Hiring the right people is essential for business growth, but choosing between an employee and a contractor matters. This decision affects your daily work, costs, legal requirements, and company culture. Employees work regular hours, follow your instructions, and are covered by employment law. Contractors set their own schedule, use their own tools, and bill for their work, giving more flexibility but less long-term security. The difference is more than titles. Officials check how work is managed, how people are paid, and the nature of the relationship. Getting it wrong can mean fines, back pay, and legal trouble.

To make the right choice, ask:

- Is this a core, ongoing role or a short-term project?

- How much control do you need over how, when, and where the work is done?

- Are you ready to handle payroll, benefits, and compliance or do you want a simpler, project-based arrangement?

This article compares employees and contractors, covering costs, legal issues, and practical effects so you can fit your hiring to your business needs and avoid common risks.

What is an Indpendent Contractor?

A contractor is a self-employed person or business hired to complete specific tasks, projects, or services for a company for a set period or until the work is finished. Contractors manage their own tasks, set their own schedules, and usually use their own tools and equipment.

They decide how, when, and where the work gets done, and they invoice for their services, often by project or hour, while handling their own taxes, insurance, and expenses. Contractors can work for multiple clients at once, accept or decline projects, and choose their own working hours.

Contractors:

- Control their own work: They decide how to complete tasks, when to work, and often where to work. The hiring company does not manage their daily activities in detail.

- Handle their own taxes and costs: Contractors are responsible for filing their own taxes and covering business expenses; employers do not deduct taxes from their payments.

- Offer flexible engagements: Both the contractor and the company can end the arrangement when the project is done. Contractors can also take on work from several clients at the same time.

- Use their own resources: They typically provide their own tools, equipment, and workspace.

- Work under a contract: The relationship is defined by a service agreement focused on a specific project or period, not ongoing employment.

- Can delegate or subcontract: Contractors may hire assistants or subcontractors to help complete the work.

What is an Employee?

An employee is a person hired by a company to work on a regular, ongoing basis, usually under a contract of employment. The employer directs the employee’s tasks, deciding what needs to be done, how it should be done, and when and where the work happens. Employees receive a fixed salary or hourly wage, paid through the company’s payroll, with taxes and social contributions deducted at source. They are eligible for paid leave, health benefits, bonuses, and pension plans, and have legal protections against unfair dismissal, with rights to minimum notice and grievance procedures.

Employees:

- Follow company instructions: They work under direct supervision, following set policies and procedures.

- Receive regular pay: Employees are paid a set salary or hourly rate, usually on a fixed schedule.

- Entitled to benefits: They qualify for paid leave, health insurance, pension plans, and other statutory and company benefits.

- Long-term role: Their employment is intended to be ongoing, supporting the core functions of the business.

- Legal protections: Employees are protected by employment laws, including rights to notice, grievance procedures, and protection from unfair dismissal.

- Use company resources: Employers typically provide the workspace, equipment, and tools needed for the job.

