As global hiring becomes the norm, organizations are often unprepared for complex compliance challenges. When hiring people in different countries, you face a critical choice: stay with a payroll service or partner with an employer of record (EOR). The core difference is who holds legal responsibility. With payroll services, you remain the employer while a provider handles payments and processing. With an EOR, the provider becomes the legal employer and assumes full compliance risk.

This difference matters because choosing incorrectly exposes you to real consequences, wrong tax filings, labor law violations, misclassification disputes, and financial penalties. Companies that make the wrong choice often realize the gaps only after facing audits or penalties. This guide explains when to use each option, helping HR leaders, finance executives, and founders make informed decisions that support their global expansion plans.

What is an Employer of Record (EOR)?

An employer of record is a third-party organization that legally acts as the employer for your workforce in foreign countries. Instead of creating a separate legal entity abroad, an EOR becomes the official employer on paper, while you maintain complete control over employee management and work direction. This model solves a critical problem for companies hiring internationally: it eliminates months of legal setup required to establish new entities, while ensuring full compliance with local employment laws.

What an EOR handles on your behalf:

- Prepares employment contracts that comply with each country’s specific labor regulations and requirements

- Manages the complete onboarding process including candidate verification, paperwork, and legal documentation

- Processes payroll, calculates taxes, and makes mandatory contributions like social security and pension funds

- Monitors changes to employment laws and ensures your team stays compliant with local regulations

What is Payroll Outsourcing?

Payroll is the process of calculating and paying your employees for their work. As the employer, you remain responsible for tracking hours, calculating wages, withholding taxes, and ensuring payments are made on time. Unlike an EOR, you keep full ownership of the employment relationship and all related decisions.

What payroll processing includes:

- Tracking employee hours worked or salary amounts

- Calculating gross pay before any deductions

- Withholding income taxes, social security, medicare, and other employee deductions

