Running payroll isn’t just about cutting checks – it’s about getting every detail right to keep your business compliant and running smoothly. Many businesses make costly mistakes like misclassifying employees, missing overtime hours, or overlooking deductions. These errors can lead to penalties, wage disputes, and even payroll fraud that puts your business at risk. That’s why regular payroll audits are essential. They help you verify employee classifications, cross-check hours worked against timesheets, and ensure tax withholdings and deductions meet all federal, state, and local requirements. Conducting these audits every quarter or twice a year can save you from unexpected problems down the road.

This guide offers practical resources on the payroll audit process, including how to gather essential documents, identify frequent errors like misclassification or incorrect overtime, and address issues quickly. Whether you’re preparing for an internal review or a government audit, this guide will help you keep your payroll accurate, compliant, and stress-free – protecting your business and building trust with your employees.

What is a Payroll Audit?

A payroll audit is a systematic review of payroll data, processes, and documentation designed to ensure compliance with labor laws, tax regulations, and internal company policies. It verifies that employees are correctly classified – whether full-time, part-time, exempt, or contractor – and confirms that wages, overtime, bonuses, and deductions are calculated accurately and applied properly. Payroll audits identify common payroll errors such as missed overtime payments, incorrect tax withholdings, duplicate or unreported compensation, and discrepancies in benefit deductions.

Detecting these errors early helps prevent costly fines, legal penalties, and wage disputes. Moreover, payroll audits play a crucial role in uncovering payroll fraud, including ghost employees, unauthorized wage changes, and falsified timesheets, protecting the business from financial losses and reputational damage. Conducting regular payroll audits reduces financial risks, ensures employees are paid correctly, and strengthens internal controls. Businesses that perform routine payroll audits improve payroll accuracy, maintain compliance with federal and state laws, and protect themselves from penalties and government scrutiny.

Objectives of Payroll Audit

The primary objective of a payroll audit is to detect and correct missing or inaccurate payroll information to ensure full compliance with labor laws and tax regulations. This process safeguards the organization from costly penalties and financial losses while maintaining employee trust. Key objectives include:

- Identify Missing Payroll Data: Detect unreported hours, overlooked bonuses, or omitted employee benefits that can affect pay accuracy.

- Verify Employee Classification: Ensure employees are correctly classified as full-time, part-time, or contractors to avoid misclassification penalties.

- Confirm Accurate Wage Calculations: Validate base pay, overtime, commissions, and bonuses to prevent underpayment or overpayment.

- Ensure Proper Tax Withholding and Submission: Check that federal, state, and local taxes are withheld correctly and submitted on time to avoid fines.

- Detect Payroll Fraud and Errors: Uncover ghost employees, unauthorized wage changes, or duplicate payments.

- Maintain Compliance with Legal Requirements: Align payroll processes with current labor laws, tax codes, and company policies.

- Enhance Financial Integrity: Provide accurate payroll data that supports reliable financial reporting and budgeting.

By focusing on these objectives, a payroll audit delivers real value by reducing risks, improving payroll accuracy, and ensuring regulatory compliance.

Scope of Payroll Audit

The scope of a payroll audit involves a detailed and systematic review of all payroll-related records and processes within a specific timeframe. This thorough process helps identify missing or incomplete data, errors, and operational weaknesses, providing actionable insights to improve accuracy and compliance. The audit scope typically includes:

- Employee Records Verification: Confirm completeness and accuracy of employee information, including hire dates, job titles, and employment status.

- Timesheet and Attendance Review: Cross-check recorded hours against payroll to identify missing or inaccurate time entries.

- Compensation Analysis: Review all pay components—salary, overtime, bonuses, commissions—to ensure correct application and calculation.

- Tax and Deduction Validation: Examine payroll tax withholdings, benefit deductions, garnishments, and ensure timely tax filings.

- Internal Controls Assessment: Evaluate payroll approval processes, segregation of duties, and system access to prevent fraud and errors.

- Reconciliation with Financial Records: Match payroll expenses with general ledger entries and bank statements to detect discrepancies.

- Compliance Check: Verify adherence to labor laws, tax regulations, and company policies throughout the payroll cycle.