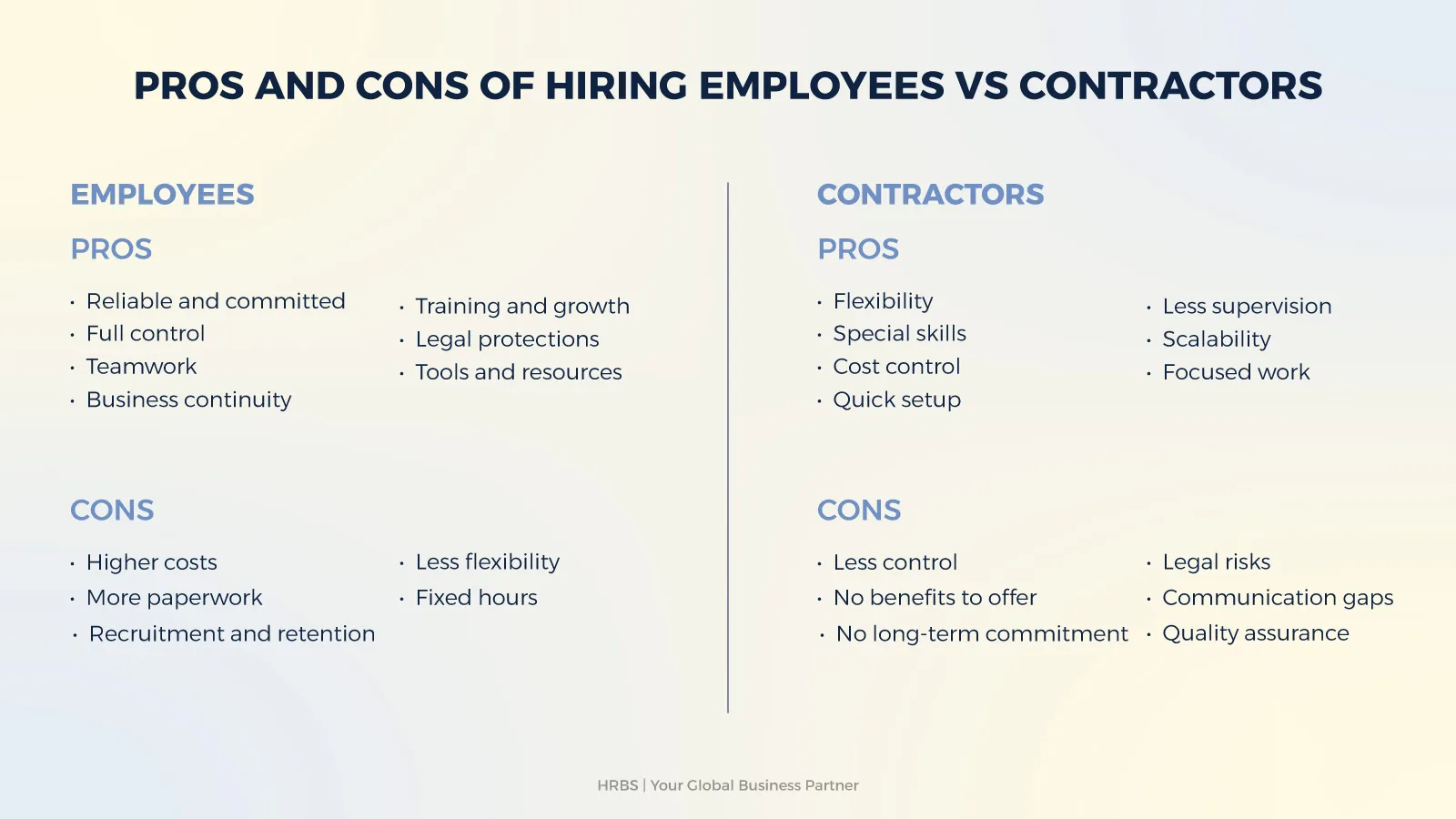

Pros and Cons of Hiring Employees vs Contractors

Understand the real benefits and drawbacks of hiring employees and contractors. This guide helps you decide the best option for your business.

Pros of Hiring Employees

- Reliable and committed: Employees build long-term relationships with your business, helping you reach company goals.

- Full control: You decide what work is done, when, and how. You can direct tasks and provide feedback.

- Teamwork: Employees work together, share ideas, and strengthen your company culture.

- Training and growth: Employees learn and improve over time, taking on more responsibility.

- Legal protections: Employees receive fair treatment, paid leave, health insurance, and protection from unfair dismissal.

- Tools and resources: Employees use company-provided tools, software, and equipment to do their work.

- Business continuity: Employees provide stability for your daily operations and long-term planning.

Cons of Hiring Employees

- Higher costs: You pay for salaries, benefits, office space, and training.

- Less flexibility: It’s harder to change your team size quickly if business needs shift.

- More paperwork: Hiring, managing, and letting employees go requires following more rules and steps.

- Recruitment and retention: Finding and keeping good employees takes time and effort.

- Fixed hours: Employees usually work set hours, which can limit flexibility for urgent or changing needs.

Pros of Hiring Contractors

- Flexibility: You can hire contractors for short-term work, special projects, or busy periods and end the arrangement easily.

- Special skills: Contractors often bring expert knowledge and experience for specific jobs your team does not have.

- Cost control: You pay for results, not salaries, benefits, or office space.

- Quick setup: Contractors can start work fast, with little training.

- Less supervision: Contractors manage their own work. You agree on results, not how to get them.

- Scalability: Contractors let you quickly add or remove support as business needs change.

- Focused work: Contractors are motivated to finish projects on time and to a high standard to get paid.

Cons of Hiring Contractors

- Less control: You cannot direct how contractors do their work. They use their own methods and tools.

- No long-term commitment: Contractors may leave for other jobs. You cannot always count on them to be available.

