Requirements

With the fiscal year 2025-26 tax reforms in effect, both employers and employees must understand the major payroll tax changes to ensure legal compliance and accurate payroll processing.

- Increased Tax for Middle and High Earners: For the fiscal year 2025-26, the minimum income tax rate for salaried individuals earning above PKR 600,000 has been set at 1% up to PKR 1.2 million, with progressive rates increasing for higher income brackets. While low-income earners below PKR 600,000 remain exempt, middle and high earners face adjusted slabs designed to enhance tax fairness and revenue generation.

- Surcharge on High Incomes: A 9% surcharge applies to individuals with annual taxable incomes exceeding PKR 10 million. This surcharge is levied in addition to regular income tax, increasing the tax obligations for top earners, including senior executives and high-net-worth professionals.

- No Change for Low-Income Earners: The tax-free threshold remains at PKR 600,000, ensuring no income tax liability for salaried workers below this level and providing crucial financial relief for low-income households.

- Mandatory Payroll System Updates: Employers are required to update payroll systems to comply with the revised tax slabs and surcharge rules. Accurate withholding from employee salaries and timely remittance to the FBR is essential to avoid financial penalties and interest charges.

- Payslip Transparency: Employers must provide payslips clearly detailing all payroll deductions, including income tax and surcharge amounts where applicable. This transparency empowers employees to understand their net salary calculations and verify the correctness of tax deductions.

Focus on Compliance to Avoid Penalties: Strict adherence to updated payroll tax rules helps avoid interest charges and fines resulting from late payments or under-withholding.

By staying informed of these payroll tax changes and implementing them effectively, businesses and employees in Pakistan can contribute to a fairer tax system while reducing compliance risks in 2025.

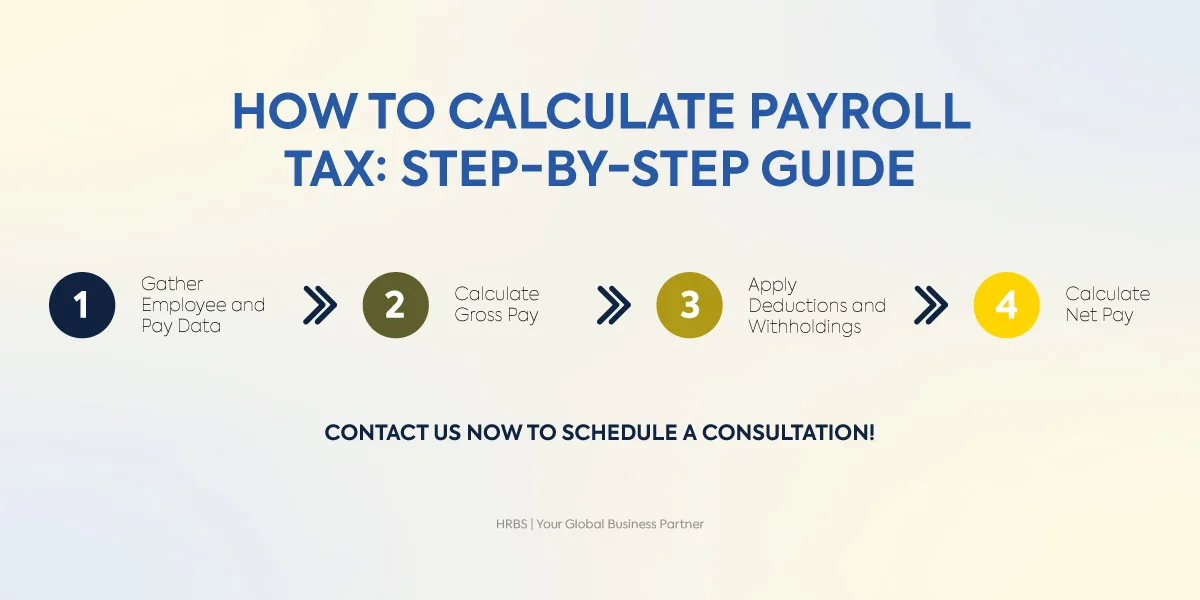

How to Calculate Payroll Taxes in Pakistan

Accurate payroll tax calculation is crucial for compliance and ensuring employees receive the correct pay. Here’s an updated step-by-step process for calculating payroll tax in Pakistan for the fiscal year 2025-26:

Step 1: Gather Employee and Salary Details

Collect all necessary employee information including:

- Basic salary

- Allowances (housing, medical, conveyance)

- Bonuses and overtime payments

- Any other taxable benefits or deductions (e.g., provident fund, loan repayments)

- Accurate data collection is crucial for precise payroll calculations and tax compliance.

