Expanding your business into new markets can be exciting, but also challenging. One of the most important decisions you’ll face is whether to hire local talent through an Employer of Record (EOR) or by setting up your own local legal entity. Both options have their own benefits and challenges, and understanding when to choose one over the other is key to growing your business smoothly. Many companies find it hard to navigate local labor laws, manage costs, and handle the complexity of running operations in multiple countries. Knowing the right signs to guide your decision, such as how fast you want to enter the market, your budget for setting up, and how much control you need can save time and reduce risks.

This guide helps business leaders, HR professionals, and executives quickly understand the differences between these two hiring models. It offers clear, practical advice to help you comply with local rules, manage payroll and taxes, and hire top talent efficiently all while growing your business around the world with confidence.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a trusted third-party organization that legally employs workers on your behalf in countries where you do not have a local entity. The EOR takes full responsibility for payroll, taxes, benefits administration, compliance with local labor laws, and regulatory reporting. Your business manages the employees’ daily work, while the EOR handles all administrative and legal employment tasks. Beyond these core functions, partnering with an EOR allows your company to rapidly enter new markets without the high upfront costs and delays of entity setup.

It also reduces legal risks by ensuring full compliance with country-specific labor laws and tax regulations, which vary significantly across jurisdictions. Additionally, an EOR supports hiring contactors and full time employees compliantly, protecting your company from worker misclassification risks. This model is especially valuable for businesses testing new markets, hiring project-based or remote teams, or seeking to expand quickly while maintaining operational control and legal safety.

What is an Own Entity?

Owning your own entity means setting up a subsidiary or branch office in a foreign country to directly employ workers under your company name. This approach gives you full control over employment contracts, HR policies, payroll, and compliance procedures, enabling a consistent brand presence and deeper operational integration. While this offers maximum autonomy, establishing and maintaining a local entity requires significant upfront financial investment, time-consuming legal registration, and ongoing compliance with evolving local regulations.

It also demands dedicated local HR and administrative resources to manage employment operations effectively. Choosing to own an entity is best suited for companies with long-term business goals and substantial workforce needs in a specific market, who are prepared to invest in building a local presence and maintaining full legal accountability.

