Direct compensation is the money employees receive in exchange for their work. This includes salaries, hourly wages, bonuses, commissions, and any other payments directly linked to the job performed. It is the most immediate and transparent form of employee reward tied to their skills, time, and performance. Direct compensation not only helps employers set transparent and fair pay that reflects employee contributions, but it also empowers workers to see how their efforts translate into earnings. By understanding direct compensation, employees can better plan their financial goals and career moves with confidence.

In this blog, we will explore the different types of direct compensation, how it differs from indirect benefits, and important factors employers consider when deciding pay. This knowledge will help both employers and employees navigate compensation in today’s workplace with clarity and confidence.

What is Direct Compensation?

Direct compensation refers to all monetary payments made directly to employees in exchange for their work or services. It is the most transparent component of an employee’s total pay and includes fixed and variable forms of pay linked clearly to job roles, performance, time worked, or company success.

Common examples of direct compensation include:

- Base salary or hourly wages

- Bonuses tied to individual or company performance

- Commissions typically given to sales employees

- Profit-sharing arrangements

- Stock options or equity grants

- Overtime payments

- Special allowances such as relocation or car allowances

Understanding direct compensation is critical because it determines the actual income employees take home and motivates them to meet organizational goals.

Direct vs. Indirect Compensation: Why the Difference Matters

Direct compensation is often confused with indirect compensation, but recognizing the distinction is crucial for a complete understanding of employee pay.

- Direct Compensation: Cash or cash-equivalent payments received regularly or as incentives. This is taxable income and found on pay stubs.

- Indirect Compensation: Non-monetary benefits that contribute to employee well-being and job satisfaction. Examples include health insurance, retirement benefits, paid time off, childcare support, wellness programs, and other perks.

Why It Matters:

- Design Fair Pay Packages: Knowing the difference ensures your salary offers are competitive, while employee benefits support needs beyond money.

- Improves Employee Satisfaction: Many workers value benefits that support their family and health as much as their paycheck. This lowers turnover and saves hiring costs.

- Supports Employee Needs: Some prefer higher salary, others prioritize benefits like flexible leave or childcare. Balancing both lets you meet diverse needs and attract better talent.

- Stay Competitive in Hiring: A clear mix of direct and indirect pay helps your business stand out in the job market, making it easier to hire the right people faster.