- Processing employer-paid taxes and contributions

- Issuing paychecks and maintaining payment records

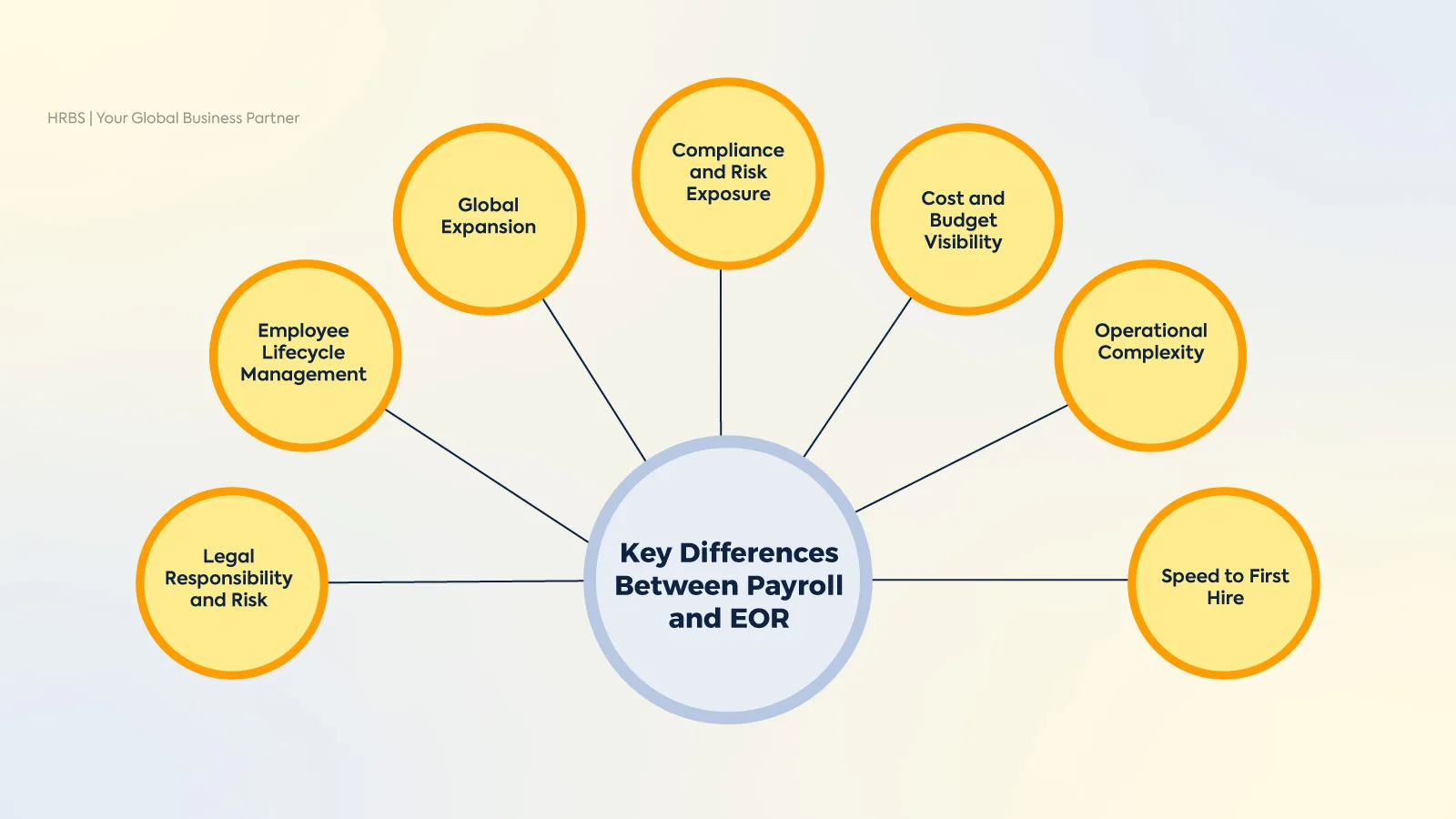

Key Differences Between Payroll and EOR

A clear understanding of differences between payroll and employer of record helps organizations choose the right solution for their global workforce strategy.

Legal Responsibility and Risk

An employer of record becomes the legal employer on paper, which means they assume all employment liabilities. If labor laws are violated, misclassification disputes arise, or tax issues occur, the EOR is responsible and you’re protected from direct legal exposure and regulatory penalties.

Payroll services keep you as the legal employer. The provider only processes payments and handles tax withholdings, while you remain liable for employment decisions, contract compliance, and labor law adherence. If something goes wrong, you face the penalties and legal consequences that come with employment violations.

Employee Lifecycle Management

An EOR manages the entire employee journey from start to finish, draft employment contracts compliant with local laws, handle hiring documentation, manage benefits administration, resolve employee disputes, and process exits and severance. The employee relationship sits with them legally, but you control the actual work and performance management.

Payroll services only handle salary and deduction processing. You manage the entire employee relationship independently—hiring decisions, terminations, benefit selection, dispute resolution, and all HR management falls on your organization. Any complexity beyond payment processing remains your responsibility.

Global Expansion

An EOR enables you to hire employees abroad without establishing a legal entity. The provider becomes your local employer, managing all country-specific requirements, tax obligations, and regulatory compliance requirements. This is essential for companies entering new markets or accessing global talent quickly without long setup timelines.

Payroll services require you to already have a legal entity in that location. If you need to hire internationally without one, payroll alone won’t work, you’d still need to establish a company presence, which requires months of setup and significant investment before any hiring can occur.

Compliance and Risk Exposure

An EOR carries compliance responsibility as part of their legal employer role. They monitor changing tax laws, employment regulations, and labor standards continuously and adjust accordingly when requirements shift. Your company operates with reduced risk because an expert is monitoring legal changes and implementing necessary adjustments in real time.

With payroll, you carry compliance responsibility independently. You must track tax law changes, labor law updates, and regulatory requirements on your own. Missing changes creates exposure to penalties and violations. For international hiring, this means monitoring multiple jurisdictions’ legal systems and staying updated on each one individually.

Cost and Budget Visibility

An EOR provides transparent, all-in pricing where you pay per employee monthly and understand exactly what’s included. No surprise costs emerge later because everything, payroll taxes, benefits, compliance, legal coverage, is bundled into one fee that remains consistent.

Payroll initially appears cheaper with lower per-employee fees, but hidden costs accumulate quickly: legal entity setup, local consultant fees, compliance audit preparation, employee benefits administration, tax software, and internal staff time managing multiple jurisdictions. The total cost of ownership often exceeds EOR pricing once you calculate all components.

Operational Complexity

An EOR simplifies your operations significantly. There’s no entity setup, no country-specific compliance research needed, and no benefits administration management required. Your internal team focuses exclusively on hiring, work direction, and performance management, while the provider handles legal and administrative details.

Payroll increases operational complexity as you expand internationally. Your HR and finance teams must develop expertise in different tax systems, benefits laws, termination procedures, and labor requirements across locations. The administrative burden grows substantially with each new location you enter, requiring ongoing expertise development.

Speed to First Hire

An EOR enables faster hiring processes overall. You interview candidates and approve them for hiring while the provider completes paperwork, verification, and legal setup in parallel. Employees can start work within days because the provider handles all bureaucratic and legal requirements upfront.