- Identification of Missing or Incomplete Entries: Highlight gaps in payroll data that could lead to inaccuracies or compliance risks.

This comprehensive scope not only mitigates financial and legal risks but also enhances payroll efficiency and data integrity, delivering measurable improvements to the organization’s payroll management.

Why are Payroll Audits Important?

Payroll audits do more than find obvious mistakes – they expose hidden problems and weaknesses that quietly drain your business’s resources and increase legal risks. Many companies underestimate how complex payroll compliance can be, especially when managing multiple states, diverse employee types, and constantly changing labor laws. Here are five key reasons why you must perform payroll audits.

- Fix Employee Classification: Auditors verify that you classify workers correctly as employees or contractors. They review contracts and actual job duties to ensure classifications comply with labor regulations. Additionally, audits help identify evolving workforce trends such as gig workers or remote employees that require updated classification approaches.

- Correct Overtime Errors: Payroll audits catch ongoing problems like underpaid overtime caused by bad time tracking or misunderstanding local laws. For example, audits can show if certain teams regularly miss paying extra for night shifts or forget to include bonuses when calculating overtime. Auditors also verify that timekeeping systems are accurate and properly integrated with payroll.

- Stop Payroll Fraud: Audits detect payroll fraud by reviewing internal controls and approval processes. They ensure segregation of duties so no single person can add employees and approve payments, reducing risks of ghost employees, unauthorized raises, and falsified timesheets. Furthermore, audits evaluate payroll system access rights and monitor unusual payroll changes to proactively prevent fraud.

- Check Tax Accuracy: Payroll audits verify that your tax withholdings comply with federal, state, and local laws. Auditors ensure timely tax filings and reconcile payroll tax liabilities with payments, helping you avoid penalties and government audits. They also review compliance with less obvious tax obligations such as local city taxes, special assessments, and recent regulatory changes impacting payroll taxes.

- Improve Data Integration: Auditors assess how well payroll integrates with HR, accounting, and timekeeping systems. They identify data mismatches and recommend automation or system improvements to increase accuracy and streamline reporting. This integration supports real-time payroll analytics, enabling better decision-making and faster issue resolution.

Types of Payroll Audit

Payroll audits mainly consist of two types: internal audits and external audits. Each type targets specific risks to ensure payroll accuracy and legal compliance. Both play a vital role in identifying hidden errors, preventing fraud, and ensuring your payroll processes meet regulatory standards, ultimately protecting your business from costly penalties and operational disruptions.

- Internal Payroll Audit: Internal audits are performed by your HR or finance team to verify critical payroll elements such as employee classification, wage calculations, overtime payments, tax withholdings, and benefit deductions. These audits identify common issues like inaccurate time tracking, missed overtime, and outdated employee records. Addressing these errors early prevents costly payroll corrections and improves operational efficiency. Internal audits also help ensure payroll aligns with company policies and labor laws.

- External Payroll Audit: External audits are conducted by independent auditors or government agencies to assess compliance with tax laws and labor regulations. These audits thoroughly review payroll tax filings, employee classifications, wage reporting, and recordkeeping accuracy. They detect serious risks such as misclassified workers, unreported wages, or incorrect tax payments that can lead to significant fines and legal actions. Preparing for external audits through regular internal checks and maintaining detailed documentation reduces the likelihood of penalties and audit disputes.