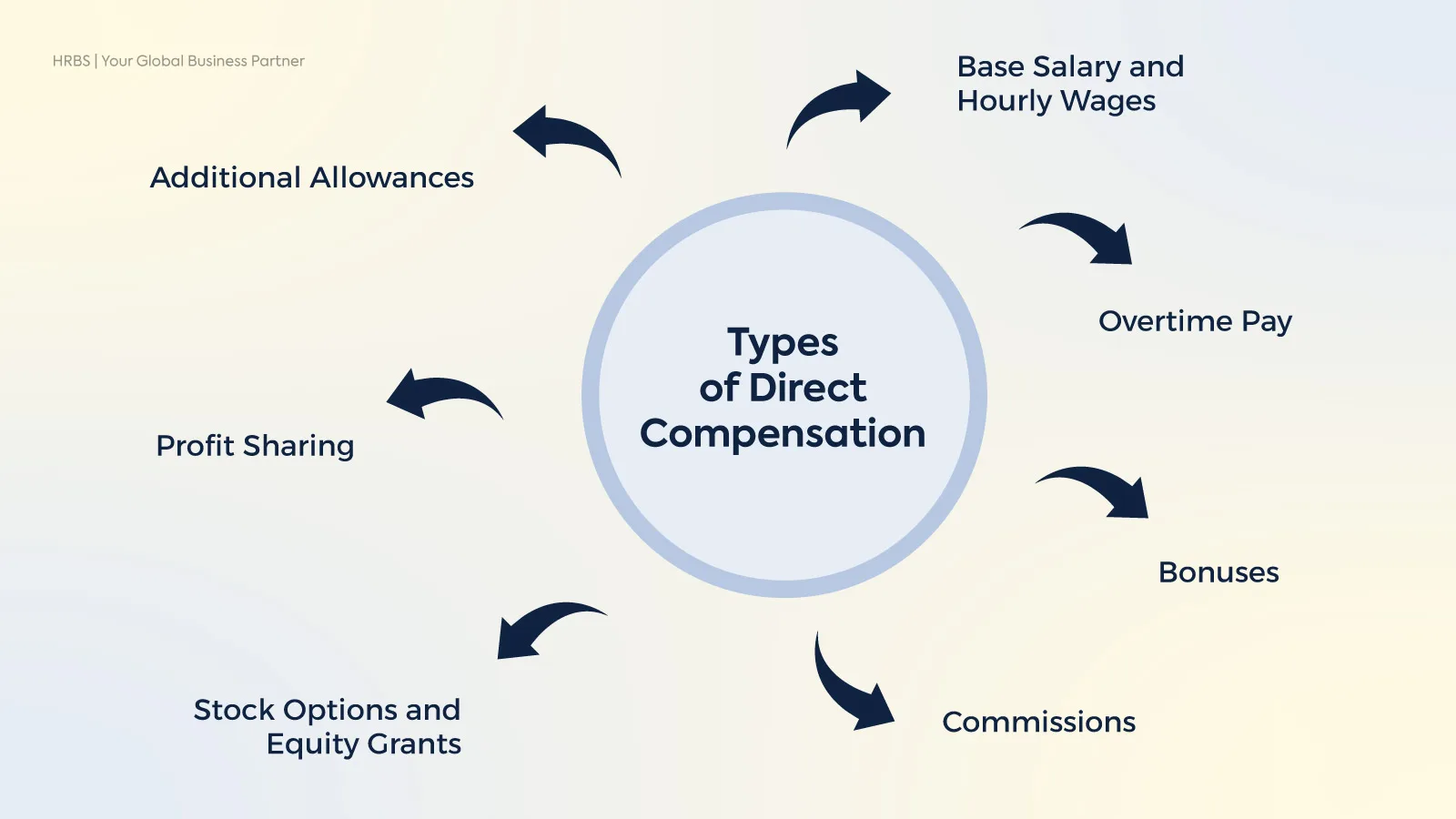

Types of Direct Compensation

Direct compensation refers to the monetary rewards employees receive for their work, delivering clear value and motivation. It includes various types such as base salary, performance bonuses, commissions, and overtime pay, all designed to directly reward effort and results. Understanding these types helps organisations structure competitive and transparent pay packages.

- Base Salary and Hourly Wages: The foundation of direct compensation, base salary, is a fixed payment made periodically (monthly, biweekly) according to employment contracts. Hourly wages compensate employees based on the exact number of hours worked, frequently used in part-time or contract roles.

- Overtime Pay: Overtime compensation provides extra pay for hours worked beyond the standard work week, typically at a premium rate (e.g., “time-and-a-half”). This is often mandated by labor laws to ensure fair pay for extra work.

- Bonuses: Bonuses are supplemental payments awarded to employees for exceptional work, meeting targets, or company-wide achievements. Unlike commissions, bonuses may be discretionary or linked to specific performance metrics.

- Commissions: Often used in sales roles, commissions pay employees a percentage of sales or profits they generate. This pay structure drives sales productivity and rewards individual performance directly.

- Profit Sharing: Profit-sharing plans distribute a portion of company profits to employees, reinforcing alignment between employee contributions and overall organizational success.

- Stock Options and Equity Grants: Equity rewards give employees partial ownership in the company, with potential long-term financial gain beyond regular pay. This encourages employee loyalty and performance over time.

- Additional Allowances: Monetary support for job-related expenses such as relocation packages, travel allowances, or company vehicle use can be classified under direct compensation when paid directly to employees.

How Employers Set Direct Compensation: Key Considerations

Setting the right direct compensation means balancing several important factors to attract and keep the best employees while staying within your budget:

- Job Analysis: Understand the role’s duties, complexity, and required skills to determine a fair salary level. Avoid under- or over-paying by clearly defining the job scope.

- Market Research: Compare pay rates in your industry and region to stay competitive. This helps attract talent and reduces turnover due to better offers elsewhere.

- Employee Experience: Consider candidates’ skills, years of experience, education, and certifications. Reward proven performance and expertise to motivate employees.

- Business Financial Health: Set salaries that your company can sustainably afford. Align pay with current financial status and long-term business goals to avoid overspending.

- Legal Compliance: Follow wage laws, overtime rules, and non-discrimination regulations fully to avoid legal issues or fines. Integrate compliance checks into your pay-setting process.

By considering these elements thoroughly, employers can set direct compensation that not only meets employee expectations but also supports business success and long-term growth.

Legal Framework Surrounding Direct Compensation

Employers must follow key laws to ensure fair and lawful pay practices and avoid costly penalties:

- Minimum Wage Laws: Set the lowest hourly pay employers can offer, preventing underpayment and wage theft.

- Overtime Regulations: Require premium pay for hours worked beyond standard schedules to protect employee rights and avoid back pay claims.

- Equal Pay Acts: Mandate equal pay for equal work regardless of gender, race, age, or other protected characteristics to prevent discrimination.

- Tax Compliance: Ensure accurate withholding and reporting of payroll taxes, Social Security, Medicare, and benefit-related deductions.

