Global hiring has changed how companies build teams. What once required physical offices and local entities can now happen with a few clicks, hiring developers in one region, designers in another, and customer support specialists anywhere in the world. By tapping into international talent pools, you have access to specialized skills and often reduce costs. However, this global approach brings complexity you can’t ignore. Each location has its own employment laws, tax requirements, and worker classification rules, and it’s up to you to get it right. One wrong decision about how you hire someone can trigger penalties, back taxes, and legal issues that cost far more than you saved.

In this guide, we’ll break down the key differences between Employer of Record (EOR) and Agent of Record (AOR) models, when to use each solution, and how much they typically cost. You’ll learn which approach fits your workforce needs and how to expand your business without the legal headaches that come with international hiring.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party organization that becomes the legal employer of your international workforce. While you manage daily work activities and performance goals, the EOR takes full responsibility for payroll taxes, benefits, and meeting local employment laws. This solution lets you hire employees abroad without establishing your own legal entity, a process that typically takes several months and involves significant setup expenses.

Using an EOR reduces legal risk, speeds up hiring timelines from months to days, and gives you access to global talent while you maintain complete control over business operations. You get the workforce you need without the administrative burden or legal complexity of international employment.

How EOR Services Work

- Legal Employment Setup: The EOR verifies work eligibility and creates employment contracts in the local language that meet region-specific labor requirements. This includes right-to-work documentation checks, identity verification, and registration with local authorities. Missing or incorrect documentation can invalidate contracts or trigger government penalties, which the EOR helps you avoid.

- Employment Contracts: EORs draft legally enforceable employment contracts covering work hours, probation periods, severance terms, termination procedures, benefits, and tax obligations. These contracts are written in the employee’s native language and include all mandatory local clauses. This eliminates the need for in-house legal review and ensures contracts hold up during disputes or audits.

- Payroll & Taxes: The EOR takes full responsibility for payroll processing, tax withholdings, remittances to local authorities, and compliance with mandatory employer contributions (e.g., pension, social security). This ensures error-free and on-time payments, avoiding misclassification or penalties for non-payment of statutory dues. This is particularly useful in countries with complex payroll systems like Pakistan.

- Benefits Administration: The EOR manages statutory benefits like healthcare, unemployment insurance, maternity/paternity leave, and vacation accrual, customized per local law. Some also offer optional benefits (like private health insurance or wellness stipends) to help you attract top talent in competitive markets. By bundling this with payroll, it creates a seamless employee experience while keeping your company protected.

- Legal Offboarding: If an employee needs to be terminated, the EOR ensures compliance with local labor laws including notice periods, termination, severance pay, and exit documentation. Mishandling terminations can result in lawsuits or reputational damage.

- IP & Data Protection: Your intellectual property and sensitive data are protected through well-structured, locally enforceable contracts that include IP assignment, NDAs, and non-compete/non-solicit clauses. Without these protections embedded into local law, you risk losing ownership over what your global team builds. EORs ensure enforceability in-country so your business remains secure.

When to Use Employer of Record Services

- Enter New Markets Faster: Need to hire before your legal entity is ready? EORs enable compliant employment in days, not months. This accelerates go-to-market timelines and gives companies an edge in regions where speed equals competitive advantage – especially for early-market hires like sales, customer success, or tech talent.

- Localize Sales & Support Teams: EORs help you hire local teams who understand the regional language, culture, and customer expectations without the administrative headache. In industries like fintech or healthcare, local employees may be a legal requirement for licensing or service delivery, making EORs indispensable.

- Retain Relocating Employees: If a valued employee relocates to another country (voluntarily or for personal reasons), an EOR allows you to keep them on board legally. This avoids gaps in employment, reduces turnover, and maintains team continuity without triggering compliance issues in their new country.

- Avoid PE Risk: Hiring directly abroad, especially in sales or revenue-generating roles, can trigger permanent establishment (PE), requiring you to pay corporate taxes in that country. Using an EOR breaks this liability chain by legally separating the employment from your core entity.

What is an Agency of Record (AOR)?

An Agency of Record (AOR) is a specialized third-party service that helps companies manage independent contractors compliantly across regions and countries. Unlike an EOR, an AOR does not employ workers instead, it focuses on worker classification, onboarding compliance, documentation, and contractor lifecycle management.

This model is ideal for businesses that rely on freelancers, consultants, gig workers, or project-based talent, especially across multiple legal jurisdictions. An AOR ensures that your contractor engagements are fully compliant with local tax and labor laws without converting them to employees.

How AOR Services Works

- Classification Assurance: The AOR conducts detailed reviews to determine whether a worker should legally be classified as an independent contractor or employee under local law. This includes applying local classification tests to avoid contractor misclassification risks, which can lead to fines, back taxes, or forced reclassification.

