Expanding into new countries usually means managing employees in places where your business doesn’t have a legal presence. Handling everything from payroll and taxes to benefits and compliance can get complicated and take up a lot of time. That’s where Employer of Record (EOR) services come in. An EOR acts as the official employer for your international team, taking care of payroll, tax compliance, benefits, and more-so you can focus on growing your business. EOR pricing can vary quite a bit, usually ranging from $199 to $1,500 per employee each month. The cost depends on things like the country you’re hiring in, how many people you have, and the specific services you need.

Countries with strict labor laws and higher taxes usually cost more, while emerging markets tend to be more affordable. This guide will walk you through the common EOR pricing models-like fixed fees and percentage-based charges-point out extra costs such as setup fees and visa processing, and give you practical tips to choose the right EOR partner. Whether you’re expanding into emerging markets like Pakistan or more established global hubs, knowing these costs will help you stay compliant, control your budget, and grow your international team smoothly.

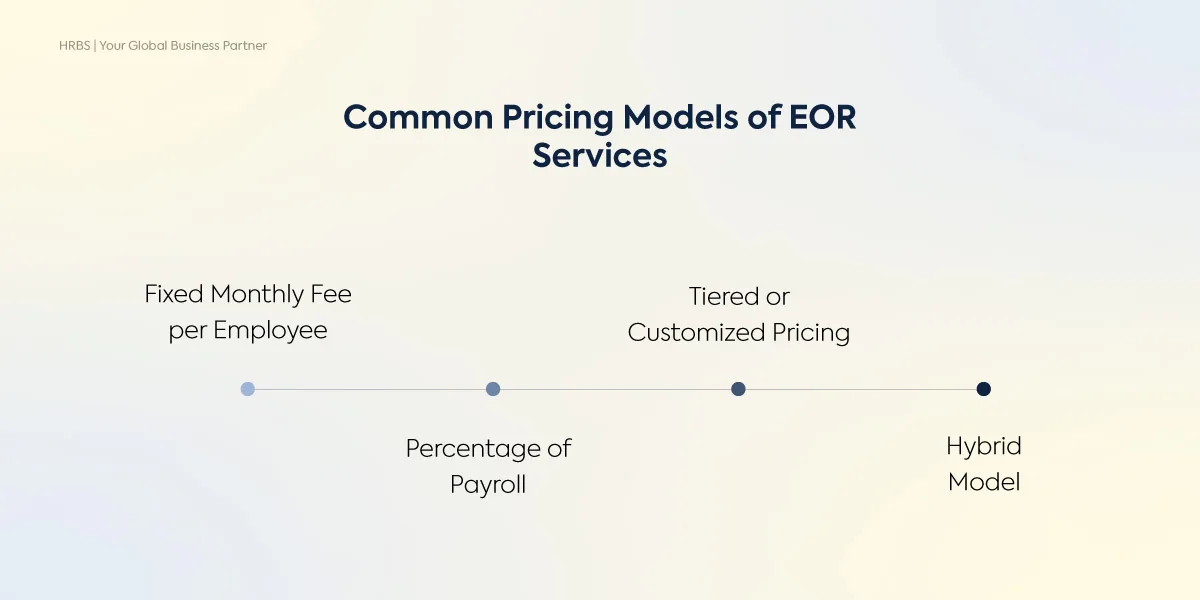

Common Pricing Models of EOR Services

Choosing the right Employer of Record (EOR) partner means understanding how their pricing works. EOR providers use different pricing models designed to fit businesses of all sizes, industries, and international goals. When you know the common pricing structures, you can compare providers with confidence, plan your global payroll budget more accurately, and manage your international team smoothly.

- Fixed Monthly Fee per Employee: This model is simple and predictable. You pay a flat monthly fee per employee, usually between $199 and $1,500. The exact cost depends on the country, local labor laws, and the services included. Typically, this fee covers payroll, tax filings, benefits administration, employment contracts, and compliance with local regulations. If you prefer steady, easy-to-budget expenses, this model is a great fit-especially if your team size stays fairly consistent.