- No benefits to offer: Contractors do not get paid leave, health insurance, or other employee perks.

- Legal risks: If you misclassify a worker as a contractor, you could face fines or legal problems.

- Communication gaps: Contractors may not be as familiar with your company’s processes or culture as employees.

- Quality assurance: You rely on the contractor’s skills and may have less ability to ensure consistent quality across projects.

When to Hire Employees?

Every business needs a reliable foundation to grow and succeed. Employees are the backbone of your company, supporting its long-term goals and daily operations.

- Core business needs: Hire employees for roles that are essential to your daily operations and will be needed long-term. These positions form the foundation of your business and require consistent effort over time.

- Collaborative work environment: Employees are best when the job involves teamwork, regular communication, and participation in company activities.

- Supervised roles: Choose employees when you need to manage daily activities closely, provide regular feedback, and maintain direct control over how work is done.

- Handling sensitive information: Employees are suited for jobs that involve access to confidential company information, client relationships, or important compliance duties.

When to Hire Contractors?

Contractors bring flexibility and expertise to your business when you need it most. They are a practical choice for specific situations that call for agility and specialized skills.

- Short-term or project-based work: Engage contractors for tasks that have a clear start and finish, such as seasonal projects, one-time assignments, or covering temporary absences.

- Specialized expertise: Contractors are ideal when you need technical, creative, or niche skills that your current team does not have.

- Clear deliverables: They work well for jobs with defined outcomes, where success is measured by results, not hours worked.

- Cost control: Hiring contractors can be more cost-effective for specific projects, as you avoid the fixed costs of salaries, benefits, and payroll taxes.

- Scalability: Contractors allow you to quickly adjust your workforce size in response to business demands, providing flexibility in uncertain or changing markets.

Contractors offer a smart way to manage workload spikes, access expert skills, and keep your business adaptable, without long-term commitments.