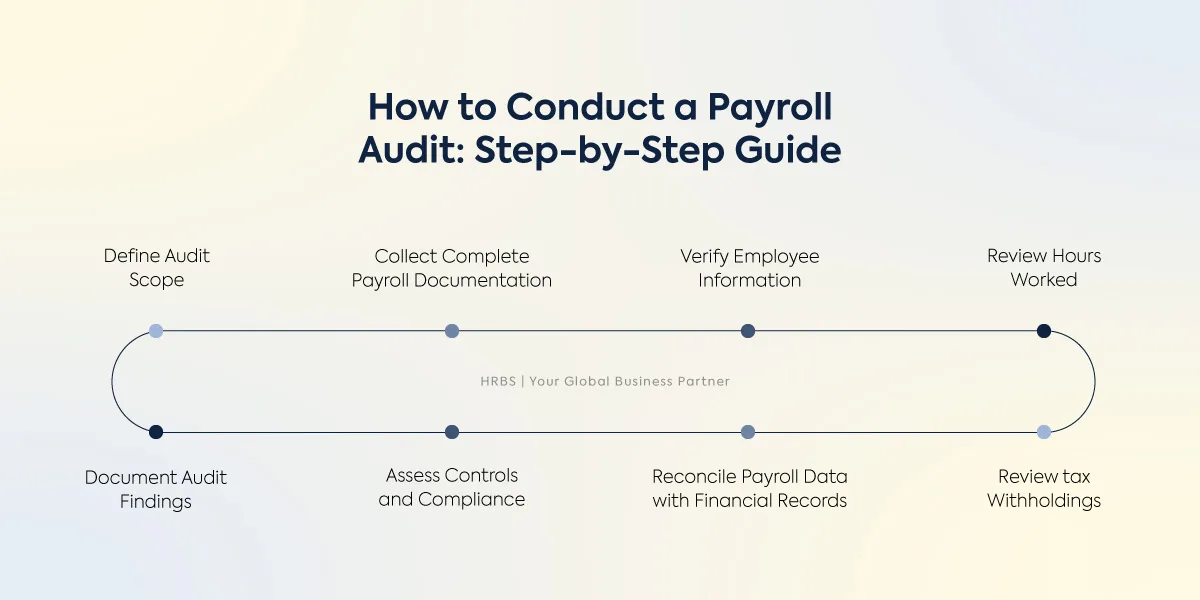

How to Conduct a Payroll Audit: Step-by-Step Process

A payroll audit is a critical process that verifies payroll accuracy, ensures compliance with tax laws, and prevents payroll fraud. Performing a thorough payroll audit helps identify errors, avoid penalties, and improve payroll efficiency. Here’s a detailed, step-by-step guide to conducting a comprehensive payroll audit:

- Define Audit Scope: Clearly outline the audit period, departments, and payroll elements to review, such as employee classifications, wage calculations, tax withholdings, benefit deductions, and payroll policies. Defining the scope ensures focused efforts on high-risk areas and maximizes audit effectiveness.

- Collect Complete Payroll Documentation: Gather all relevant payroll records, including employee contracts, payroll registers, timesheets, tax filings, benefits enrollment forms, direct deposit authorizations, and payment approvals. Verify that records are complete, accurate, and up-to-date to avoid missing critical data during the audit.

- Verify Employee Information: Ensure all individuals on payroll are currently employed or properly engaged as contractors. Confirm that job titles, employment status, and classification (exempt, non-exempt, contractor) align with company records and legal definitions. This step prevents unauthorized payments and ensures payroll reflects actual workforce composition.

- Review Hours Worked: Match pay rates to employment agreements and confirm hours worked using verified timesheets or electronic time-tracking systems. Review all forms of compensation – including regular wages, overtime, bonuses, and commissions – to ensure calculations comply with company policies and applicable labor laws.

- Review tax Withholdings Check that federal, state, and local tax withholdings are accurate and submitted on time. Verify that deductions for benefits, retirement plans, wage garnishments, and other authorized withholdings are properly applied. Ensure tax filings correspond with payroll data to avoid discrepancies.

- Reconcile Payroll Data with Financial Records: Compare payroll expenses against bank statements, general ledger entries, and accounting software reports. Identify any inconsistencies such as duplicate payments, unauthorized adjustments, or unexplained variances. This reconciliation helps maintain financial accuracy and detect potential fraud.

- Assess Controls and Compliance: Review payroll policies, approval workflows, and security protocols. Identify gaps in internal controls like segregation of duties, access restrictions, and documentation standards. Strengthening these controls reduces the risk of errors and fraudulent activities.

- Document Audit Findings: Record all discrepancies, errors, and risks discovered during the audit. Develop a clear plan to correct issues promptly and update payroll procedures to prevent future occurrences. Keep thorough documentation to support compliance efforts and facilitate subsequent audits.