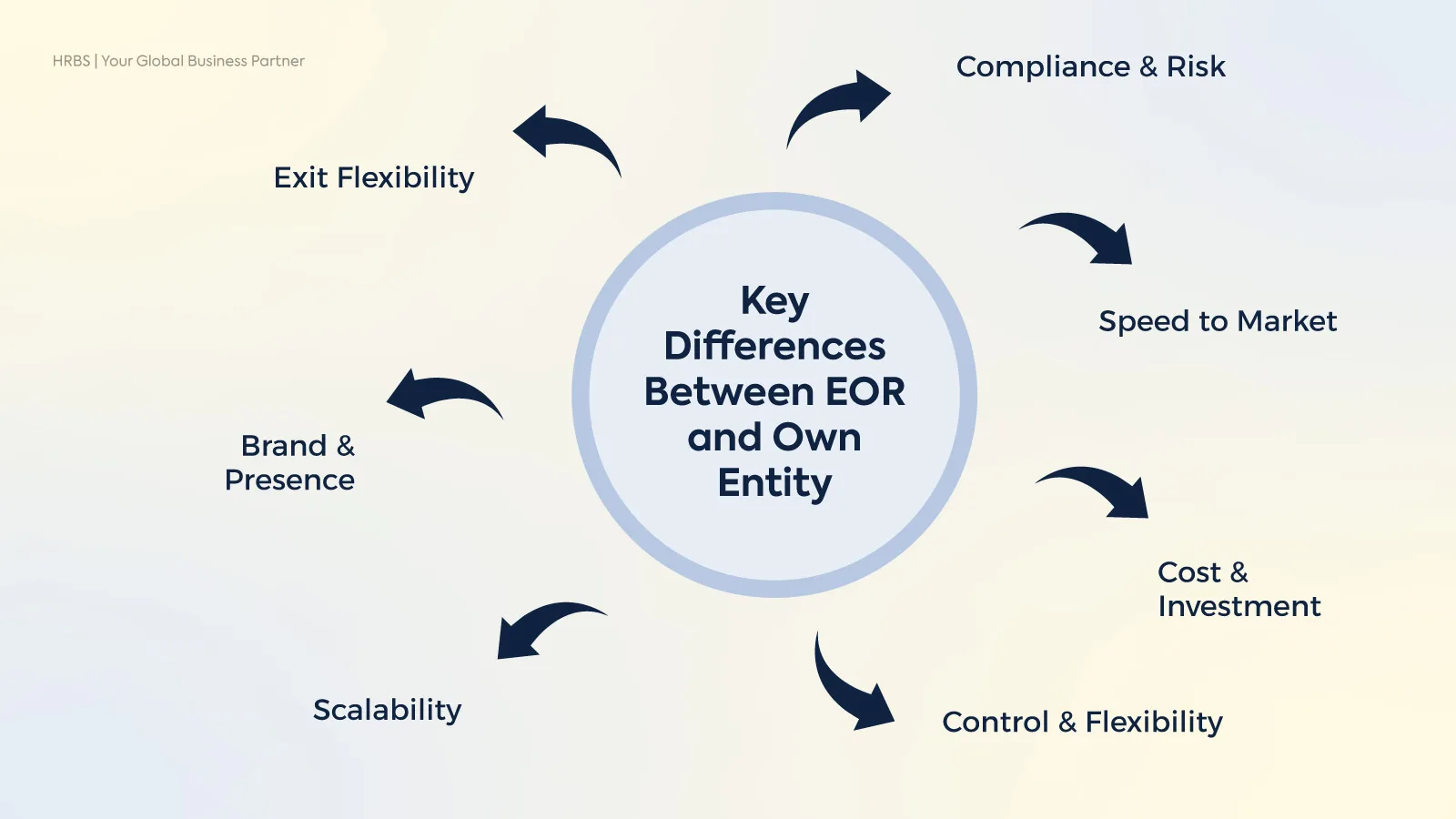

Key Differences Between EOR and Own Entity

When deciding how to expand internationally and hire local talent, choosing between an Employer of Record (EOR) and setting up your own local entity is a major consideration. This side-by-side comparison highlights the key differences across compliance, cost, speed, control, and scalability factors.

| Factor | Employer of Record (EOR) | Own Entity |

| Compliance & Risk | EOR assumes full legal responsibility and compliance risk | Company bears all compliance and legal risks |

| Speed to Market | Hire employees within days or weeks | Setup can take several months |

| Cost & Investment | Lower upfront costs, pay as you go | Significant initial setup and ongoing administrative costs |

| Control & Flexibility | Limited control over contracts and benefits | Full control over HR policies and operations |

| Scalability | Ideal for small to medium teams and market testing | Better suited for long-term, large-scale operations |

| Brand & Presence | Less local brand presence | Stronger local brand credibility |

| Exit Flexibility | Easier market exit with less sunk cost | Higher exit barriers due to investments |

Compliance and Risk Management

Legal compliance across borders is complex, involving distinct labor laws, tax regulations, and reporting obligations. Non-compliance can result in penalties, fines, and reputational damage.

- With an EOR, the compliance responsibility fully shifts to the provider, who continuously tracks and updates changes in local laws and regulations. The EOR manages payroll, benefits, employment protections, and mandatory filings, substantially lowering your company’s legal risks and liability.

- An EOR also helps prevent costly mistakes related to worker misclassification by ensuring correct employment contracts are followed according to local standards.

- With your own entity, your company assumes direct legal responsibility. This requires hiring or contracting experienced local legal counsel and dedicating compliance teams to stay updated on evolving laws, reducing the risk of violations.

- Entities bear financial and operational risks related to audits, fines, and penalties if compliance is not rigorously maintained.

- Managing an owned entity demands ongoing investments in compliance technology, staff training, and legal consulting to maintain regulatory adherence.

Operational Speed and Flexibility

Market speed is crucial in international growth:

- Using an EOR lets you hire employees in new markets within days or weeks, bypassing lengthy entity registration and setup processes. This fast-track hiring supports rapid market entry, pilot testing, short-term projects, and flexible workforce scaling.