Step 2: Calculate Gross Salary

Add the basic salary, allowances, bonuses, and overtime to determine the employee’s gross salary. For salaried employees, this typically includes fixed monthly pay plus any additional earnings.

Step 3: Calculate Income Tax Deduction

Using the 2025-26 progressive tax slabs effective July 1, 2025, calculate income tax:

- Up to PKR 600,000 annual income: 0% tax

- PKR 600,001 – 1,200,000: 1% on amount exceeding PKR 600,000

- PKR 1,200,001 – 2,200,000: PKR 6,000 plus 11% on amount exceeding PKR 1,200,000

- PKR 2,200,001 – 3,200,000: PKR 116,000 plus 23% on amount exceeding PKR 2,200,000

- PKR 3,200,001 – 4,100,000: PKR 346,000 plus 30% on amount exceeding PKR 3,200,000

- Above PKR 4,100,000: PKR 616,000 plus 35% on amount exceeding PKR 4,100,000

Calculate the monthly equivalent by dividing the annual tax by 12 for monthly withholding.

Step 4: Deduct Other Statutory Contributions

Subtract mandatory deductions such as:

- 1% Employees’ Old-Age Benefits Institution (EOBI) contribution from the employee’s salary

- Provident fund contributions (if applicable)

- Any other statutory or company-specific deductions

Step 5: Calculate Net Salary

Subtract total deductions (income tax + statutory contributions + other deductions) from the gross salary to determine the net salary payable to the employee.

Example

An employee earns:

- Basic salary: PKR 100,000

- Housing allowance: PKR 20,000

- Medical allowance: PKR 5,000

- Gross Salary: PKR 125,000

- Monthly equivalent exemption = PKR 50,000 (PKR 600,000 annual exemption / 12)

- Taxable amount = PKR 125,000 – PKR 50,000 = PKR 75,000

- Income tax = 1% of 75,000 = PKR 750

- EOBI contribution (1%) = PKR 1,250

- Total deductions = PKR 2,000

Net salary = PKR 125,000 – PKR 2,000 = PKR 123,000

Also Read: How to calculate payroll costs.

Payroll Tax Filing Deadlines and Documentation Requirements

Timely payroll tax filing and maintaining accurate documentation are crucial for compliance with Pakistan’s tax laws and avoiding penalties. Employers must understand the key filing deadlines and keep all necessary paperwork organized.

- Monthly Tax Filing Deadline: Employers are required to deduct and deposit payroll taxes, including income tax withholding, EOBI, and provincial social security contributions, by the 15th day of the month following the salary payment. For instance, tax deductions on salaries paid in June must be filed and paid by July 15.

- Annual Salary Certificates (Form 16): Employers must issue detailed salary certificates to employees by August 31 each year. These certificates summarize total earnings, tax deductions, and other payroll information, enabling employees to accurately file their annual income tax returns.

- Required Documentation: Employers should maintain comprehensive records such as employee copies of CNIC, monthly payroll registers with salary, allowances, and tax deductions, tax deduction certificates provided to employees, and proof of tax deposits and challans submitted to both the Federal Board of Revenue (FBR) and provincial social security institutions. These records should be preserved for at least five years to satisfy audit and compliance reviews.

- Electronic Filing via IRIS Portal: The FBR encourages electronic filing of payroll taxes and income tax returns through its IRIS portal. E-filing enhances accuracy, accelerates processing, and offers instant confirmation of submission, reducing the chances of errors and late penalties.

How Payroll Taxes Affect Freelancers and Contract Workers

Freelancers and independent contractors in Pakistan have distinct payroll tax responsibilities compared to salaried employees, including self-assessment tax filing, managing withholding tax on payments, and registering with tax authorities like the FBR and Pakistan Software Export Board (PSEB). Understanding these differences is essential not only for legal compliance and tax optimization but also for maximizing access to government incentives and ensuring sustainable financial planning in Pakistan’s rapidly growing freelance economy.