Best Practices for Payroll Audit

A well-executed payroll audit not only uncovers errors and discrepancies but also strengthens your company’s financial integrity. Regular audits help you stay ahead of regulatory changes, minimize risks, and build trust with employees and authorities alike. Follow these best practices to conduct accurate and compliant payroll audits that reduce errors, prevent fraud, and ensure regulatory compliance.

- Target High-Risk Areas: Analyze your payroll data to find departments or employee groups with frequent overtime, inconsistent hours, or tricky tax situations. Focus your audit on these areas to catch misclassified employees, unauthorized payments, or pay errors. Review data over several pay periods to spot emerging issues.

- Automate Payroll Integration: Make your timekeeping system send data directly to your payroll software to avoid manual entry mistakes. Set up alerts to notify you of sudden pay rate changes or unusual overtime. Keep detailed records of all changes for easy review later.

- Keep Payroll Records Organized: Maintain up-to-date employee information, timesheets, tax forms, benefit deductions, and payroll adjustments. Save every version of important documents and protect them from unauthorized changes. Back up your data regularly to prevent loss.

- Reconcile Payroll with Financial Records: Compare payroll reports with bank statements and accounting records regularly. Investigate any duplicate payments, missing payroll runs, or unauthorized changes right away. Have a clear process to resolve issues quickly.

- Train Payroll Staff: Provide quarterly training on new labor laws, tax changes, and audit procedures. Use case studies relevant to your industry to help staff identify common errors. Well-trained teams reduce audit findings and improve compliance, as demonstrated by firms that saw a huge drop in payroll errors after regular training.

- Use External Auditors: Engage external auditors to review payroll processes objectively. External experts bring fresh perspectives, benchmark your practices, and identify hidden risks. Companies using external audits often discover control weaknesses missed internally, improving overall payroll governance.

Payroll Audit Checklist

A payroll audit ensures your payroll process is accurate, compliant, and efficient by systematically reviewing employee data, wage calculations, tax withholdings, and internal controls. Use this clear, actionable checklist to identify errors, prevent fraud, detect compliance gaps, and improve payroll accuracy. This checklist follows industry best practices and regulatory standards to help HR and payroll professionals conduct thorough audits with confidence and precision, ultimately reducing financial risks and ensuring reliable payroll management.

Verify Employee Information

- Confirm employee names, job titles, classifications (exempt/non-exempt, full-time/part-time), and tax statuses match official records.

- Remove terminated or inactive employees from payroll immediately to avoid overpayments.

- Check pay rates against signed contracts or offer letters for every employee to prevent under- or overpayment.

- Validate payroll data across HR, payroll, and accounting systems to ensure consistency and eliminate duplicate records.

- Confirm proper pay treatment for employees on leaves of absence (e.g., medical, parental, unpaid leave) to ensure compliance with labor laws.

Validate Hours Worked and Payments

- Compare timesheets or attendance logs with payroll hours, especially for hourly and non-exempt employees.

- Investigate duplicate, missing, or suspicious time entries to prevent time theft and payroll fraud.

- Ensure overtime, shift differentials, holiday pay, vacation pay, and paid leave are calculated and paid according to company policy and legal requirements.

- Confirm paid hours align with scheduled work hours and reported attendance to avoid ghost employees or phantom hours.

Audit Variable Pay and Deductions

- Verify bonuses, commissions, and other incentive pay are calculated accurately, authorized, and documented.

- Check all deductions for benefits, retirement plans, garnishments, tax levies, and voluntary contributions are accurate, authorized, and compliant with regulations.

- Review employer contributions (e.g., social security, pension, workers’ compensation) for accuracy and timely payment to avoid penalties.

Confirm Payroll Tax Accuracy and Compliance

- Verify federal, state, and local payroll tax withholdings are correct, reflecting current tax rates and employee tax statuses.

- Ensure timely submission of payroll taxes and filing of required tax forms to avoid fines and interest.

- Check employee tax exemptions, allowances, and changes in withholding status are updated promptly.

- Maintain detailed records of tax payments and filings to support audits and regulatory reviews.