- Tax & Compliance Documentation: AORs collect, manage, and store all required contractor documentation and GST details in international markets. This not only satisfies local tax authorities but also streamlines your year-end reporting and audit readiness.

- Contractor Agreements: The AOR drafts and issues legally compliant contractor agreements tailored to local regulations. These contracts clearly define scope of work, deliverables, payment terms, IP ownership, and jurisdiction clauses, mitigating disputes and protecting your company’s interests.

- Onboarding & Offboarding: The AOR manages the entire contractor lifecycle – from collecting NDAs and background checks to ensuring proper documentation and IP return at offboarding. This ensures a compliant and consistent experience for contractors, regardless of where they are based.

- Payment Support & Invoicing: While AORs don’t typically process payroll like EORs, many facilitate or integrate with your team to ensure timely contractor payments. They also validate invoices against deliverables and ensure correct local tax handling – especially in complex jurisdictions with VAT or GST regulations.

When to Use an AOR

- Manage Global Freelancers: If you work with contractors across multiple countries, an AOR centralizes oversight and ensures cross-border freelancer compliance. This eliminates the need to manually track different tax forms, classification laws, and onboarding policies across jurisdictions.

- Scale Flexible Talent: An AOR enables you to scale up a freelance workforce quickly to meet project surges, new client demands, or short-term needs without taking on full-time headcount or permanent employment liabilities. Ideal for agencies, consultancies, or fast-growing tech companies.

- Engage Specialists On-Demand: Need to engage high-value creative, engineering, or consulting talent on a contract basis? AORs ensure these engagements are compliant while giving talent the independence they expect. This also helps build long-term relationships with trusted contractors without risk.

- Streamline Documentation: As contractor headcount grows, so does paperwork and risk. AORs maintain centralized documentation across countries and businesses, reducing your internal admin load and keeping you audit-ready and legally covered in case of disputes or investigations.

EOR vs AOR: Detailed Comparison

| Feature | EOR | AOR |

| Worker Type | Full-time employees | Independent contractors/freelancers |

| Legal Employment Responsibility | Yes – EOR is the legal employer | No – Client retains legal relationship with contractor |

| Compliance Focus | Labor law, tax, benefits, employment rights | Worker classification, tax documentation |

| Payroll & Tax Filing | Managed by EOR | May assist, but client often pays directly |

| Benefits Administration | Yes – statutory and optional | No – not applicable to contractors |

| Ideal For | Global workforce expansion | Flexible, project-based workforce |

| Risk Mitigation | Employment law, PE risk, benefits compliance | Misclassification risk, tax non-compliance |

| Onboarding Time | 1–2 weeks (varies by country) | A few days |

| Average Cost | 15%–25% markup on salary | Fixed monthly fee or % per contractor invoice |

Common Misconceptions About AOR and EOR

Many businesses make costly hiring decisions based on incorrect assumptions about how EOR and AOR services work. Understanding these misconceptions helps you avoid misclassification penalties, unexpected legal exposure, and choosing the wrong model for your workforce needs.

Using an EOR Means Losing Control Over Employees

The EOR handles legal employment paperwork, but you retain complete operational control. You manage daily work assignments, set performance goals, conduct reviews, and make all business decisions. The EOR processes payroll and ensures labor law adherence, but they don’t direct your employees’ work. You maintain the manager-employee relationship exactly as you would with direct hires.

An AOR Eliminates All My Legal Responsibilities

AORs reduce administrative burden and help prevent misclassification, but you retain ultimate legal responsibility for contractor relationships. If you treat contractors like employees, setting fixed schedules, requiring exclusive work, providing company equipment you can still face reclassification claims even with an AOR. The AOR helps structure relationships properly, but improper management remains your liability.

These Models Only Work for International Hiring

While EORs and AORs excel at international expansion, they’re equally valuable domestically. Companies use EORs to hire employees in regions where they don’t have legal entities, avoiding multi-state registration complexity. AORs help manage contractors across different locations with varying classification laws and tax requirements.

I Can’t Use Both AOR and EOR Together

Many companies use both models simultaneously. You might employ full-time engineers through an EOR while engaging specialized consultants or seasonal workers through an AOR. This approach builds stable core teams while maintaining flexibility for project-based needs. The key is proper classification; each worker’s relationship must genuinely reflect either employment or independent contractor status.

EORs Are Only for Large Corporations

Startups and small businesses regularly use EORs to expand without the resources to handle foreign labor laws, payroll regulations, and tax requirements. EORs provide cost-effective solutions for testing new locations before committing to full-scale expansion. They scale to fit your needs, whether you’re hiring one engineer or building a regional team.