- Percentage of Payroll: In this model, the EOR charges a percentage of each employee’s gross monthly salary, usually between 10% and 25%. This aligns your Employer of Record cost with your payroll expenses, offering flexibility for businesses with fluctuating salaries or seasonal hiring. For instance, if an employee earns $3,000 monthly and the EOR charges 15%, your monthly cost for that employee would be $450. This model suits industries with variable compensation or project-based work but can become costly for high-salary roles or in markets with expensive labor costs.

- Tiered or Customized Pricing: Many EOR providers offer tiered or fully customized pricing packages. A basic tier might cover essential payroll and compliance services, while higher tiers add recruitment support, onboarding, visa and work permit processing, and employee training. This approach benefits companies with complex, multi-country operations or those in regulated industries such as finance, healthcare, or technology. For example, a company expanding into multiple regions with different compliance requirements might choose a premium tier to ensure full regulatory adherence.

- Hybrid Model: Some EORs offer pay-as-you-go pricing, charging only for the services you use. This is ideal for companies with fluctuating or project-based hiring needs. Fees might include per-transaction charges or hourly rates for HR support and legal consultations. A hybrid model might combine a fixed base fee per employee with additional hourly charges for specialized services like visa applications or compliance audits. This flexibility helps businesses control costs while accessing expert support when needed.

Hidden and Additional Costs to Watch Out For

When managing your international workforce through an Employer of Record (EOR), costs go beyond basic monthly fees. Hidden charges like setup fees, compliance costs, payroll processing, and termination fees can significantly increase your expenses. Identifying these costs upfront helps you budget accurately and prevents unexpected financial setbacks during global expansion.

- Setup and Onboarding Fees: Most EOR providers charge a one-time setup or onboarding fee per employee. This fee covers essential administrative tasks such as drafting employment contracts, registering with local labor authorities, and ensuring compliance with local employment laws. Setup fees can range from a few hundred to several thousand dollars depending on the complexity of the local market and the number of hires.

- Security Deposits: Some EORs require a security deposit equal to one or more months of service fees. This deposit acts as a financial guarantee for the contract but can tie up your working capital. Since this cost isn’t always disclosed upfront, it’s important to clarify this during contract negotiations to avoid surprises.

- Transfer Fees: If you pay employees in multiple currencies, watch out for currency conversion fees, exchange rate markups, and international wire transfer charges. These can add 1% to 5% or more to your payroll costs depending on the provider’s payment methods and banking partners. Understanding how your EOR manages currency exchange can help you minimize these extra expenses.

- Processing Charges: Additional fees often apply for visa applications, work permits, background checks, and other legal documentation required for international employment. Some EORs also charge separately for compliance consulting or customized regulatory reporting beyond standard payroll and tax services. Make sure to review these potential costs carefully.

- Benefits Management: Offering benefits such as health insurance, retirement plans, or bonuses through your EOR usually involves extra charges. Enhanced or customized benefits packages designed to attract and retain top talent often come with higher fees. Clarify what benefits are included and which require additional payments.

- Termination Fees: Terminating your EOR contract early or transferring employees to another legal entity can trigger penalty fees. These termination charges sometimes equal one or more months of service fees and are often buried in contract terms. Reviewing termination clauses thoroughly helps you avoid unexpected costs.

- Administrative Charges: Additional fees may apply for expedited payroll processing, dedicated account management, custom payroll cycles, or enhanced reporting services. These premium or administrative charges can accumulate quickly if you require specialized support or faster turnaround times.

What Influences the Cost of an Employer of Record?