- Self-Assessment and Tax Filing: Freelancers are responsible for calculating and paying their own income tax based on their business income. They must file annual income tax returns with the Federal Board of Revenue (FBR), declaring all earnings from freelancing activities, including payments received from both domestic and international clients.

- Withholding Tax on Payments: Payments to freelancers may be subject to withholding tax. Registered freelancers with the PSEB benefit from reduced withholding tax rates (as low as 0.25%), while non-registered freelancers face higher flat rates (up to 1%).

- Tax Registration: Freelancers must register with the FBR to obtain NTN, which is mandatory for filing taxes and accessing various benefits. Additionally, IT and digital service freelancers earning from international clients are encouraged to register with the PSEB. It offers a significant tax benefits, including eligibility for tax credits, reduced withholding tax rates, and access to government grants and support programs.

- Record-Keeping Requirements: Maintaining detailed invoices, bank statements, receipts, and expense records is critical. Proper documentation allows freelancers to claim allowable business expenses, reducing taxable income and optimizing tax liabilities.

- No Employer Social Security Contributions: Unlike salaried employees, freelancers do not receive employer-funded social security benefits like pensions or medical coverage. They must independently secure private insurance and retirement savings plans.

Common Payroll Tax Mistakes and How to Avoid Them

Payroll tax mistakes in Pakistan can cause costly financial penalties and legal issues. These errors often arise due to outdated payroll systems, lack of staff training, or misunderstanding tax laws. Key mistakes to avoid include:

- Incorrect Application of Tax Slabs: Incorrect tax slab application happens when employers fail to update payroll systems with the latest progressive tax rates or misclassify employee income. This leads to wrong tax withholding—either overcharging or undercharging employees. Ensure payroll software is regularly updated and all salary components, including allowances and bonuses, are correctly included.

- Misclassification of Taxable Allowances: Misclassifying taxable allowances like conveyance and medical allowances inflates tax liabilities unnecessarily. Employers should distinguish between taxable and exempt benefits according to current Pakistan tax rules to avoid excess deductions.

- Ignoring Provincial Social Security Contributions: Ignoring provincial social security contributions is another common error. Contribution rates vary by province—such as 7% for Punjab’s PESSI and 6% for Sindh’s SESSI—so employers must apply correct rates to stay compliant.

- Late Submission of Payroll Taxes: Late payroll tax submissions result in fines and interest from FBR and provincial institutions. Automate your payroll schedule, use electronic filing systems like FBR’s IRIS portal, and set internal reminders to meet deadlines.

- Inadequate Payroll Record-Keeping: Poor payroll record-keeping with incomplete payslips, missing tax certificates, or absent employee CNIC copies complicates audits and legal compliance. Keep detailed, accurate records for at least five years as required by law.

How HRBS Can Help?

Navigating payroll taxes in Pakistan can be complex, rules frequently change, provincial requirements vary, and non-compliance can result in significant penalties. That’s why HRBS offers expert, local payroll solutions designed to keep your business compliant and your workforce paid accurately and on time. Here’s how HRBS delivers value with a focus on compliance, accuracy, and transparency:

- Accurate Payroll Calculations: HRBS uses advanced payroll software combined with expert knowledge of Pakistan’s latest tax structures and labor laws to ensure every salary component, allowance, and statutory deduction is calculated precisely according to regulations.

- Timely Tax Filings and Payments: The team manages all payroll tax filings and remittances including income tax, EOBI, and provincial social security contributions, meeting monthly and annual deadlines to help your business avoid fines and audits.

- Clear and Transparent Payslips: Employees receive detailed payslips explicitly showing earnings and all deductions, building trust and clarifying how net salaries are arrived at according to current tax laws.

- Data Security: HRBS prioritizes confidentiality by implementing strict security protocols and compliance with data protection standards, ensuring employee payroll data is securely handled at all times.

- Dedicated Local Expertise and Support: HRBS’s knowledgeable payroll specialists provide personalized guidance and responsive support to address your questions and adapt payroll processes to evolving regulations.

- Comprehensive Payroll Outsourcing: Free your internal teams from managing complex payroll processes. HRBS offers scalable outsourcing services tailored to startups, SMEs, and large enterprises, streamlining payroll tax compliance and employee payments with minimal disruption.