- Salary Transparency Requirements: In some regions, laws require disclosing salary ranges in job postings or upon request to fight pay inequity.

- Record-Keeping Obligations: Employers must maintain detailed compensation records as proof of compliance during audits or legal reviews.

Violating these laws can result in fines, legal action, back pay orders, and damage to an employer’s reputation, making compliance essential for responsible compensation management.

Best Practices: Maximizing the Effectiveness of Direct Compensation

Effective direct compensation strategies benefit both employers and employees by promoting fairness, motivation, and retention. Here’s how each group can maximize the impact of direct pay:

For Employers:

- Maintain a clear and transparent pay structure, so employees understand how compensation is calculated.

- Regularly conduct market pay benchmarking to stay competitive.

- Combine base pay with performance-based incentives to encourage productivity.

- Implement pay equity audits to identify and eliminate disparities.

- Ensure all pay practices comply with labor laws.

For Employees:

- Understand your complete compensation package, including bonuses and benefits.

- Research industry salary standards for your role and geographic area.

- Keep detailed records of your job performance and accomplishments.

- Approach salary negotiations with clear evidence of your market value.

- Be aware of benefits and perks to maximize total employment value.

Common Challenges in Direct Compensation Management

Managing direct compensation effectively involves navigating several key challenges that impact both employers and employees:

- Budget Constraints: Organizations often struggle to offer competitive pay while staying within financial limits. Balancing fair salaries without overspending requires careful planning and prioritization of roles critical to business success.

- Pay Equity and Fairness: Unconscious biases, inconsistent pay practices, or lack of standardized criteria can lead to unfair pay gaps. Ensuring fairness means regularly reviewing compensation data and applying objective measures to make equitable decisions.

- Keeping Current with Labor Laws: Wage, overtime, tax, and equal pay regulations frequently change. Companies must actively monitor updates and adjust policies to stay compliant and avoid legal penalties.

- Effective Communication: Poor communication about how pay is determined can cause misunderstandings, lower morale, and mistrust. Clear, transparent, and consistent messaging about compensation builds confidence and reduces employee concerns.

Addressing these challenges requires ongoing strategic compensation planning and employee engagement.

Emerging Trends in Direct Compensation

Direct compensation is changing fast as both employers and employees adjust to new workplace realities. Understanding these trends can help businesses stay competitive and employees get paid fairly.

- Data-Driven Pay Decisions: Using real data to spot and fix pay gaps helps companies pay fairly and keep employees satisfied.

- Increased Pay Transparency: Employees want clear information about how pay is set, which builds trust and reduces misunderstandings.

- Flexible Pay Models: Companies are offering pay options for gig, freelance, and project work to meet changing workforce needs.

- Equity Compensation: Offering stock options or ownership shares helps keep key employees motivated and invested in company success.

- Regular Pay Reviews: More employers are scheduling frequent pay reviews to adjust compensation quickly based on market and employee performance.

Companies that adopt these trends in a timely way can attract and keep skilled workers in a tight job market.

Conclusion

Direct compensation is the main part of employee pay, covering salaries, wages, bonuses, commissions, profit sharing, and equity. It reflects the immediate financial reward for work done and plays a key role in employee motivation. A strong understanding of direct compensation allows employers to set pay that is fair, competitive, and clearly linked to employee performance. This clarity helps employees feel valued and confident about their earnings. Beyond just the numbers, effective management of direct pay helps companies avoid costly legal risks and adapt to changing workforce needs.

By combining fair pay with up-to-date compliance and keeping pace with emerging compensation trends, employers can improve employee loyalty, reduce turnover costs, and boost overall productivity.

FAQ’s

What is included in direct compensation?

Direct compensation is money paid to employees for their work, including salaries, hourly wages, bonuses, commissions, profit sharing, and stock options. It represents the actual cash employees receive and can be subject to taxes and payroll deductions.

How is direct compensation different from indirect compensation?

Direct compensation is cash or cash equivalents paid regularly, while indirect compensation includes non-cash benefits like health insurance, retirement plans, paid time off, and other perks. Both are important for total employee rewards but serve different purposes.

Why is direct compensation important for employees?

It provides immediate income that supports daily living expenses and reflects how the company values an employee’s work. Good direct pay also motivates employees to perform better and feel financially secure.

How do employers decide on the right direct compensation?

Employers consider the job’s duties, industry pay rates, employee skills, company budget, and legal pay requirements to set appropriate salaries. They also review internal pay fairness to keep employee morale high and avoid turnover.

How does direct compensation affect employee retention?

Fair and competitive direct pay helps employees stay motivated and reduces the chance they will leave for better pay elsewhere. Transparent pay practices and regular pay reviews also improve trust and loyalty among employees.