Understanding what influences Employer of Record (EOR) pricing allows you to plan your international hiring budget accurately and avoid costly surprises. When you clearly grasp pricing models, you make smarter decisions that align with your business goals and support sustainable global growth. This knowledge helps you evaluate EOR providers based on transparency, service quality, and value, ensuring you select a partner that meets your specific workforce needs. By managing your budget effectively and recognizing the benefits of EOR, you maintain financial control and streamline your global expansion process, positioning your business for long-term success in international markets.

- Country of Employment: The location where you employ staff has the biggest impact on pricing. Countries with strict labor laws, higher social security contributions, and complex tax systems usually come with higher fees. For example, hiring in Western Europe or Canada tends to cost more than in emerging markets like Pakistan or Southeast Asia. Labor regulations, mandatory benefits, and local compliance requirements vary widely, so costs reflect these differences.

- Number of Employees: Most EOR providers charge a fee per employee, so the size of your team directly affects your total cost. However, many providers offer volume discounts as your workforce grows. If you’re hiring across multiple countries, some EORs provide bundled pricing packages that can help reduce expenses when managing large teams.

- Services Included: Basic EOR services typically cover payroll processing, tax compliance, and legal employment responsibilities. But if you require additional services-such as visa and work permit processing, recruitment support, employee training, or HR consulting – expect higher fees. It’s crucial to clarify which services are included in your package and which are add-ons to avoid surprises.

- Employee Benefits and Compensation: Offering benefits like health insurance, retirement plans, or bonuses adds administrative work and compliance obligations, which can increase your EOR fees. Many providers offer flexible benefit packages tailored to your budget and employee needs, helping balance cost with employee satisfaction.

- Industry-Specific Regulations: Certain industries face more regulatory requirements than others. For example, finance, healthcare, and technology sectors often require stricter compliance and reporting. If your business operates in these fields, your EOR may charge higher fees to cover the extra legal and administrative workload.

- Currency and Payment Methods: Paying your EOR in a different currency can affect your overall expenses due to exchange rates and conversion fees. Some providers bill in local currency, while others use major currencies like USD or EUR. Understanding how payment terms and currency fluctuations impact your costs helps you avoid unexpected charges.

- Customization and Reporting Needs: If your company needs specific payroll schedules, detailed reporting, or integration with your internal HR or accounting systems, expect additional charges. Custom solutions require more time and resources, so discuss these requirements upfront to get accurate pricing.

Cost Comparison: EOR Pricing Around the World

Here’s a quick look at starting prices for Employer of Record and contractor services from some of the top providers. Most include contract management, payroll, and compliance as part of their packages. Check out our pick of the best employer of record services to easily compare services and costs.

| EOR Provider | Employer of Record Pricing per Month | Contractor Pricing per Month |

| HR Business Solutions (HRBS) | Custom Pricing | Pricing available upon request |

| RemoFirst | From $199 | From $39 |

| Horizons | From $299 | $49 |

| Deel | From $599 | $49 |

| Globalization Partners | From $1,500 or 15% of payroll | Not public |

| Remote | From $599 | $29 |

| Rippling | From $500 | $8 |

| Oyster HR | From $599 | $29 |

| Papaya Global | From $599 | $30 |

| Velocity Global | From $1,500 or 18% of burdened salary | Not public |

Cost-Benefit Analysis: Is an EOR Worth the Investment?

Are you considering an Employer of Record (EOR) to support your global hiring strategy? An EOR manages critical functions such as employee onboarding, payroll, benefits administration, and compliance with local labor laws. This allows your business to expand internationally without the need to establish a local legal entity. This cost-benefit analysis explains how investing in an EOR can lead to substantial savings, reduce operational risks, and accelerate your market entry.

- Reduce Legal Risks and Stay Compliant: EOR providers take full responsibility for following local employment laws, payroll taxes, and regulations. This reduces your risk of fines, audits, or legal penalties that can arise from non-compliance. For example, many countries impose strict labor regulations and complex tax rules that are hard to navigate without local expertise. Setting up your own legal entity requires hiring local legal counsel and can cost tens of thousands of dollars just to get started.