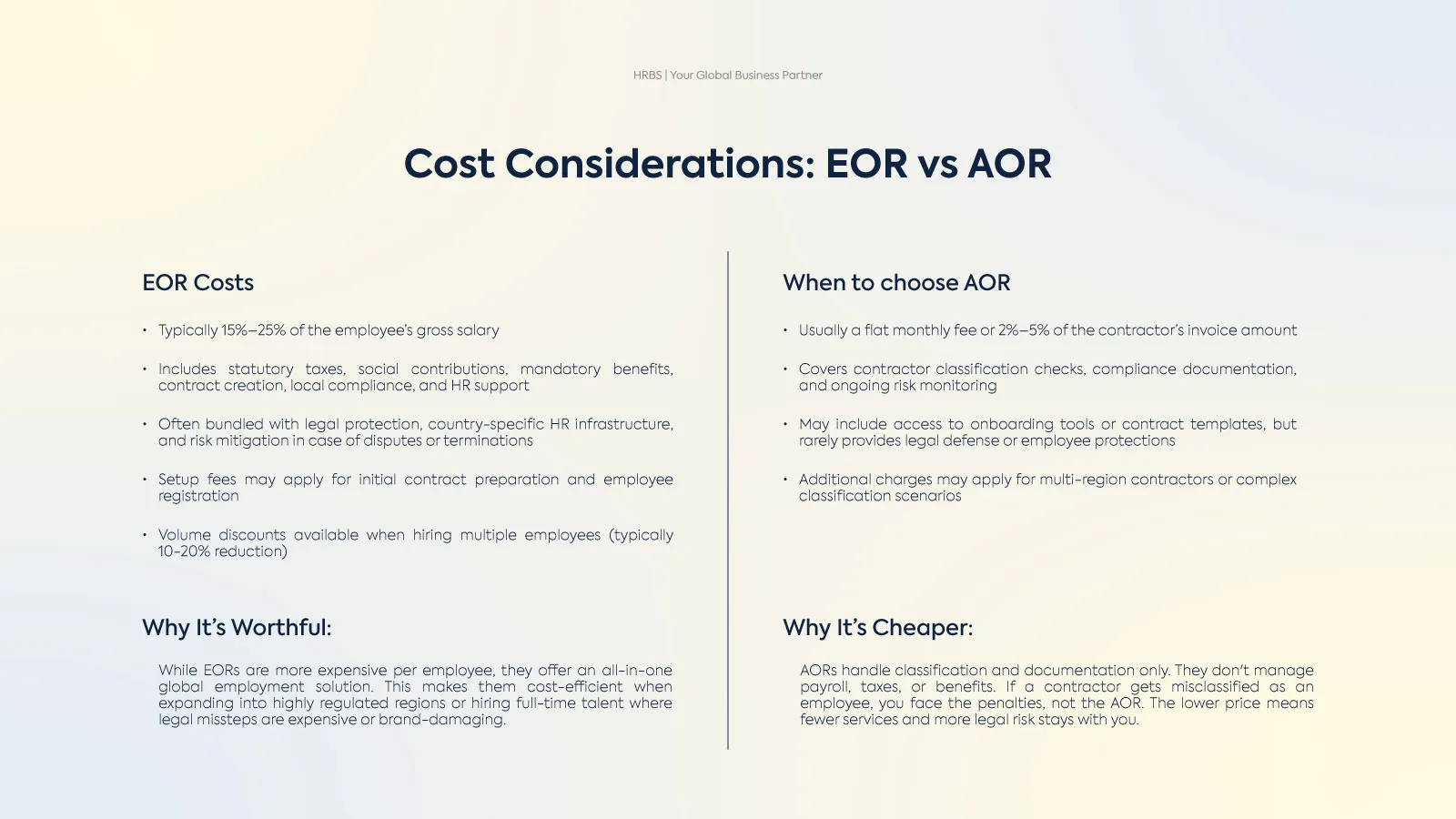

Cost Considerations: EOR vs AOR

Understanding cost differences between EOR and AOR models isn’t just about line items, it’s about what you’re actually getting (or risking) for that price.

EOR Costs

- Typically 15%–25% of the employee’s gross salary

- Includes statutory taxes, social contributions, mandatory benefits, contract creation, local compliance, and HR support

- Often bundled with legal protection, country-specific HR infrastructure, and risk mitigation in case of disputes or terminations

- Setup fees may apply for initial contract preparation and employee registration

- Volume discounts available when hiring multiple employees (typically 10-20% reduction)

Why It’s Worthful: While EORs are more expensive per employee, they offer an all-in-one global employment solution. This makes them cost-efficient when expanding into highly regulated regions or hiring full-time talent where legal missteps are expensive or brand-damaging.