- EORs allow companies to expand easily into multiple countries simultaneously without setting up numerous entities, increasing operational agility.

- Establishing your own entity requires registering with local authorities, securing tax IDs, opening bank accounts, and building operational infrastructure. This process often takes several months to complete, delaying hiring and business activities.

- Owning an entity offers less flexibility to exit a market quickly since closing or selling an entity involves complex legal and financial procedures.

Cost Considerations: A Real-World Example

Consider hiring 10 employees in Pakistan:

- Setting up your own local entity involves registration fees, legal and consulting services, infrastructure costs, ongoing payroll administration, and tax obligations on profits and retained earnings. These expenses can add up significantly each year, especially when factoring in indirect costs like accounting, tax filings, HR management, and maintaining compliance.

- Using an Employer of Record (EOR) removes the need for entity setup fees and cuts down on administrative overhead. Instead, you pay a clear, regular monthly service fee per employee that includes payroll taxes, benefits, and compliance management. This cost-effective approach offers substantial savings compared to owning an entity, particularly when entering a new market or managing smaller teams.

- The EOR model also reduces financial risks associated with compliance and changes in local regulations, while eliminating the need for local office space and dedicated administrative staff.

- While costs for owning an entity generally become more efficient with larger employee counts, EORs typically deliver stronger cost advantages for smaller or medium-sized operations and quicker market entries.

Control and Customization

Own Entity: Owning your own entity provides full control over every aspect of employment, including contracts, benefits schemes, work policies, and HR operations. This level of control allows companies to:

- Tailor employment terms and benefit packages precisely to align with company culture and strategic goals.

- Implement specialized HR policies that comply with local regulations while reflecting organizational values.

- Manage employee engagement, performance reviews, and career development programs within a fully customized framework.

- Respond flexibly to unique business needs such as remote work arrangements, specific leave policies, or bespoke compensation structures.

Employer of Record: In contrast, an Employer of Record (EOR) operates using standardized contract templates and managed benefits plans, which offer less room for customization. While this setup works well for many organizations by simplifying compliance and administration, companies with highly specialized or complex employment requirements may find the EOR model limiting.

However, leading EOR providers in markets like HRBS build strong local expertise and offer flexible options within their frameworks, such as:

- Advice on local benefit expectations (health insurance, bonuses, statutory contributions).

- Scalable solutions that can adjust to workforce size and project duration.

- Timely and accurate processing of statutory payments and benefits to attract and retain talent.

Ultimately, the choice depends on whether your priority is full control and tailored employee programs (own entity) or the convenience of simplified compliance and faster market access with some limits on customization (EOR).

When to Choose an Employer of Record?

- Need the immediate ability to hire employees across multiple countries quickly, without the delays of entity setup.

- Lack internal expertise or resources to manage complex foreign employment laws, local payroll processes, and tax compliance.

- Operate on short-term projects, pilot market tests, or uncertain business phases where flexibility and speed are critical.

- Want to minimize legal, financial, and administrative burdens by outsourcing compliance and risk management to experts.

- Prefer to maintain the option to rapidly scale your workforce up or down, or exit markets without long-term commitments or sunk costs.

- Looking for a cost-effective solution for smaller teams or initial market entry before committing to a permanent presence.

When to Choose Your Own Legal Entity?

- Planning to establish permanent, large-scale business operations with a long-term commitment to the local market.

- Hiring numerous employees who require customized contracts, specialized benefits, or tailored HR policies aligned with corporate culture.

- Investing in building a strong local brand, market credibility, and deeper engagement with the local workforce and regulatory bodies.

- Ready to allocate internal resources, including legal counsel and HR professionals, to manage compliance, payroll, and employment relations.

Risks and Challenges of Choosing EOR Vs Own Entity

Employer of Record (EOR)

- Reduced control over employment decisions can impact consistency of company culture and brand perception across markets.

- Standardized contracts and managed benefits limit workforce customization compared to owning an entity.

- Dependency on the EOR’s service quality and financial stability may introduce operational risks such as payroll delays, compliance mistakes, or service disruptions.