- Faster Market Entry: Registering a local entity can take anywhere from 3 to 9 months depending on the country, delaying your ability to hire and operate. An EOR lets you onboard employees within days or weeks, speeding up your market entry. This quick setup can be crucial in competitive industries where timing affects your market share and revenue.

- Operational Efficiency: Managing payroll, benefits, contracts, and compliance internally requires dedicated HR and legal teams, which adds salary and operational costs. Outsourcing these tasks to an EOR reduces overhead and frees your internal teams to focus on core business activities. Many EORs provide digital platforms that streamline employee management, reduce errors, and improve reporting accuracy.

Real-World Example: Cost Savings Using an EOR

A U.S.-based software company planned to expand into Pakistan. Setting up a local legal entity would have cost approximately $20,000 in legal, registration, and administrative fees and taken 4 to 6 months to complete. Instead, partnering with an EOR charging $199 per employee per month for full payroll, compliance, and benefits management enabled onboarding the Pakistan team within two weeks. This approach saved roughly $18,000 in upfront costs and administrative work during the first year. Additionally, the company avoided ongoing expenses related to maintaining a local entity, such as accounting, tax filings, and HR compliance management. Operations started 5 months earlier, allowing the business to generate revenue sooner, establish brand presence faster, and gain a critical first-mover advantage in a competitive market.

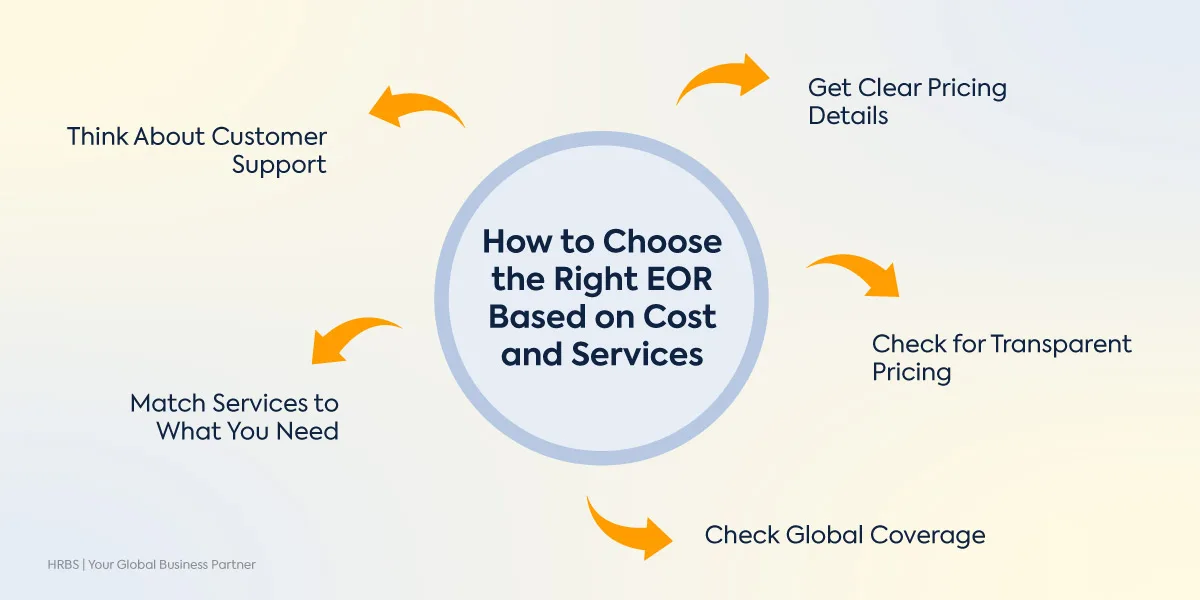

How to Choose the Right EOR Based on Cost and Services

Selecting the right Employer of Record (EOR) is essential for managing your global workforce efficiently while controlling costs. Evaluating both pricing transparency and service scope ensures you avoid hidden fees, maintain compliance with local labor laws, and receive the precise support your business requires. Use these practical tips to compare providers, understand pricing, and match services to your business needs.