Payroll requires extensive upfront setup before any hiring occurs. You must establish a legal entity, register for local taxes, set up payroll systems, obtain tax identification numbers, and complete compliance registration. Only after completing all this preliminary work can you begin hiring employees.

EOR vs Payroll: Comparison Table

| Function | Employer of Record (EOR) | Payroll Service |

| Acts as Legal Employer | Yes | No |

| Processes Payroll | Yes | Yes |

| Drafts Employment Contracts | Yes | No |

| Manages Onboarding | Yes | No |

| Handles Benefits Administration | Yes | No |

| Responsible for Labor Law Compliance | Yes | No |

| Manages Employee Disputes | Yes | No |

| Requires Local Entity Setup | No | Yes |

| Handles Tax Filing and Reporting | Yes | Partial (processing only) |

Cost Comparison: EOR vs Payroll

Payroll services cost less per employee monthly, but EOR delivers better overall value for international hiring because it includes all-in pricing with no hidden expenses. The real cost difference becomes clear when you factor in entity setup, consultant fees, and internal HR time required for payroll management across multiple countries.

| Cost Factor | Employer of Record (EOR) | Payroll Service |

| Monthly Cost Per Employee | $199–$1,500 (fixed) or 10–25% of payroll | $20–$100 |

| What’s Included | Payroll, taxes, benefits, contracts, compliance, regulatory updates | Payroll processing, tax withholdings, payment processing only |

| Setup and Implementation | No upfront setup costs | Legal entity establishment and setup required |

| Benefits Administration | Included | Requires separate management or software |

| Employment Contracts | Drafted and maintained by EOR | Client handles independently |

| Tax Filing and Compliance | Handled by EOR | Client ensures accuracy and filing |

| One-Time Fees | Onboarding fees per employee, currency exchange fees (2–10%) | Legal registration, tax ID setup, permits |

| Hidden Costs | Minimal; all-in pricing model | Internal HR time, compliance audits, multiple payroll system management |

| Annual Cost (1 employee) | Lower overall when all-in costs calculated | Higher when setup and hidden costs included |

When to Use EOR vs Payroll Services

Choosing between an employer of record and payroll services depends on your company’s structure, expansion stage, and compliance needs. Both handle employee payments, but they operate at fundamentally different levels of responsibility. Understanding which model matches your business situation prevents costly mistakes and ensures compliance with employment laws.

Use an EOR When:

- You’re expanding into new countries without an established legal entity.

- You need employees hired within weeks instead of months.

- Compliance complexity across jurisdictions is high and expertise is limited internally.

- Your organization wants the provider responsible for employment law violations and penalties.

- You’re building a remote team across different regions.

- You need to scale rapidly without setting up separate legal structures.

Use Payroll Services When:

- Your company already has established legal entities in hiring locations.

- All hiring occurs domestically within one country.

- Your HR team has expertise managing employment law and compliance independently.

- Cost per employee is the primary factor over operational simplicity.

- You maintain full control over all employment decisions and employee management.

- Your employees are standard employees with traditional employment classifications.

How to Choose the Right EOR Provider

Selecting the right employer of record provider directly impacts your international expansion success, compliance risk, and operational efficiency. The wrong choice creates compliance gaps, delays hiring, and exposes your company to legal penalties in foreign jurisdictions.

- Geographic Coverage and Local Presence: Verify the EOR operates directly in your target countries with its own local entities, rather than relying on third-party partnerships. Confirm the provider understands local tax systems, employment regulations, and labor laws in each jurisdiction where you hire.

- Transparent Pricing: Compare what’s included in monthly fees, payroll, taxes, benefits, contracts, compliance monitoring, and regulatory updates. Ask about onboarding costs, offboarding charges, and currency exchange fees. Clear pricing prevents budget surprises and allows accurate comparison across providers.

- Track Record and Legal Knowledge: Ask how the provider monitors employment law changes and implements regulatory updates automatically. Review their risk management processes and request case studies showing how they’ve handled compliance challenges in your target countries.

- Customer Support: Confirm service availability during your business hours and ask about average response times for payroll issues or compliance questions. Dedicated account managers provide faster resolution than shared service models, especially for complex international hiring issues.

- Industry Experience: Request references from companies similar to yours in size and industry. Ask specifically about their experience hiring in your target countries and whether the provider understands your industry’s specific employment and compliance needs.

How to Select Best Payroll Service Company

Finding the best payroll service providers protects your business from calculation errors, tax filing mistakes, and compliance violations while maintaining employee satisfaction and trust. A reliable payroll provider becomes a critical operational partner for companies managing domestic workforce payments and regulatory requirements.

- Accuracy and Tax Filing: Verify the provider calculates wages, tax withholdings, and statutory contributions accurately. Confirm they file taxes on time and generate accurate regulatory reports. Ask about their error correction process and how they handle payroll mistakes. Processing accuracy directly affects employee trust and compliance.