- Risk of being classified as having a permanent establishment (PE) if employees perform core business functions abroad, leading to potential tax liabilities and legal complications.

- Potential for co-employment or joint employment issues, where both the client company and EOR are considered legal employers, possibly increasing legal exposure.

- Data security and privacy risks arise since sensitive employee information is managed by a third party, necessitating strong EOR security protocols.

Own Entity

- Establishing and managing an entity involves navigating complex local bureaucracy, registration, and legal requirements that can delay operations.

- Higher compliance risks if evolving regulations are misunderstood or inadequately monitored, potentially resulting in costly fines and audits.

- Requires significant investment of time and resources for maintaining employment law compliance, tax reporting, payroll, and HR administration.

- Legal and financial exposure is direct; any violations can affect the parent company’s reputation and attract regulatory penalties.

- Slower ability to enter or exit a market due to costs in infrastructure, staffing, and legal commitments.

How HRBS Can Help with Your Global Hiring Needs

Navigating international expansion can be complex, but partnering with a trusted Employer of Record (EOR) like HR Business Solutions (HRBS) makes the process seamless and risk-free. HRBS specializes in managing compliance, payroll, taxes, benefits, and HR administration across borders, enabling businesses to hire quickly without setting up costly and time-consuming local entities.

- Global Compliance Expertise: HRBS stays fully updated with local labor laws, tax regulations, and employment standards, ensuring your business remains compliant in every market where you hire. This reduces legal risks and avoids penalties, so you can operate with confidence.

- Fast Market Entry: HRBS removes the barriers of entity setup, helping you onboard employees in new countries within days. This accelerated hiring process enables rapid market testing and quicker time to revenue.

- Simplified Payroll and Benefits Management: Managing multi-currency payroll and statutory benefits across markets is handled expertly by HRBS, ensuring accurate, timely payments and adherence to local requirements without burdening your internal teams.

- Reduced Administrative Burden: HRBS takes on complex administrative duties like contracts, tax filings, and compliance reporting, freeing up your HR and finance departments to focus on strategic priorities.

- Scalability and Flexibility: Whether expanding gradually or scaling rapidly, HRBS offers flexible solutions that grow with your workforce needs, enabling easy adjustments without the hassle of restructuring legal entities.

- Risk Mitigation: By managing all employment-related legal responsibilities, HRBS protects your business from potential labor disputes, tax issues, and regulatory violations.

With HRBS as your Employer of Record, you work with a reliable partner in Pakistan committed to smooth global workforce management and compliance, empowering your business to grow internationally without the typical complexities.

FAQ’s

What is the main difference between an Employer of Record (EOR) and owning a legal entity?

An Employer of Record (EOR) legally employs workers on your behalf in a foreign country, handling compliance, payroll, taxes, and benefits. Owning a legal entity means your company registers a subsidiary or branch abroad and directly employs workers, managing all HR, compliance, and operational functions internally.

When should a business choose an Employer of Record over setting up its own entity?

Using an EOR is best when a company needs fast market entry, wants to minimize legal risks, lacks local regulatory expertise, or operates short-term projects. It offers flexibility and reduces administrative burdens. Own entity setup is preferable for long-term presence, larger teams, and when full control over HR and compliance is required.

How do costs compare between using an Employer of Record and establishing an own entity?

EORs usually charge monthly service fees per employee covering payroll and compliance, which means lower upfront investment and predictable costs. Setting up an own entity involves significant incorporation fees, ongoing administrative costs, payroll infrastructure setup, and local tax representation, which can be more expensive initially but cost-effective at scale.

Can a company switch from using an Employer of Record to owning its own entity?

Yes, many companies start with an EOR to quickly enter and test a market. Once they scale and have larger teams, they transition to owning a legal entity to optimize costs and strengthen their local presence.

How can HR Business Solutions (HRBS) assist with Employer of Record services?

HRBS provides expert EOR services, managing compliance, payroll, taxes, and benefits across multiple countries. We help businesses hire rapidly without entity setup, reduce legal risks, simplify payroll management, and support scalable global workforce expansion with minimal administrative burden.