Reconcile Payroll with Financial Records

- Match payroll registers and reports with general ledger entries to identify and resolve discrepancies.

- Ensure payroll expenses align with approved budgets and financial statements to maintain financial integrity.

- Investigate and document causes of any mismatches or unusual variances.

- Record all reconciliations and adjustments clearly to provide an audit trail.

Maintain Accurate Record-Keeping

- Retain payroll records, including timesheets, tax documents, employee contracts, and audit reports, for the legally required period (typically 3-7 years depending on jurisdiction).

- Organize records systematically for easy retrieval during internal or external audits.

- Keep detailed logs of audit findings, corrective actions, and follow-up measures to support continuous process improvement.

Set Audit Frequency and Coordination

- Schedule payroll audits regularly – quarterly, biannually, or annually – based on company size, complexity, and risk exposure.

- Involve cross-functional teams from HR, payroll, finance, and compliance to ensure a comprehensive review.

- Use audit results to update payroll policies, improve controls, and train staff to prevent future errors.

Common Payroll Mistakes to Avoid

Avoiding common payroll mistakes is crucial to keep your payroll accurate, comply with tax laws, and prevent costly penalties. Below are frequent errors found during payroll audits and practical steps to fix them.

- Misclassification of Employees: Classifying employees incorrectly – such as labeling a worker as an independent contractor or exempt employee without meeting legal criteria – leads to inaccurate tax withholding and missed overtime payments. Misclassification exposes businesses to audits, back taxes, and fines. Regularly review job roles and responsibilities against guidelines to ensure proper classification.

- Inaccurate Overtime Calculations: Many companies fail to calculate overtime pay correctly, especially for non-exempt employees. Incorrect tracking of hours worked or applying wrong pay rates causes underpayment or overpayment. Use reliable time-tracking systems and verify overtime calculations align with the state-specific laws to avoid violations.

- Errors in Tax Withholding and Reporting: Incorrect federal, state, or local tax withholdings can trigger penalties and interest charges. Payroll systems must be updated promptly to reflect tax rate changes and employee withholding allowances. Conduct regular reconciliations between payroll records and tax filings to ensure consistency and accuracy.

- Incomplete or Disorganized Record Keeping: Poor record keeping complicates audits and increases the risk of undetected errors or fraud. Maintain detailed, organized records of employment contracts, time logs, pay rates, tax documents, and benefits deductions. Digital payroll systems with audit trails improve transparency and simplify compliance reviews.

- Weak Internal Controls: When duties are not separated and approval steps are missing, payroll errors and fraud are more likely. Use clear approval processes, limit who can access payroll systems, and perform regular checks. These steps help find problems early and keep payroll accurate.

Addressing these issues through regular audits, clear policies, proper training, and robust payroll systems helps ensure compliance, reduce risks, and maintain employee trust.

Signs Your Company Needs a Payroll Audit

When payroll discrepancies begin to impact your financial records or employee satisfaction, it’s important to take a closer look at your payroll processes. Issues like inaccurate tax filings, frequent payroll mistakes, or unexpected changes in employee compensation often point to deeper problems that need addressing. Regular audits help uncover these issues early, ensuring compliance with labor laws and avoiding costly penalties. Here are clear signs that your company should run a payroll audit soon:

- Employees Report Consistent Pay Errors: If employees frequently report missing overtime, incorrect deductions, or wrong pay amounts, your payroll system likely has errors. These issues often stem from manual entry mistakes, outdated pay rules, or poor communication between departments. A payroll audit verifies hours worked, pay rates, and deductions to identify and fix these errors, ensuring employees are paid correctly and on time.

- Payroll Doesn’t Match Bank Records: When payroll totals don’t match your bank withdrawals or accounting ledgers, it could indicate duplicate payments, ghost employees, or unauthorized payroll runs. Payroll reconciliation during an audit compares payroll data with bank statements and accounting records to find and fix discrepancies, preventing financial losses and fraud.

- Constant Payroll Corrections: Frequent payroll adjustments after payments show weak internal controls. This usually happens when timecards aren’t properly verified or pay changes lack formal approval before payroll processing. Implementing clear approval workflows and regular audits ensures accuracy and reduces the need for costly corrections.