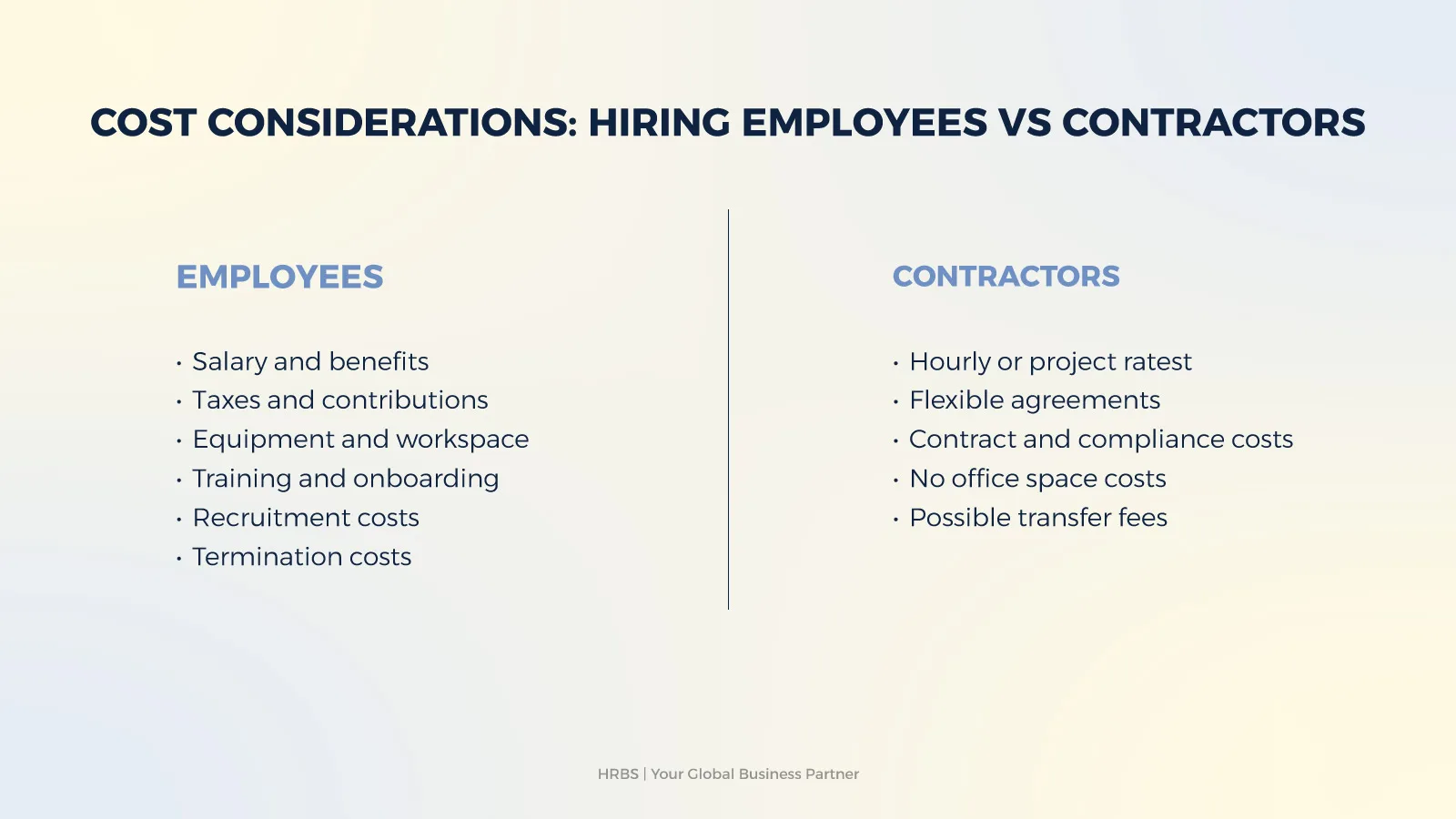

Cost Considerations: Hiring Contractors vs Employees

Deciding between employees and contractors means looking closely at your budget. There are clear differences in upfront costs, long-term expenses, and flexibility. Here’s what you need to know to make a smart choice for your business.

Employees: Costs to Expect

- Salary and benefits: Employees receive a regular salary and often benefits like health insurance, paid leave, and pension plans. These are fixed costs, paid every month.

- Taxes and contributions: Employers pay payroll taxes, social security, and other government-mandated contributions for each employee.

- Equipment and workspace: You provide employees with the tools, computers, software, and office space they need to work.

- Training and onboarding: New employees need time and resources to learn your company’s processes and systems.

- Recruitment costs: Finding the right employee takes time and may involve agency fees or advertising costs.

- Termination costs: If an employee leaves, you may have to pay for notice periods, severance, or other legal requirements.

Total cost: The real cost of an employee is usually much higher than just the salary. Expect to pay about 1.25 to 1.5 times the base pay when you include all benefits, taxes, and overhead. For example, if you pay an employee PKR 500,000 per year, the total cost could be PKR 625,000–750,000 or more after adding everything up.

Contractors: Costs to Expect

- Hourly or project rates: Contractors charge by the hour or for the entire project. Their rates may seem high, but you only pay for the work done.

- Flexible agreements: You can hire contractors for as long as you need, hours, days, weeks, or months. When the job is done, the contract ends. There are no long-term commitments or termination costs.

- Contract and compliance costs: Sometimes you may need to pay for legal help to draft or review contracts, especially for larger or more complex projects.

- No office space costs: Since contractors work remotely or at their own offices, your business saves on office space, utilities, and related expenses.

- Possible transfer fees: If you pay a contractor from abroad, you may have transfer fees or currency exchange costs. Keep these in mind for international payments.

Total cost: Contractors may cost more per hour, but you avoid many ongoing expenses. For short-term or specialized work, contractors can be more cost-effective overall.

Legal & Compliance Considerations of Hiring Contractors vs Employees

Hiring workers as employees or contractors requires clear understanding of legal and compliance issues. Mistakes in this area can lead to fines, penalties, and legal disputes.

- Worker classification: Authorities use specific tests to decide if a worker is an employee or contractor. The main factors are who controls the work, whether the worker is part of your business, who provides tools/equipment, and if the worker can do jobs for others. Getting this wrong (misclassification) can mean you owe back pay, benefits, taxes, and face legal action.

- Contracts: Always use a written contract that states the work, payment, and that the contractor is responsible for their own taxes and expenses. The contract should make it clear the contractor decides how to do the work and can work for others.

- Tax obligations: For employees, you must deduct and pay income tax and social security. For contractors, they handle their own taxes. If you pay contractors, keep accurate records to show they are not employees.

- Benefits and protections: Employees get rights to paid leave, overtime, notice periods, and protection from unfair dismissal. Contractors do not get these protections. Their rights and duties are only what is in the contract.

- Safety and insurance: If contractors work on your site, you may need to make sure they follow safety rules and have their own insurance. Employees get workplace insurance from the employer.