- Request Transparent Pricing Details: Ask each EOR provider for a detailed breakdown of their pricing structure. Understand whether fees cover onboarding, benefits administration, local compliance, payroll processing, and termination costs, or if these are charged separately. Transparent pricing not only helps you compare providers accurately but also enables you to forecast total expenses and avoid budget overruns during your global expansion.

- Verify Full Cost Disclosure: Choose EORs that disclose all fees upfront, including setup charges, security deposits, payroll processing, tax filings, legal assistance, and termination or contract modification fees. Full cost disclosure protects your business from hidden expenses that can disrupt cash flow and ensures you maintain financial control over your international hiring operations.

- Check Global Coverage: Confirm that the EOR operates in all countries where you plan to hire, with proven expertise in local labor laws, payroll taxes, social security contributions, and compliance updates. A provider with deep local knowledge helps you mitigate legal risks, adapt quickly to regulatory changes, and maintain uninterrupted workforce operations across multiple jurisdictions.

- Match Services to What You Need: List the services your company requires-such as payroll management, tax compliance, benefits administration, contractor management, or HR support. Compare EOR packages and select one that offers the services you need without paying for extras. Also, check if the provider can scale services as your team grows.

- Evaluate Customer Support and Technology: Prioritize EORs that provide responsive, multilingual customer support and intuitive technology platforms for onboarding, payroll management, compliance tracking, and reporting. Advanced tools with real-time data access reduce administrative errors, accelerate decision-making, and improve transparency, helping your HR and finance teams manage global employees effectively and with confidence.

Check out our in-depth analysis of EOR vs PEO services to find the best fit for your business.

Key Questions to Ask EOR Providers About Pricing

Ask EOR providers key questions about pricing to ensure you choose a cost-effective and transparent solution that fits your business needs, reduces hidden fees, and supports smooth global compliance and international workforce management.

- What pricing model do you use-flat fee, percentage, or custom?

- Are there any setup fees or extra costs?

- What’s included in your base package? What services cost extra?

- How do you handle payroll taxes and compliance? Are these included?

- Do you offer discounts for larger teams or long-term contracts?

- How frequently do you update your pricing, and how will changes be communicated?

- Can you provide detailed invoices and reports for all charges?

- Do you offer trial periods or pilot programs to test your services before full commitment?

- What is your process for scaling services as my workforce grows or contracts?

- What is your policy on handling tax audits or legal disputes related to employment?

- How do you handle currency exchange and international payment processing fees?

- Are there any penalties or fees for early contract termination?

Main Factors That Affect Employer of Record Costs

Understanding what influences Employer of Record (EOR) pricing allows you to plan your international hiring budget accurately and avoid costly surprises. When you clearly grasp pricing models, you make smarter decisions that align with your business goals and support sustainable global growth. This knowledge helps you evaluate EOR providers based on transparency, service quality, and value, ensuring you select a partner that meets your specific workforce needs. By managing your budget effectively, you maintain financial control and streamline your global expansion process, positioning your business for long-term success in international markets.

- Employee Location: EOR fees vary significantly by country due to differences in market conditions, labor market maturity, and operational complexity. High-cost regions with competitive talent markets and complex administrative requirements typically have higher fees. Monitoring local economic and regulatory changes helps you anticipate pricing fluctuations and budget accordingly.

- Pricing Methods: EOR providers charge in different ways: a fixed monthly fee per employee, a percentage of the employee’s salary, or custom pricing. Larger teams often get discounts, which can lower overall costs.

- Remote and Cross-Border Hiring: Hiring remote employees across multiple jurisdictions adds complexity in coordination, communication, and compliance, which can increase costs. However, many EORs offer volume discounts, multi-country packages, or integrated platforms that streamline management and reduce overall expenses as your global team expands.