- Outdated Employee Records: Missing or outdated employee information – such as hire dates, job titles, pay rates, or employment status (full-time vs. contractor) – can cause tax errors and incorrect benefit calculations. Regularly updating employee files during payroll audits helps maintain compliance with tax laws and avoids penalties.

- Unexplained Payments: Sudden spikes in overtime pay or payments to employees who have left the company are major red flags for payroll fraud or system errors. Payroll audits cross-check payroll data with HR termination records, timekeeping logs, and overtime approvals to detect unauthorized or duplicate payments and prevent financial losses.

- Payroll System Isn’t Updated: When your payroll software doesn’t reflect the latest tax rates, minimum wage laws, or benefit deduction rules, you risk making incorrect payments and facing fines. An outdated system can cause errors in tax withholdings and wage calculations. A payroll audit verifies that your software is current with all regulatory changes, ensuring accurate payroll processing, timely tax filings, and full compliance with federal, state, and local laws.

- Growth and Restructuring: Rapid hiring, mergers, or departmental changes often cause payroll gaps such as missing employees, duplicate records, or inconsistent pay practices. A payroll audit confirms that all employees are properly added, classified, and paid according to company policies and legal requirements, helping you avoid compliance issues during periods of change.

Benefits of Payroll Audit

Regular payroll audits are more than just a compliance check. They help improve your business processes, protect you from financial risks, and build trust with your employees. By finding mistakes, stopping fraud, and making sure you follow tax and labor laws, payroll audits give you clear information to control costs and work more efficiently. Here are the key benefits of doing regular payroll audits:

- Ensure Legal Compliance: A payroll audit verifies that your business accurately calculates and submits payroll taxes, social security contributions, unemployment insurance, and other mandatory deductions in line with federal, state, and local regulations. It also confirms adherence to wage and hour laws, including correct overtime payments and proper employee classifications, helping you avoid costly fines and legal penalties.

- Prevent Fraud: Payroll fraud can take many forms, such as ghost employees on the payroll, falsified timesheets, unauthorized salary increases, or fake expense reimbursements. A thorough audit cross-checks payroll records with HR files, timekeeping systems, and approval workflows to detect these issues early. Identifying fraud promptly protects your company from financial loss and reputational damage.

- Improve Financial Planning: Payroll audits generate detailed reports on labor costs, overtime usage, and benefit expenses, highlighting departments or teams with unusually high spending. This insight enables you to adjust staffing levels, control overtime, and optimize benefit programs, resulting in more accurate budgeting and improved financial forecasting.

- Increase Payroll Efficiency: Audits often reveal inefficiencies such as manual data entry errors, duplicate records, or disconnected systems between time tracking and payroll software. By identifying these gaps, you can implement automation and integrate systems, speeding up payroll processing, reducing errors, and lowering administrative costs.

- Employee Trust and Satisfaction: Accurate and timely payroll builds employee confidence. Audits ensure wages, overtime, and benefits are correctly calculated and paid, minimizing payroll disputes and complaints. When employees trust payroll accuracy, it improves morale, reduces turnover, and supports a positive workplace culture.

- Control and Backup Plans: Payroll audits assess whether proper approval processes exist for pay changes and if duties are segregated to prevent errors or fraud. They also encourage establishing backup procedures to maintain payroll continuity during staff absences, reducing operational risks.

How HRBS Can Help with Payroll Audit

Regular payroll audits help you identify critical issues such as employee misclassification, incorrect tax withholdings, missed overtime payments, and unauthorized salary changes. These audits ensure your payroll complies with federal, state, and local laws, helping you avoid costly fines, penalties, and legal disputes. They also detect payroll fraud like ghost employees, falsified timesheets, and duplicate payments, protecting your company’s financial resources. Additionally, payroll audits provide detailed insights into labor costs, overtime trends, and benefit expenses, allowing you to manage budgets more effectively and make informed staffing decisions.