- Data and privacy: If contractors handle your company or customer data, your contract should include privacy and security rules.

- Termination: Ending a contract should be clear in your agreement. For employees, you must follow labor laws about notice and severance.

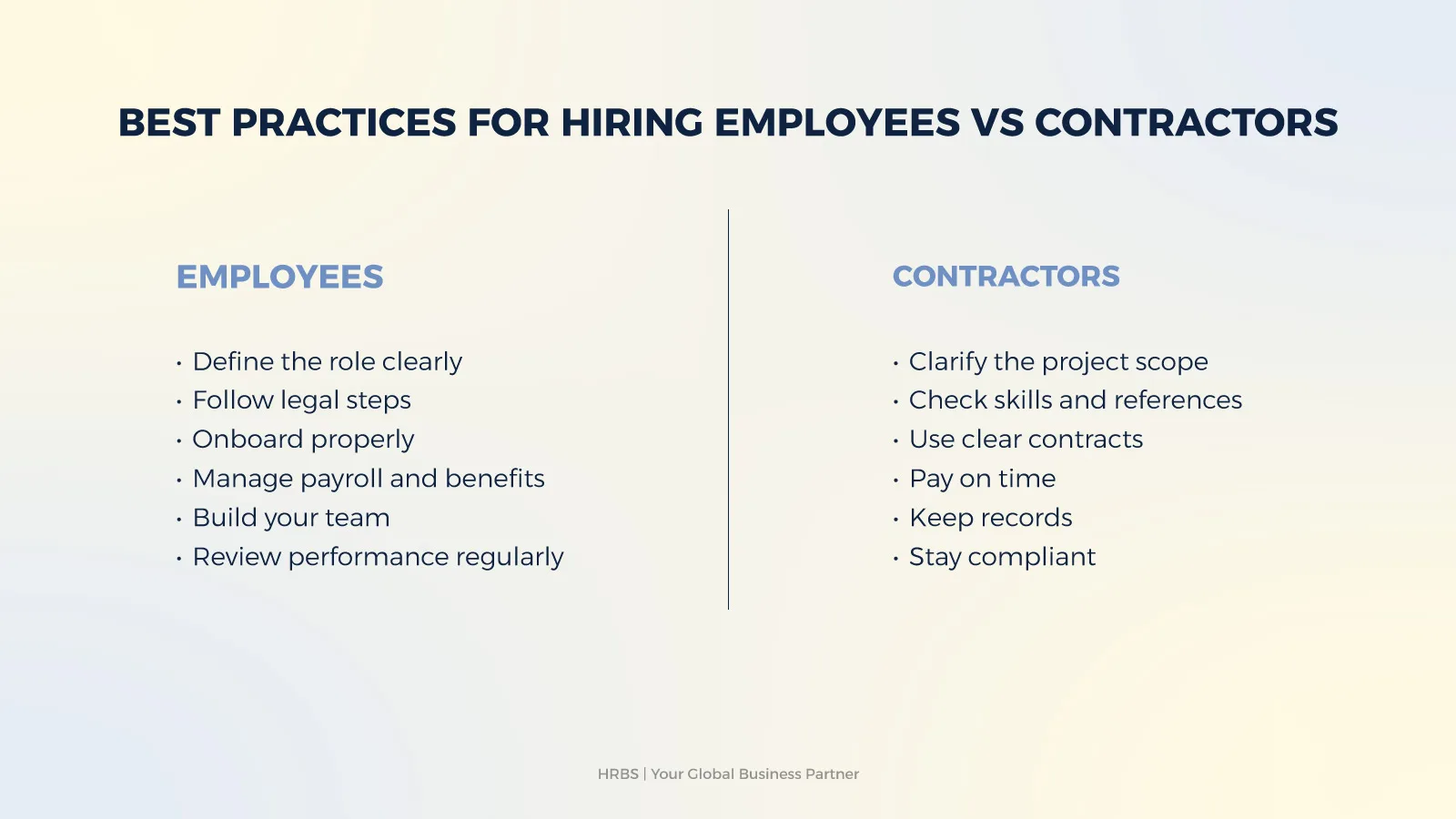

Best Practices For Hiring Employees vs Contractors

Making the right hiring decision requires a clear process and attention to legal, financial, and operational details. Here’s how to approach hiring employees and contractors, focusing on what matters most.