Take the stress out of payroll management partner with HRBS today for expert, compliant, and accurate payroll solutions tailored to Pakistan’s unique regulations.

FAQs

What are the current income tax slabs for salaried individuals in Pakistan for FY 2025-26?

For the fiscal year 2025-26, the income tax slabs for salaried individuals in Pakistan follow a progressive structure. Income up to PKR 600,000 is exempt from tax, providing relief for low-income earners. Income between PKR 600,001 and PKR 1,200,000 is taxed at 1%, while higher income brackets are taxed at increasing rates up to 35% for the highest earners. This system ensures that tax liability rises with salary levels, offering significant relief for low and middle-income groups while maintaining proportional contributions from higher earners. These updated slabs have been effective since July 1, 2025, helping employees understand their tax obligations more clearly under the latest regulations.

What are the key payroll tax filing deadlines employers must follow in Pakistan?

Employers are required to deduct payroll taxes, including income tax and social security contributions, and deposit these amounts with FBR by the 15th day of the month following salary payments. Furthermore, employers must issue annual salary certificates, known as Form 16, to their employees no later than August 31 each year. These certificates assist employees in accurately completing their income tax returns.

Are bonuses and incentives subject to payroll tax in Pakistan?

Yes, bonuses and incentives such as performance bonuses, cash incentives, commissions, and other taxable allowances are considered part of an employee’s taxable income and are subject to payroll tax deductions. Employers must include all such monetary benefits alongside the regular salary when calculating monthly withholding tax based on the applicable progressive tax slabs.

Are freelancers and contract workers subject to payroll tax deductions in Pakistan?

Freelancers and contract workers in Pakistan are obligated to self-assess and pay their income tax. While clients may deduct withholding tax on payments made to freelancers, these workers must register with the FBR themselves, file annual income tax returns, and maintain detailed records of income and allowable expenses. Although freelancers do not fall under traditional payroll tax withholding by employers, ensuring proper registration and tax filing is critical for compliance with Pakistan’s tax laws.

What supporting documents must employees submit to claim payroll tax deductions or credits?

To claim payroll tax deductions or credits, employees need to submit valid documentation such as receipts for approved pension fund contributions, certified proofs of charitable donations including zakat, records for educational expenses where deductions apply, and medical certificates relating to allowable health expenses. Submitting these documents ahead of payroll processing deadlines enables employers to adjust tax withholding amounts accordingly, maximizing employee take-home pay while maintaining compliance with FBR policies.

What social security benefits do payroll tax deductions fund for employees in Pakistan?

Payroll tax deductions in Pakistan fund essential social security benefits, including medical care, hospitalization, specialist consultations, maternity leave, and compensation for workplace injuries through provincial institutions like PESSI and SESSI. Additionally, retirement pensions and disability benefits are provided via the EOBI.

Can employers outsource payroll tax management in Pakistan, and what are the advantages?

Many employers in Pakistan choose to outsource payroll tax management to specialized professional service providers. This approach ensures accurate tax calculations, timely compliance with ever-changing tax laws, and the efficient filing of monthly and annual returns. Outsourcing reduces the administrative burden on companies, minimizes audit and penalty risks, and provides access to expert guidance on complex payroll matters, improving overall payroll accuracy and regulatory adherence.

How are payroll taxes handled for expatriate employees working in Pakistan?

The taxation of expatriate employees working in Pakistan depends on their resident or non-resident status and length of stay. Residents are taxed on their global income, whereas non-residents are taxed only on Pakistan-sourced earnings. Employers must apply the correct withholding tax in line with local tax slabs, taking into account any exemptions or benefits available under Double Taxation Agreements (DTAs). Special attention is also given to the treatment of allowances, reimbursements, and social security contributions under local labor contracts.

What are the penalties for late or non-filing of payroll and income tax returns in Pakistan?

Failure to file payroll taxes or income tax returns on time results in significant penalties imposed by the Federal Board of Revenue. These penalties include daily fines, fixed monetary fines, and interest on overdue tax payments. Non-filers may also be subjected to higher withholding tax rates on various financial transactions such as property purchases and banking activities. Timely and accurate filing is crucial to avoid financial loss and adverse legal consequences.