Partnering with HR Business Solutions means working with payroll experts who stay updated on the latest labor laws, tax regulations, and compliance requirements. We use integrated payroll and time-tracking systems to reduce manual errors and improve data accuracy. Our audit process cross-checks payroll records with HR files, tax filings, and approval workflows to ensure transparency and compliance. This reduces the risk of non-compliance, lowers administrative workload, and strengthens your financial controls. Contact us to schedule a comprehensive payroll audit and ensure your payroll processes are accurate, compliant, and efficient.

FAQ’s

What is the scope of a payroll audit?

The scope of a payroll audit includes verifying employee data accuracy, confirming hours worked, and validating pay rates and compensation calculations. It checks payroll deductions and tax withholdings for correctness and compliance with laws. The audit reconciles payroll data with accounting records to identify discrepancies and reviews payroll adjustments for proper authorization and documentation. It also assesses payroll system security and access controls to prevent unauthorized changes. Finally, it verifies that payroll tax filings and payments are timely and accurate, ensuring full regulatory compliance. The objective is to detect errors, prevent fraud, and maintain payroll accuracy and legal adherence.

How often should a payroll audit be conducted?

The frequency of payroll audits depends on your business size and complexity. Conducting a quarterly payroll audit helps most businesses catch errors early – such as incorrect tax withholdings or misclassified employees – that could lead to costly penalties. Larger organizations with complex payroll systems benefit from monthly audits to manage higher risks effectively. Smaller businesses with simpler payroll processes can schedule bi-annual audits without compromising accuracy. Regular audits ensure ongoing payroll compliance and reduce the risk of financial errors.

What documents are required for a payroll audit?

A thorough payroll audit requires organized and accurate documentation. This includes payroll registers detailing employee wages, deductions, and bonuses; signed employee contracts specifying compensation terms; timesheets or attendance logs verifying hours worked; filed tax returns and payment receipts for payroll taxes; benefits enrollment and contribution records; and bank statements confirming payroll disbursements. Having these documents readily available allows auditors to verify compliance, identify discrepancies, and ensure accurate payroll processing.

Can payroll audits detect fraud?

Yes, payroll audits are essential for detecting payroll fraud. They help uncover issues such as ghost employees receiving unauthorized paychecks, inflated work hours, unauthorized salary changes, and manipulated payroll entries. By cross-checking payroll data with attendance records, employee contracts, and authorization logs, audits strengthen internal controls and reduce financial losses. Regular payroll audits also act as a deterrent by increasing oversight and accountability.

What are the risks involved in a payroll audit?

Payroll audit risks occur when organizations lack accurate and secure payroll processes. Errors such as incorrect pay rates, misreported hours, or missed overtime payments can cause financial losses and employee dissatisfaction. Fraud risks include ghost employees, falsified timesheets, and unauthorized payroll adjustments. Weak internal controls and poor segregation of duties increase the chance of unauthorized access and undetected errors or fraud. Identifying and addressing these risks during a payroll audit helps protect assets, ensure accurate payments, and maintain regulatory compliance.

What is a payroll audit report?

A payroll audit report is a detailed document that summarizes the findings of a payroll audit. It outlines the accuracy and compliance of payroll processes, employee data, wage calculations, tax withholdings, and deductions. The report highlights discrepancies, errors, or non-compliance issues discovered during the audit and provides recommendations to correct them. It serves as a communication tool for HR, finance, and management teams, helping them understand payroll risks and take necessary actions. The report typically includes an overview of the audit scope, methodology, detailed findings, and an action plan to address identified gaps.

How does technology assist in payroll audits?

Technology enhances payroll audits by automating complex calculations for wages, taxes, and deductions, which reduces human error. Advanced payroll software continuously monitors for unusual payroll entries and maintains detailed, time-stamped audit trails for every transaction. It generates comprehensive reports that highlight discrepancies and compliance issues, enabling auditors to focus on investigating potential problems rather than manual data review.

Who should be involved in a payroll audit?

Effective payroll audits require close collaboration between Payroll, HR, and Finance teams. Payroll provides detailed payment data, HR verifies employee status and contracts, and Finance ensures tax compliance and reconciles payroll expenses with financial records. This teamwork helps identify issues quickly and ensures all payroll processes comply with legal and company standards.