Employees

- Define the role clearly: Write a detailed job description with responsibilities, required skills, and reporting structure. This helps attract the right candidates and sets expectations from the start.

- Follow legal steps: Use a proper employment contract. Register the employee with tax authorities and enroll them in social security and other benefit programs as required by law.

- Onboard properly: Provide training, introduce company policies, and assign necessary tools and equipment. Good onboarding helps employees contribute faster.

- Manage payroll and benefits: Set up payroll to handle salaries, taxes, and benefits. Keep accurate records for compliance and audits.

- Build your team: Encourage teamwork and communication. Employees who feel part of the company are more likely to stay and perform well.

- Review performance regularly: Give feedback, recognize good work, and address issues early. This supports growth and retention.

Contractors

- Clarify the project scope: Define the work, deliverables, timeline, and payment terms in a written contract. This reduces misunderstandings and disputes.

- Check skills and references: Verify the contractor’s experience, past work, and ability to deliver what you need.

- Use clear contracts: Make sure the contract states the contractor is responsible for their own taxes, insurance, and tools. Avoid controlling how they work to prevent misclassification.

- Pay on time: Stick to the payment schedule in the contract. Late payments can damage trust and lead to disputes.

- Keep records: Save all contracts, invoices, and communications. This is important for compliance and if any issues arise.

- Stay compliant: Ensure the contractor is genuinely independent. Misclassifying an employee as a contractor can lead to fines and back payments.

Choose HRBS For Hiring Contractors in Pakistan

Hiring contractors in Pakistan can be complex due to local regulations, payroll requirements, and compliance risks. HRBS simplifies the process by combining local expertise with efficient digital tools, so you can hire skilled professionals confidently, quickly, and compliantly.

- Legal compliance: We ensure your hiring process aligns with current labor, tax, and contractor regulations, minimizing misclassification risks, legal penalties, and back payments.

- Talent pool access: HRBS provides direct access to pre-vetted, skilled contractors across industries, including software developers, project managers, finance experts, and business process specialists all matched to your specific requirements and technical needs.

- Clear, legally sound contracts: Our customized contracts define project scope, deliverables, timelines, payment terms, and independent contractor status, protecting your business from disputes and ensuring compliance with local employment standards.

- Onboarding Support: HRBS manages documentation, background checks, and contractor setup, so your team can start work quickly, reducing project delays and ramp-up time.

- Payroll and tax handling: We handle contractor payroll, payments, and tax filings according to Pakistani regulations, including required deductions and submissions. This ensures timely, compliant payments without administrative burden.

- Ongoing support: Our specialists monitor regulatory updates and audit your contractor engagements, helping you avoid fines and maintain good standing with authorities over time.

FAQ’s

How much does it cost to hire an employee vs contractor?

Employees require fixed costs including salary, payroll taxes, social security, health insurance, paid leave, pension contributions, office space, equipment, and training. Contractors charge higher hourly or project-based rates but eliminate ongoing expenses like benefits, workspace, and employer tax obligations. Contractors are more cost-effective for short-term projects while employees suit ongoing business needs.

What happens if i misclassify an employee as a contractor?

Misclassification penalties include back payment of salaries, unpaid benefits, payroll taxes, and social security contributions for the entire employment period. Authorities may impose fines, legal action, and audits. Classification is determined by work control, business integration, tool ownership, and whether the worker serves multiple clients. Misclassification risks increase when you control work schedules, provide equipment, or prohibit contractors from working for others.

Do contractors pay their own taxes or does the employer withhold taxes?

Contractors are self-employed and responsible for filing and paying their own income taxes and social security contributions. Employers pay contractors the full agreed amount without withholding taxes. For employees, employers must withhold income tax at source and pay employer contributions to payroll taxes and statutory benefits.

When should you hire a contractor vs an employee?

Hire contractors for project-based work, specialized skills, temporary assignments, or when you need flexibility without long-term commitment. Contractors suit defined deliverables and short-term needs. Hire employees for core business functions, ongoing roles, positions requiring direct supervision, collaborative team environments, or jobs handling confidential information and compliance responsibilities.

What should a contractor agreement include to avoid misclassification?

Contractor agreements must specify project scope, deliverables, timeline, payment terms, and confirm the contractor is responsible for their own taxes, insurance, and business expenses. Include clauses stating the contractor controls work methods, provides their own tools and equipment, can work for multiple clients, sets their own schedule, and the relationship is not employment. Add confidentiality terms for sensitive data and clear termination conditions.