- Real-Time Reporting: Ask whether the provider offers real-time dashboards showing payroll status, employee deductions, tax liabilities, and financial metrics. Access to instant reporting helps you monitor payroll health, forecast budget impact, and identify issues before they become problems. Real-time visibility improves financial planning.

- Employee Self-Service: Confirm employees can view pay stubs, tax documents, and deduction details through a user-friendly portal or mobile app. Self-service portals reduce administrative burden on your HR team and give employees immediate access to payroll information without contacting support.

- Pricing Transparency and Scalability: Request detailed pricing that clearly shows all included features without hidden charges. Confirm how pricing changes as your workforce grows. Verify whether they offer flexible pricing models that don’t require long-term contracts or annual commitments.

Questions to Ask Potential Providers

Asking the right questions during provider evaluation reveals service gaps and ensures you choose a partner aligned with your needs.

For Employer of Record Providers:

- What countries do you operate in directly versus through partnerships?

- How do you handle regulatory changes, and what happens if violations occur?

- Can you provide references from companies hiring in my target countries?

- How quickly can employees start working after hire approval?

- What technology platform do you use to manage worker data and compliance?

- How flexible are you with part-time workers, contractors, or short-term contracts?

- What are your pricing terms, and can I exit the agreement if needed?

For Payroll Service Providers:

- What services are included in your base package, and what costs extra?

- How do you prevent payroll errors before they occur?

- How do you stay current with tax law changes and apply updates automatically?

- What security measures protect payroll data?

- How do you handle year-end audits and provide supporting documentation?

- How does pricing scale as my workforce grows?

- Can you manage complex salary structures specific to my industry?

How HRBS Can Help with EOR and Payroll Services

HRBS manages global hiring, payroll processing, and benefits administration so your company enters new markets without establishing local legal entities. This removes the legal complexity and administrative burden that prevents rapid global expansion.

- Global Hiring: Hire employees in target markets in days instead of months. HRBS becomes your local employer, handling employment contracts, work permits, tax registration, and documentation so new hires start immediately.

- Multi-Currency Payroll: Process payroll across multiple countries with transparent reporting that tracks all payments in one place. Payments run automatically on local paydays with zero delays, ensuring every employee receives accurate compensation in their local currency.

- Benefits Administration: HRBS administers mandatory and voluntary benefits aligned with local market standards, so employees get competitive benefits and you stay fully covered. This eliminates the complexity of managing multiple benefit vendors across different locations.

- Dedicated Support: Work with a dedicated team that understands local employment practices, handles contract renewals, manages employee disputes, and provides guidance on complex HR decisions specific to each market.

Ready to expand globally without legal setup delays? Book your free EOR and payroll consultation today and see how HRBS simplifies hiring and payments globally so you scale faster from Pakistan

FAQs

Can I switch from Payroll Services to EOR if my company is already established?

Yes. Switching works best when you expand from your home market to new countries. Your payroll provider handles domestic payments, while EOR becomes your legal employer abroad. The migration takes 2 to 4 weeks, depending on workforce size. You avoid setting up separate legal entities in each country, while maintaining your domestic payroll without interruption.

How to choose between payroll services and EOR for expansion?

Use payroll services if you already have a legal entity in that country or work through a local partner. Use EOR if you want to hire directly without setting up entities or test new markets quickly. With payroll services, you remain the legal employer and responsible for all compliance. With EOR, the provider becomes your legal employer and assumes compliance responsibility. EOR eliminates the 6 to 12 month legal setup timeline that payroll solutions require.

What payroll mistakes happen most when managing employees across borders?

The most common errors are applying wrong tax rates, missing pension contributions that vary by country, currency conversion timing mistakes, and missing filing deadlines that differ per location. Automated tax calculation and verification before payments run prevents these costly errors.

How quickly do employees start working after you approve hiring?

EOR onboarding takes 2 to 10 business days depending on country complexity. During this time, the provider prepares employment contracts, registers for tax and benefits, sets up payroll, and grants system access. Employees can begin work on their start date while remaining administrative tasks complete in the background. Setting up a business entity in new markets traditionally takes 6 to 12 months. With EOR, you eliminate this waiting period entirely, allowing employees to become productive immediately after hiring approval rather than many months later.

Can HRBS manage both domestic and global payroll and EOR?

Yes, we handle both payroll and EOR services, managing your domestic payroll for local employees while running EOR in other markets. Since both services come from the same company, you see all workforce costs and compliance information together instead of tracking separate services. This eliminates coordination confusion and gives you reporting across all locations while maintaining local expertise in each market.