- Compliance Requirements: EORs invest in ongoing compliance monitoring, benefits administration, visa and immigration support, and HR services such as performance management and employee relations. Higher service levels or industries with stringent requirements increase fees but minimize legal risks and administrative overhead, protecting your business and workforce.

- Employee Skill Level and Industry: When you hire specialized talent or employees in highly regulated industries, the EOR must provide additional expertise and support. This includes ensuring compliance with industry-specific regulations, delivering targeted training, and managing specialized benefits packages. While these services increase costs, they protect your business from compliance risks and help maintain a highly skilled, productive workforce.

- Service Customization and Support Levels: When you require tailored services – such as dedicated account management, customized reporting, specialized onboarding, or seamless integration with your HR systems – the EOR adjusts their offerings accordingly. These customized solutions may raise fees but improve operational efficiency, enhance employee satisfaction, and give you greater control and transparency over your international workforce.

Why Choose HRBS for Employer of Record Services?

HR Business Solutions works with trusted local experts to provide comprehensive Employer of Record (EOR) services. HRBS manages payroll processing, employee benefits administration, tax compliance, and background checks to ensure international hires are fully supported and businesses comply with local labor laws and regulations. HRBS specializes in handling complex cross-border employment challenges across multiple regions. Transparent pricing and customizable service packages help control payroll expenses while maintaining compliance with changing labor laws and tax requirements. Detailed reporting and dedicated account management reduce administrative burdens and improve operational efficiency. With expertise in international payroll, compliance management, and employee onboarding, HRBS enables businesses to expand into new markets quickly without establishing local legal entities. This approach minimizes risks related to labor law violations, tax penalties, and employee misclassification.

Contact HRBS to learn how tailored EOR solutions can streamline your global hiring process, reduce compliance risks, and optimize international workforce management.

FAQ’s

What factors affect the cost of using an Employer of Record?

The cost depends on where you hire employees, the pricing model your EOR uses (flat fee, percentage of salary, or custom pricing), the size of your workforce, and the services you require such as payroll processing, benefits administration, and compliance management. Complex local labor laws and tax regulations also influence pricing. Understanding these factors helps you plan your international hiring budget precisely.

How can I avoid extra or hidden fees with an Employer of Record?

Request a detailed fee breakdown before signing any contract. Check for setup fees, currency exchange charges, and additional costs for compliance consulting or benefits management. At HR Business Solutions, we provide full pricing transparency through an online portal so you can track all expenses clearly and avoid surprises.

Can I get discounts if I hire many employees or sign a long contract?

Yes. Many EOR providers, including HRBS, offer volume discounts for larger teams or extended contracts. Discuss these options upfront and negotiate to lower your overall global payroll expenses and improve cost efficiency.

How do changes in local laws affect Employer of Record prices?

When local labor or tax laws change, EOR fees may increase to cover new compliance requirements or tax obligations. Staying updated on regulatory changes helps you avoid unexpected costs. HRBS monitors global legal environments to keep your business compliant and informed.

Which services should I focus on to keep EOR costs low but stay compliant?

Focus on essential services like payroll management, tax filing, benefits administration, and legal compliance. These ensure employees are paid correctly and your business meets local laws. Avoid paying for unnecessary add-ons. HRBS offers flexible service packages so you only pay for what you need.

Does hiring employees in different countries change my total Employer of Record costs?

Yes. Costs vary by country due to differences in taxes, social security contributions, and labor regulations. Hiring in countries with simpler labor laws and lower social charges usually costs less. Comparing country-specific pricing helps you plan your international hiring budget effectively.

How often should I review my Employer of Record contract and fees?

Review your contract and fees at least annually or before expanding your team. Regular reviews help identify savings and ensure services align with your business needs. At HRBS, we provide annual contract audits and recommendations to optimize your costs and service levels.