AOR Costs

- Usually a flat monthly fee or 2%–5% of the contractor’s invoice amount

- Covers contractor classification checks, compliance documentation, and ongoing risk monitoring

- May include access to onboarding tools or contract templates, but rarely provides legal defense or employee protections

- Additional charges may apply for multi-region contractors or complex classification scenarios

Why It’s Cheaper: AORs handle classification and documentation only. They don’t manage payroll, taxes, or benefits. If a contractor gets misclassified as an employee, you face the penalties, not the AOR. The lower price means fewer services and more legal risk stays with you.

Key Questions to Ask EOR and AOR Providers

Choosing the right provider requires evaluating operational reliability, legal protection, and global scalability. Use these questions to assess real capabilities beyond marketing claims.

Legal Protection & Employment Infrastructure

- How do you ensure adherence to local employment laws and tax regulations?

- Do you operate through owned entities or third-party partnerships in each location?

- What legal support do you provide during employment disputes or tax audits?

- How do you handle changes to labor regulations and tax codes?

Data Security & IP Protection

- What data protection protocols and certifications do you maintain (GDPR, ISO 27001)?

- Where is employee data stored, and who has access to it?

- How do you structure IP assignment clauses to ensure enforceability?

- What happens to sensitive data if the provider relationship ends?

Onboarding & Operational Speed

- What’s your typical timeline for employee onboarding in different regions?

- Can you provide references from clients who are hired in my target locations?

- What documentation do you need from us to start the onboarding process?

- How do you handle urgent hiring needs or expedited onboarding?

Pricing Transparency

- What’s included in your base pricing and what costs extra?

- Are there setup fees, offboarding charges, or early termination penalties?

- How do you handle currency conversion and international payment fees?

- What volume discounts are available as we scale?

Support Structure

- Do we get a dedicated account manager or shared support team?

- What are your support hours and response time commitments?

- How do you handle time zone differences for urgent issues?

- Can you provide local language support for employees?

Track Record & Stability

- How long have you operated in my priority locations?

- What’s your client retention rate and average partnership length?

- Can you share case studies of companies similar to ours?

- What’s your financial stability and backing?

Conclusion

The choice between EOR and AOR isn’t binary – it’s a strategic decision with long-term operational and legal consequences. An EOR gives you legal infrastructure to hire full-time employees without setting up an entity, but it also reshapes how you manage employment relationships across borders. It’s not just a payroll tool; it’s a liability shield, a compliance framework, and a speed-to-market enabler in countries with complex labor laws. An AOR, on the other hand, doesn’t just manage contractors – it defines your exposure. It’s lean, scalable, and cost-efficient, but the burden of misclassification risk remains largely on your shoulders.

Most companies underestimate this risk until it becomes a retroactive legal issue, one that could trigger fines, back pay, or forced employment recognition. There’s no one-size-fits-all solution. The real strategy is segmentation: use an EOR where legal protection and employment continuity matter, and deploy an AOR where speed, flexibility, and project-based work justify the risk. The companies that scale globally without regulatory damage are the ones that tailor their model to each use case, not the ones that pick the cheapest option upfront.

FAQ’s

What are the consequences of misclassifying a contractor under an AOR?

Misclassification can result in severe financial and legal penalties. Local authorities may reclassify a contractor as an employee, triggering retroactive tax obligations, unpaid benefits, severance liabilities, and statutory penalties. In some jurisdictions, it can escalate to labor court claims or trigger permanent establishment risk, which may subject the company to corporate taxation in that country.

Is AOR always more cost-effective than EOR?

Not necessarily. While AORs typically have lower upfront costs, they do not assume full compliance liability. This creates downstream risk exposure that, if triggered, can outweigh the initial savings. For companies hiring long-term, high-touch roles, the absence of benefits, legal protections, and employer control in an AOR setup can lead to turnover, disengagement, or forced reclassification, each carrying significant cost implications.

Can I switch from an EOR to my own legal entity later?

Yes. Many companies use EORs as a bridge solution while establishing their own legal entity. Once your entity is operational, you can transfer employees from the EOR to your direct employment. This requires proper transfer documentation to avoid employment gaps, benefit disruptions, or contractual issues. Some EORs offer transition support services to ensure smooth handoffs.

What happens to my employees if the EOR provider goes out of business?

This is a critical risk factor when selecting providers. If an EOR ceases operations, your employees’ legal employer disappears, creating potential employment gaps and unpaid obligations. Evaluate provider financial stability, ask about contingency plans, and review what happens to employee contracts if the provider exits.

Can I use different EOR providers in different locations?

Yes, though it adds administrative complexity. Some companies use specialized regional EORs with deep local expertise rather than one global provider. This works when you need a strong presence in specific locations or when a single provider lacks coverage. However, managing multiple EOR relationships means coordinating different contracts, platforms, billing cycles, and support teams.